Peer To Peer Lending India Interest Rates

Lending made easy creditworthy borrowers investor protection fund good returns simplified process.

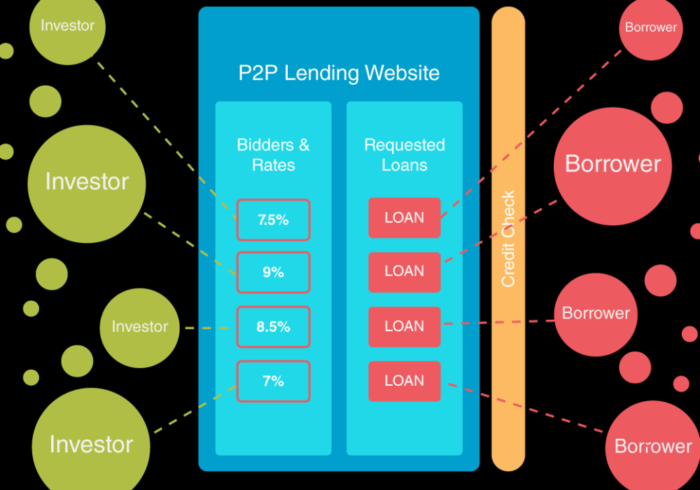

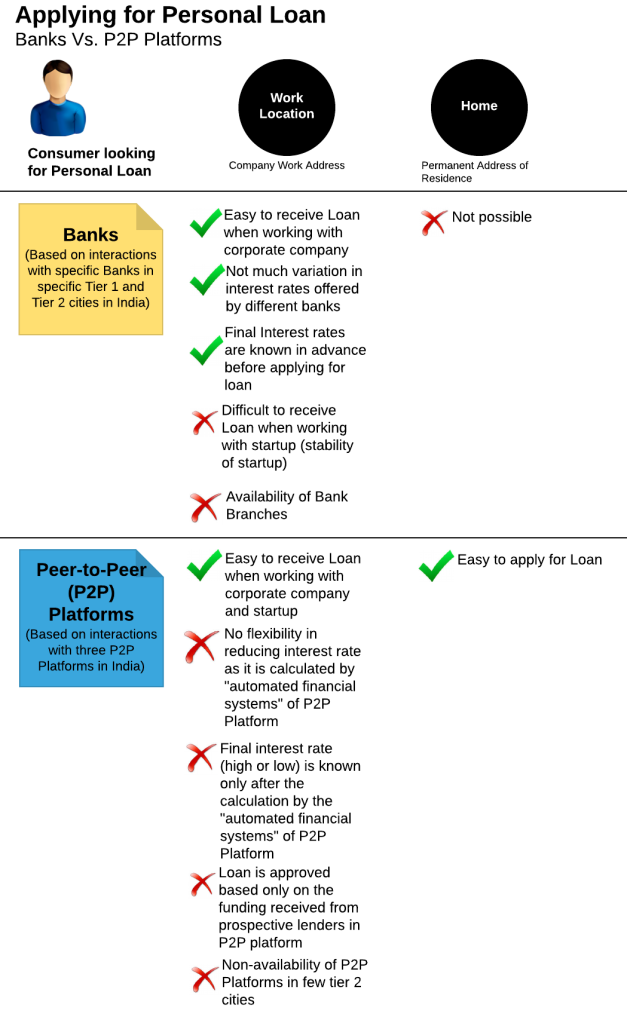

Peer to peer lending india interest rates. For example you could receive a loan of 6 000 with an interest rate of 7 99 and a 5 00 origination fee of 300 for an apr of 11 51. Peer to peer lending p2p lending connects investors who lend money online with verified borrowers who are seeking to get affordable peer to peer p2p loans. I2ifunding is a reserve bank of india rbi registered non banking financial company p2p lending platform nbfc p2p. However peer to peer lending in india is an emerging sector that is gaining momentum at a speedy pace.

Lendbox offers a wide range of interest rate options varying between 12 27 per annum. The roi on the investment would depend on the borrower profile tenure and the amount of loan. A fast growing peer to peer lending platform in india connecting creditworthy borrowers with mindful lenders. Interest rate of 21 25 to 25 4 of loan amount or rs 4 000 whichever is higher.

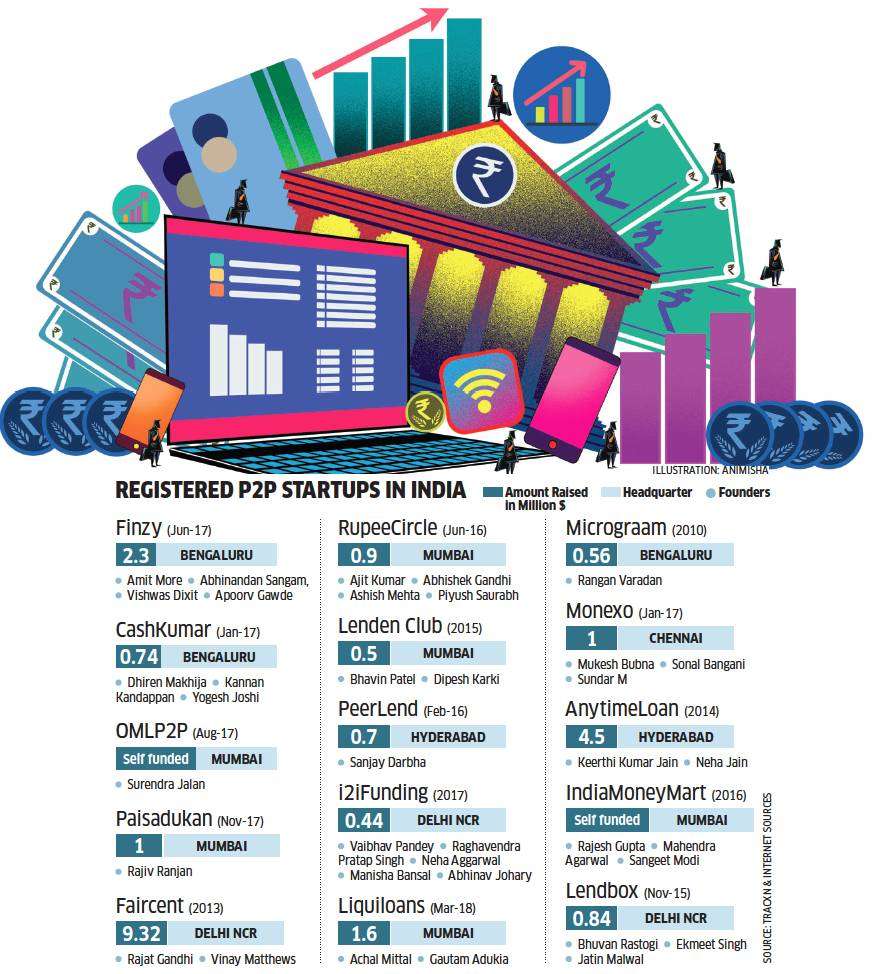

Rajat gandhi who has 20 years of experience is the ceo and founder of this company. I2ifunding is the best and most trusted peer to peer lending platform in india it started operation in oct 2015. A borrower can get personal loans investors can earn higher returns by lending money online through p2p lending with lendenclub. Peer to peer lending is already a common phenomenon at the global level.

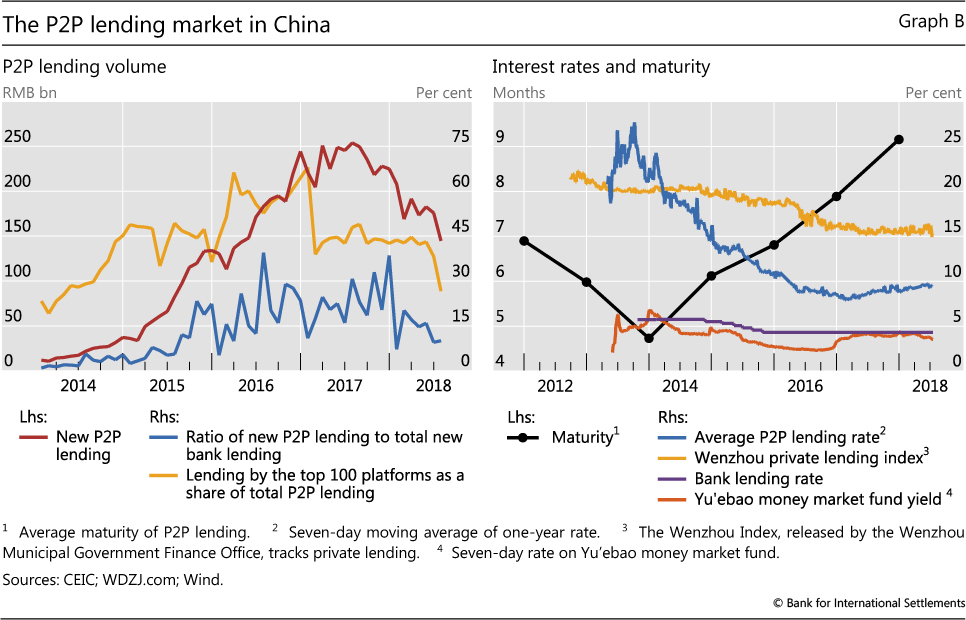

For investors lower default higher roi collection support is our expertise in peer to peer lending in india. Returns from p2p lending is generally higher compared to traditional investment options like a fixed deposit or mutual funds. Most p2p companies divide the borrowers in categories like very low risk low risk moderate risk to high risk and very high risk profiles. Faircent started in 2014 and it is one of the oldest start ups in the field of peer to peer lending business.

Start with peer to peer p2p lending in india with the most trusted p2p platform. You can choose the desired rate of interest you want to invest at depending on your risk appetite. Many startups are showing interest in this new technology enabled and online p2p lending business model. Interest rate of 25 25 to 28 5 of loan amount or rs 5 000 whichever is higher.

Savers on the ratesetter platform who are technically lenders matched up over the internet to borrowers have been told their interest rates will be reduced by 50 until the end of 2020. Borrowing made affordable optimal interest rate minimal documentation faster disbursement no. The apr ranges from 6 95 to 35 89. Interest rate above 28 6 of loan amount or rs 6 000 whichever is higher.

Start lending start borrowing. Your actual rate depends upon credit score loan amount loan term and credit usage and history. All loans made by webbank member fdic.

-Lending-Market-Revenue-(USD-Billion).png)

.jpg)