Private Retirement Scheme And Deferred Annuity

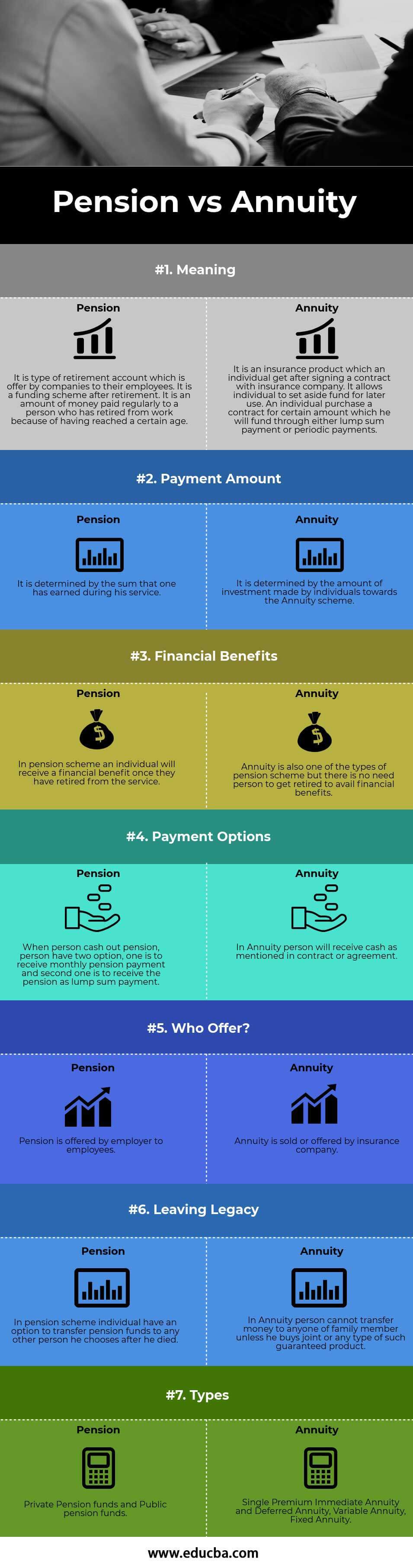

With an immediate annuity you pay the insurer a lump sum and start collecting regular payments right away.

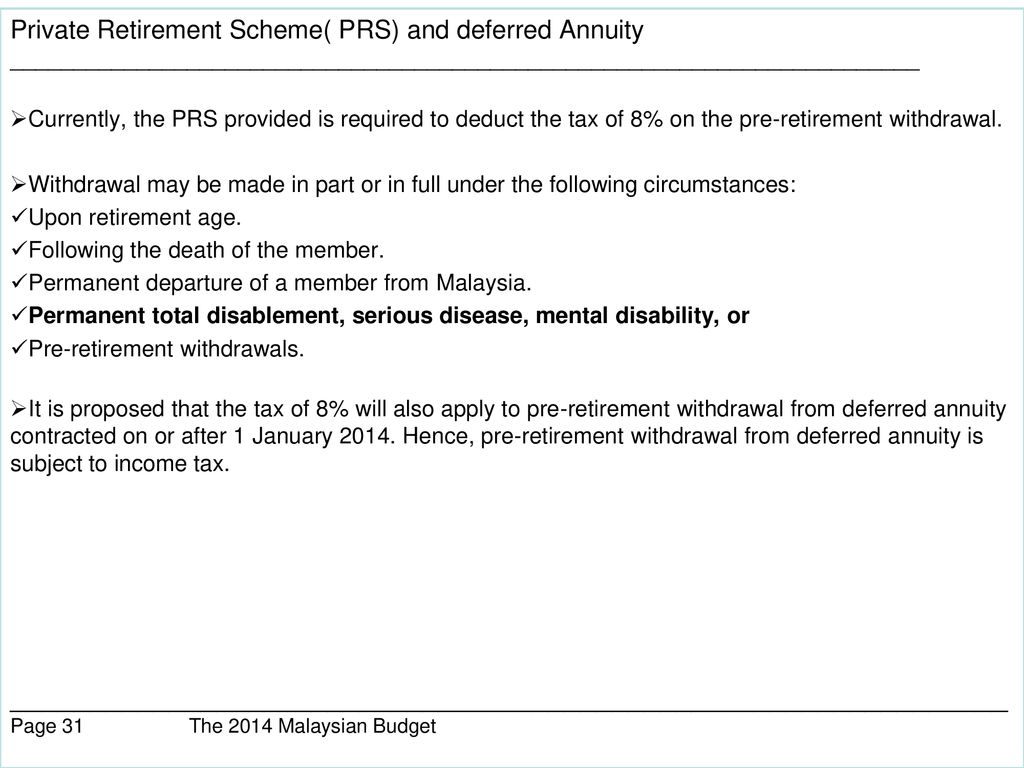

Private retirement scheme and deferred annuity. Deferred retirement annuities. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. Some older adults for example may choose. With prs there are no fixed amount of intervals or term of contribution.

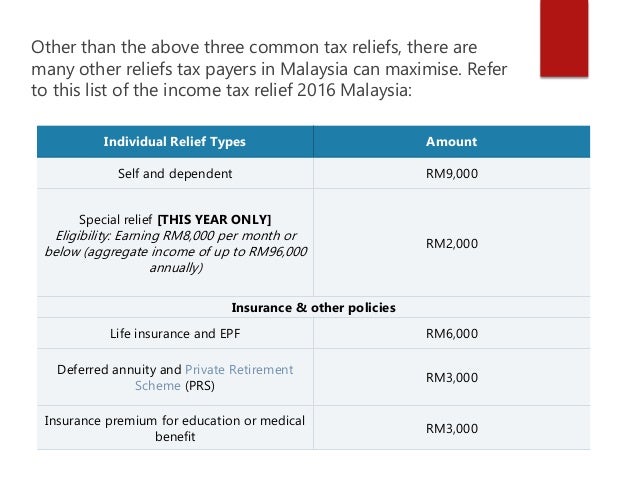

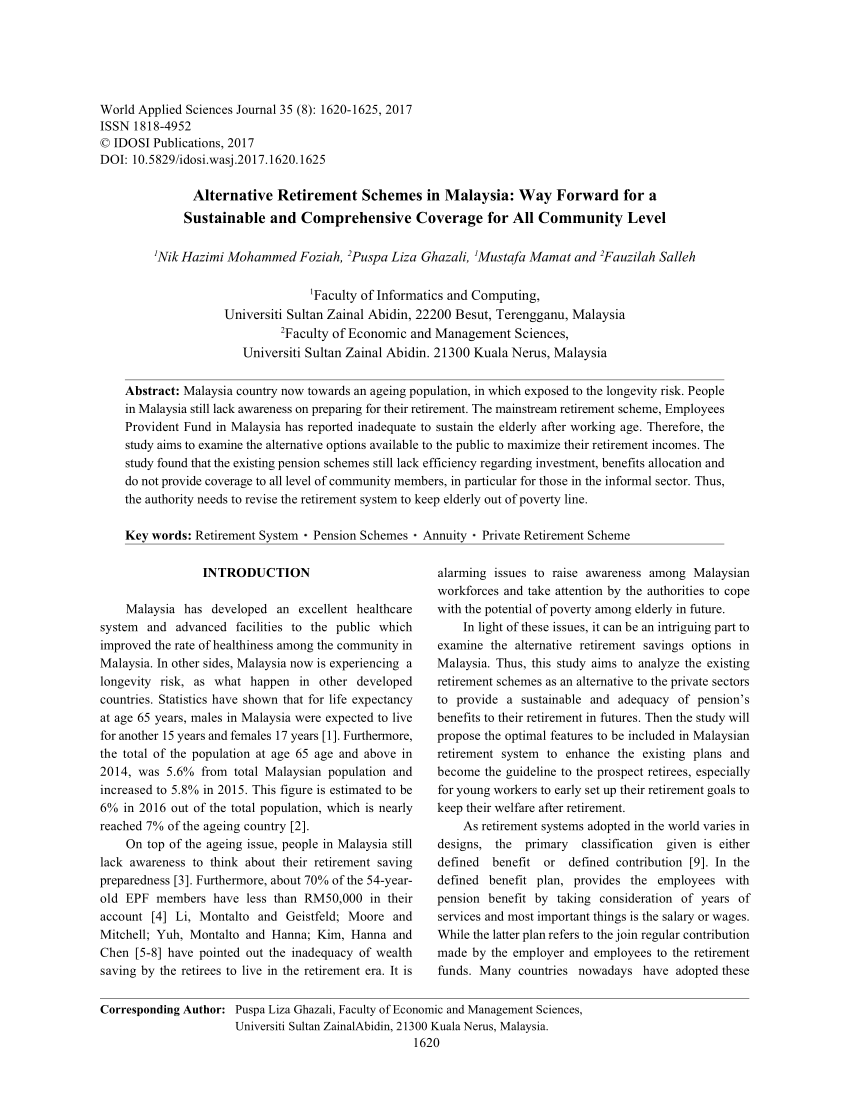

Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. When talking about the retirement funding method that malaysian can choose from we have private retirement scheme prs and deferred annuity in which both of them also entitle you up to rm3 000 tax relief. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. The tax relief entitlement makes this two planning methods even more attractive for retirement planning purpose.

Prs is offered by unit trust companies whereas deferred annuity is offered by insurance companies. Differences between private retirement scheme prs and deferred annuity august 15 2020 by smdk friday 25 november 2016 published in retirement planning. Explained some differences between private retirement scheme provided by unit trust companies and the deferred annuity plan provided by. As you are probably aware with effect from the year of assessments 2012 to 2021 10 year period only individual taxpayers are eligible to claim a personal relief of up to rm3 000 annually for contributions to the private retirement scheme prs or the deferred annuity scheme.

Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. The managing director of sac wealth management sdn. Further to the post on contribute to the private retirement scheme to reduce your tax bill i have been often asked what is your personal preference ie.