Peer To Peer Lending Platforms Australia

Coassets brings real estate developers businesses and investors together with excess of a 48 million worth of transactions taking place through the platform in the last two years.

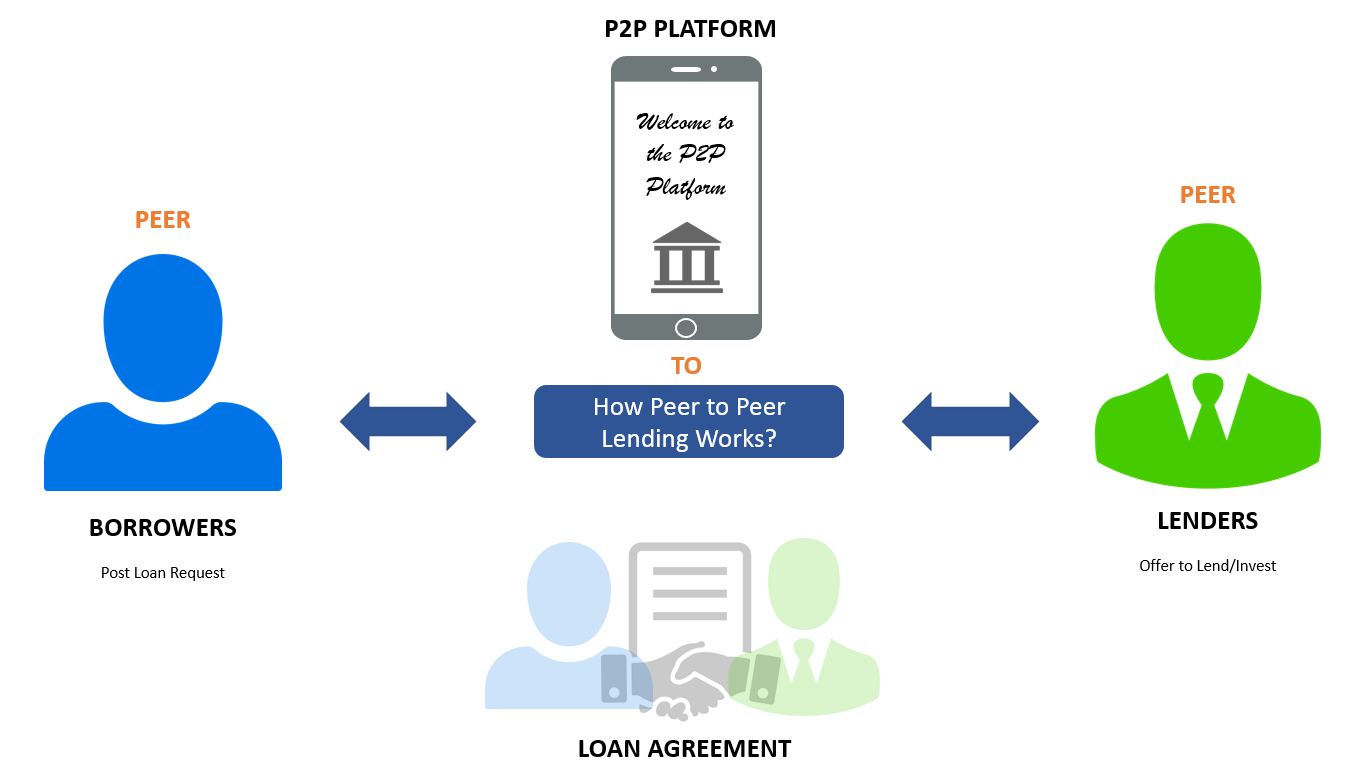

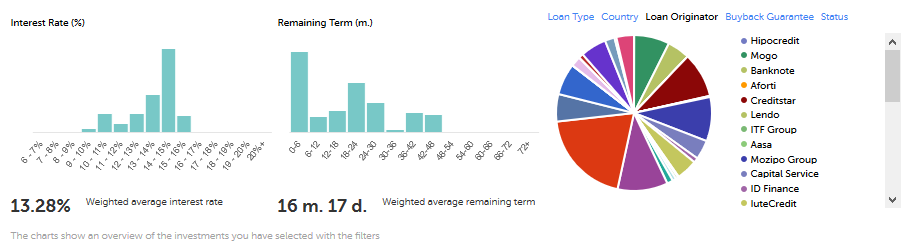

Peer to peer lending platforms australia. While borrowers sign up to receive loans investors become lenders in order to receive a higher return than what they d normally get from savings accounts term deposits and other investments. They offer a range of loan types for borrowers and investors to choose from. Started in 2007 lending club offers personal loans of up to 40 000 and up to 500 000 for businesses. When peer to peer personal loans launched in australia one new aspect about these loans was that the interest rate was personalised to the borrower.

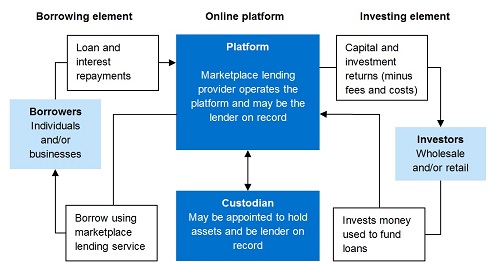

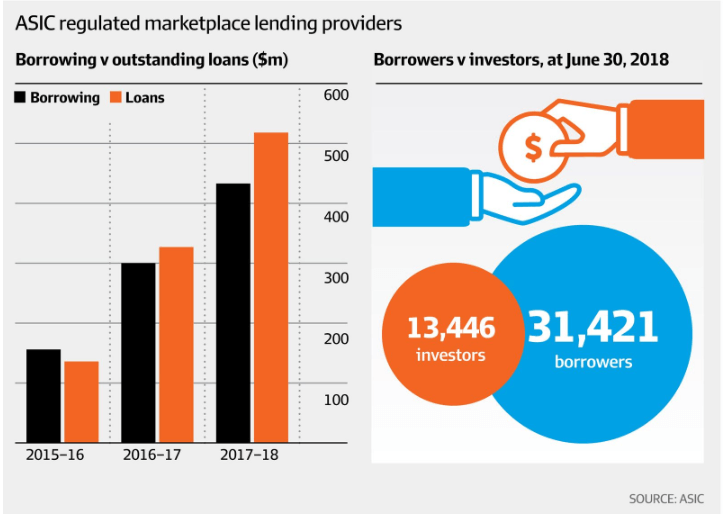

P2p lending to consumers is expected to reach 10 4 billion whereas p2p lending to small businesses is expected to reach 11 4 billion during the same period. Thincats australia is an offshoot of thincats a uk based online p2p lending platform established in 2010 offering loans of up to three million pounds. Focusing on peer to peer lending in australia we cut out the middleman bank and provide a direct link between businesses and investors. Head of marketing at plenti sebastian paulin shared more details about the.

Lending club is an industry giant and one of the largest peer to peer lending platforms in the world. Societyone is australia s leading peer to peer lender that connects investors with creditworthy borrowers anonymously in a secure online platform. As a stable online platform marketlend still provides the peace of mind that comes with loss protection we invest and accept losses of at least 1 of the loan and insurance in certain circumstances with the benefit of a quick effortless process. Now banks and other non p2p lenders have been embracing this.

Depending on your credit history the investor and p2p business may team up to offer you a better interest rate than traditional banks. The go between is a web based p2p platform a couple of which have been establishing a strong foothold in australia lately. In australia thincats is targeted at small to medium enterprises smes and offers secured business loans of up to 300 000 for loan terms of up to five years. How p2p lending works how p2p lenders get your credit history.

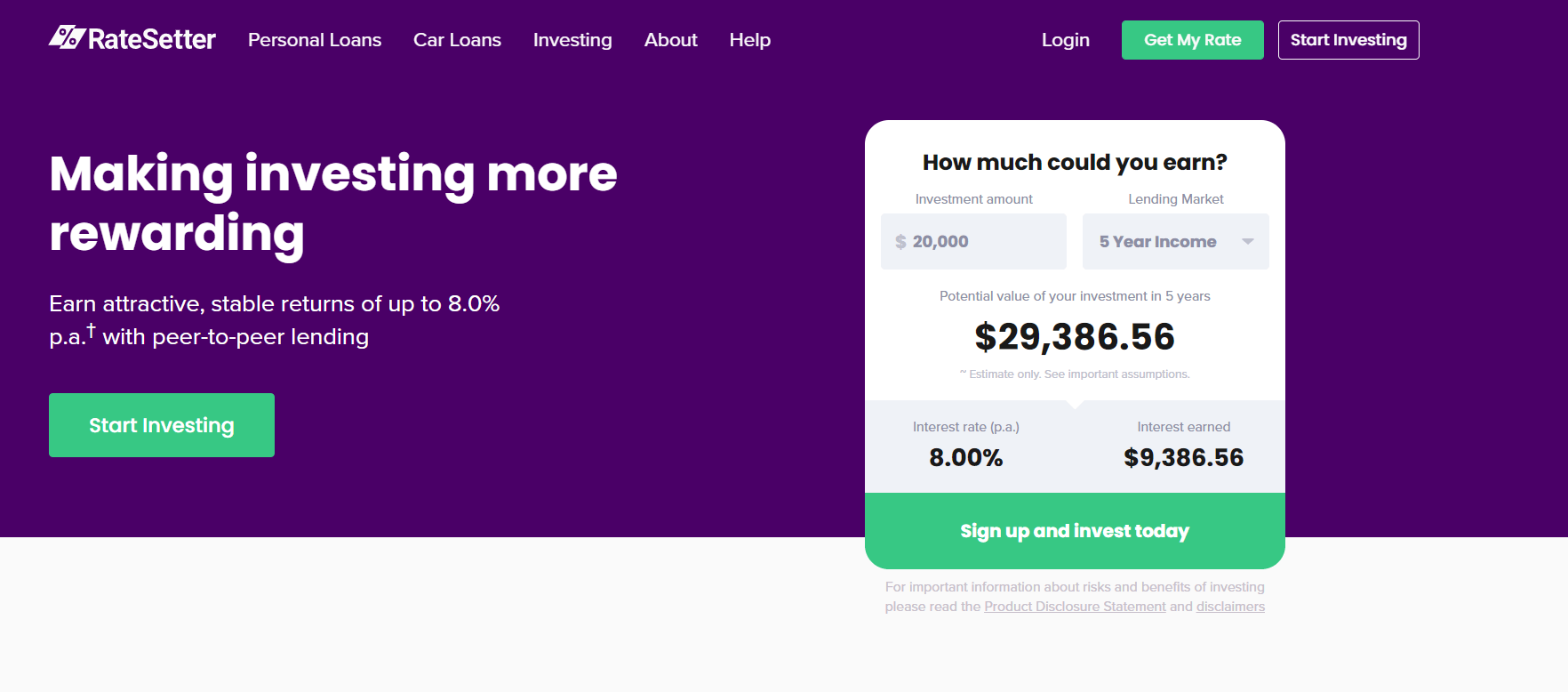

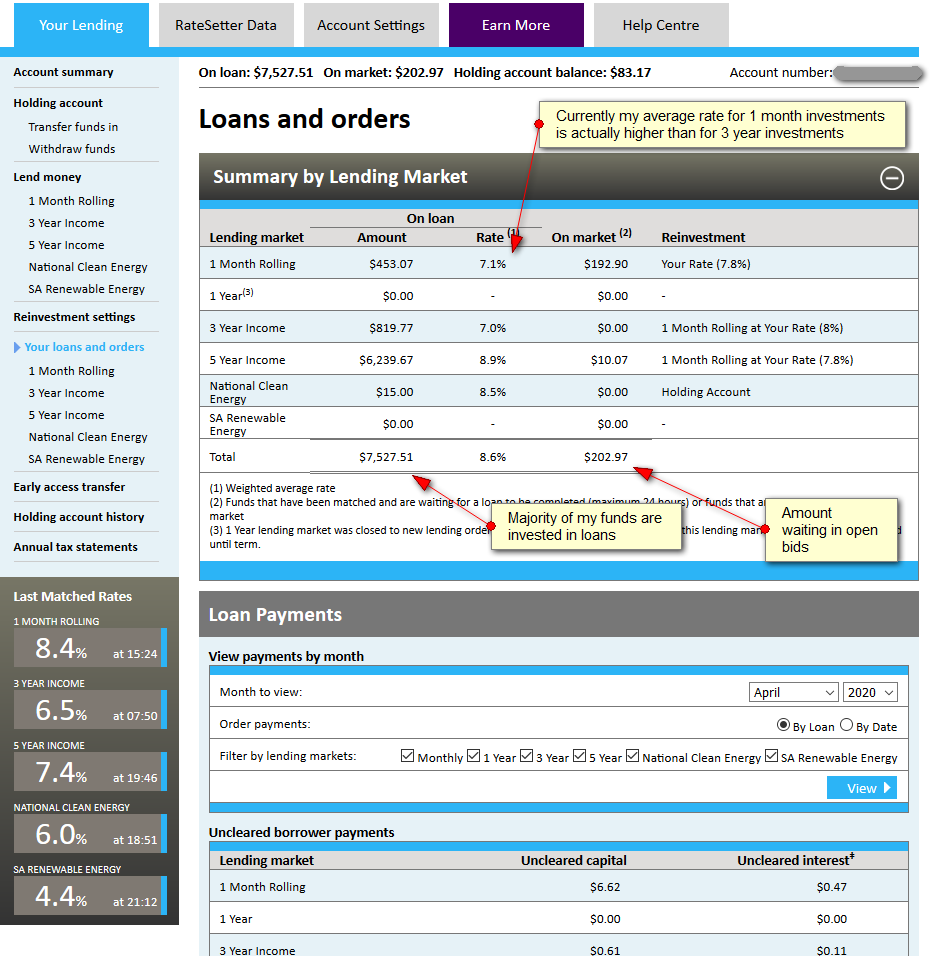

Ratesetter a leading uk based peer to peer lender has rebranded its australian p2p lending platform to plenti. According to the research by morgan stanley value of loans made by online lending platforms in australia is expected to reach 22 billion in next five years.

-Lending-Market-Revenue-(USD-Billion).png)

.jpg)

.jpg)