Public Ruling Rental Income

12 2018 inland revenue board of malaysia date of publication.

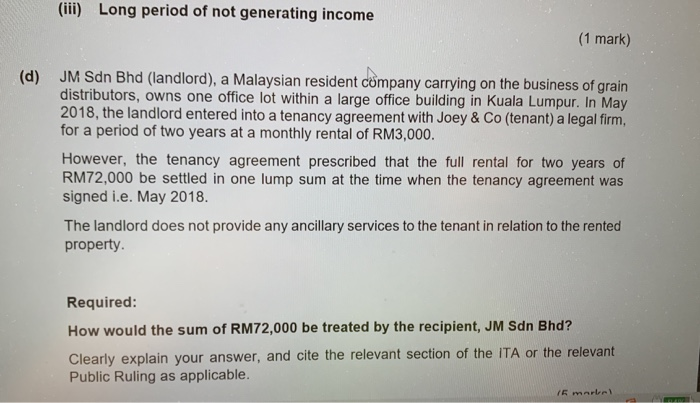

Public ruling rental income. Pr 12 2018 replaces public ruling 4 2011 income from letting of real property 4 2011 pr 4 2011. 1 2004 issued on 30 june 2004 provides clarification on. Periods after the rental income was received in advance public ruling 12 2018 income from letting of real property the irb has issued public ruling 12 2018 income from letting of real property pr 12 2018. We will promptly acknowledge receipt of all private letter ruling requests.

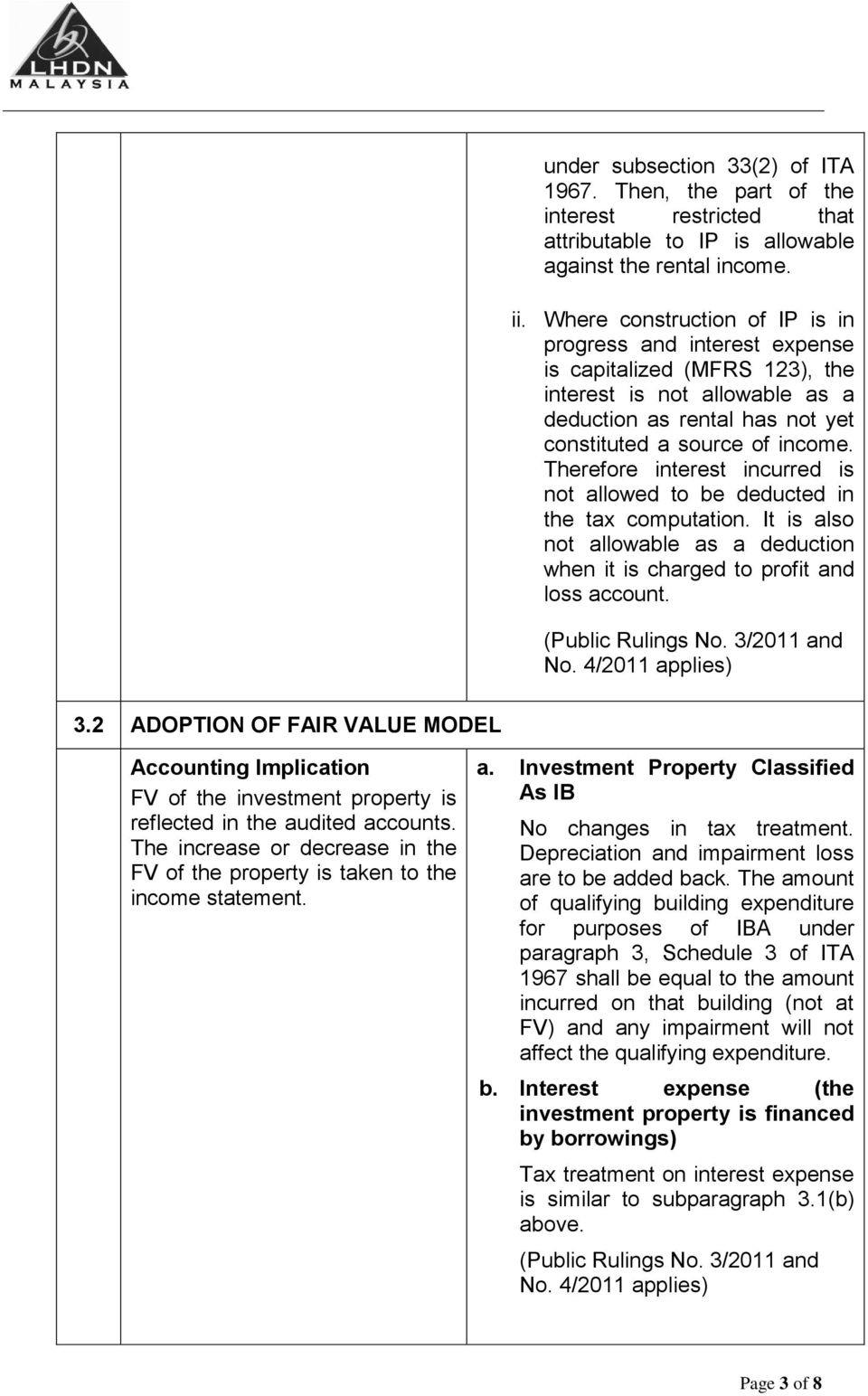

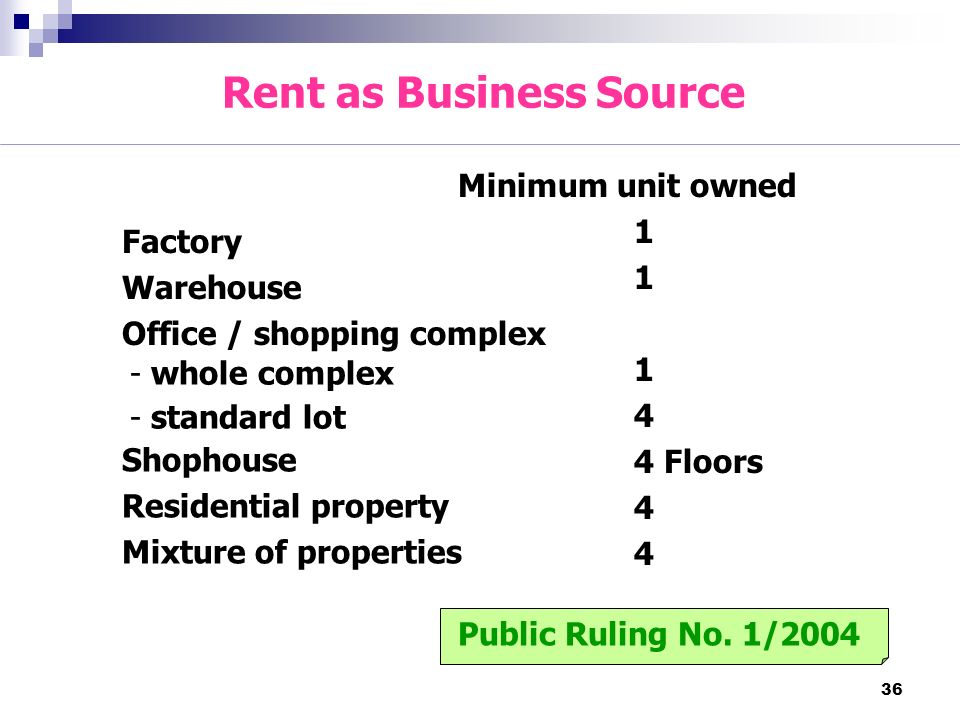

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Recognizing that covid 19 may have impacted renters across the state the texas apartment association taa offers the following guidance to households who may have experienced a loss or reduction of income and are concerned about paying their rent. 1 1 the treatment of rent as a non business source of income under section 4 d of the income tax act 1967 the act. The inland revenue board irb has issued public ruling no.

Request a private letter ruling by emailing tax help cpa texas gov or by mailing. Income from letting of real property. Texas comptroller of public accounts attn. Example 7 azrie owns 2 units of apartment and lets out those units to 2 tenants.

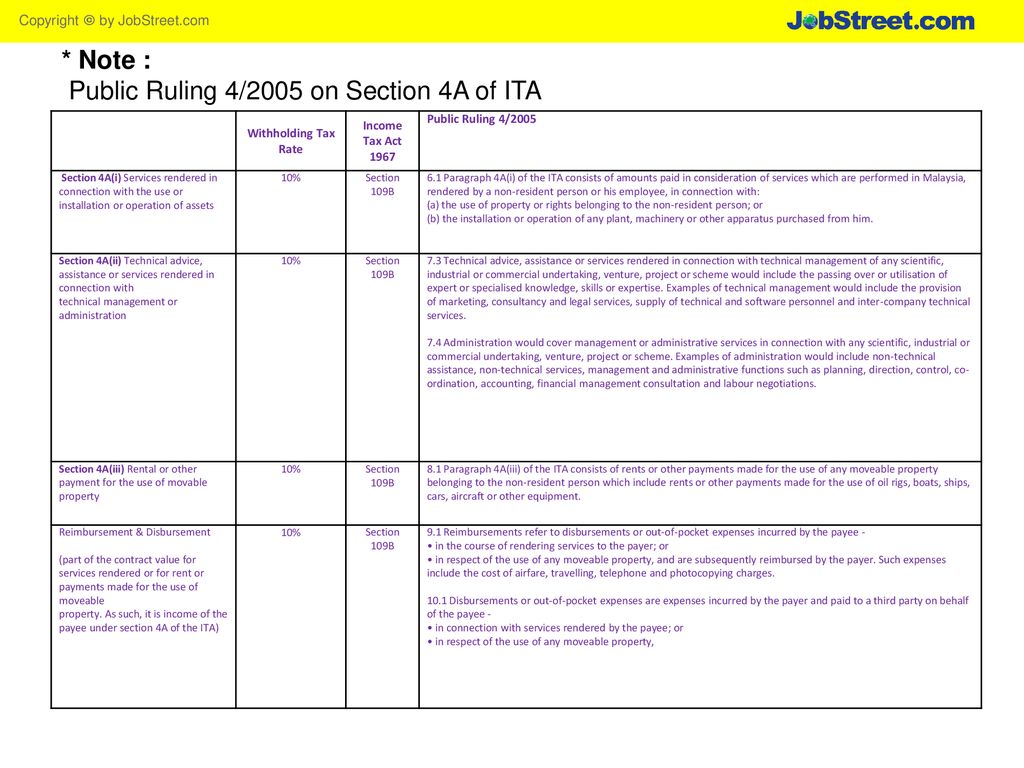

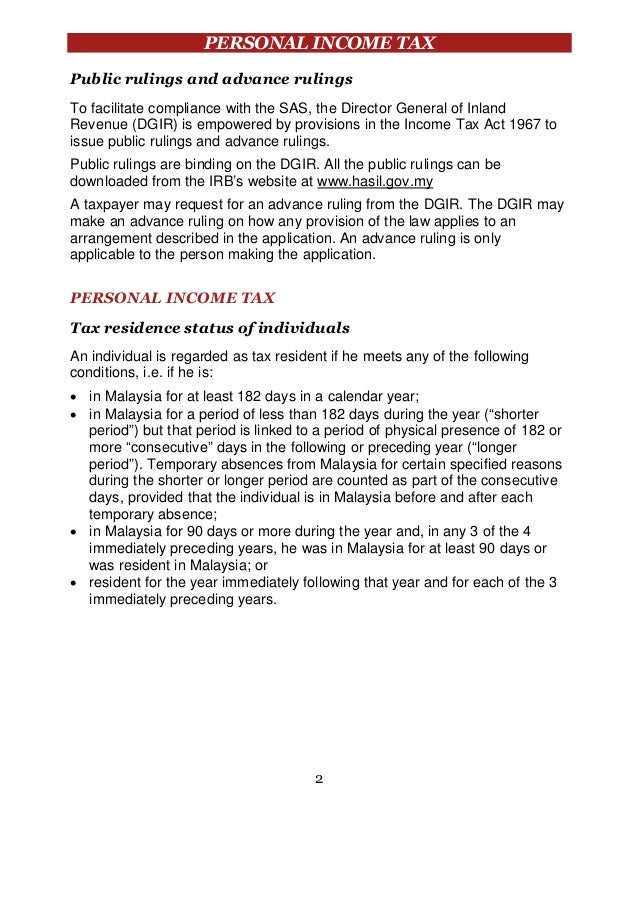

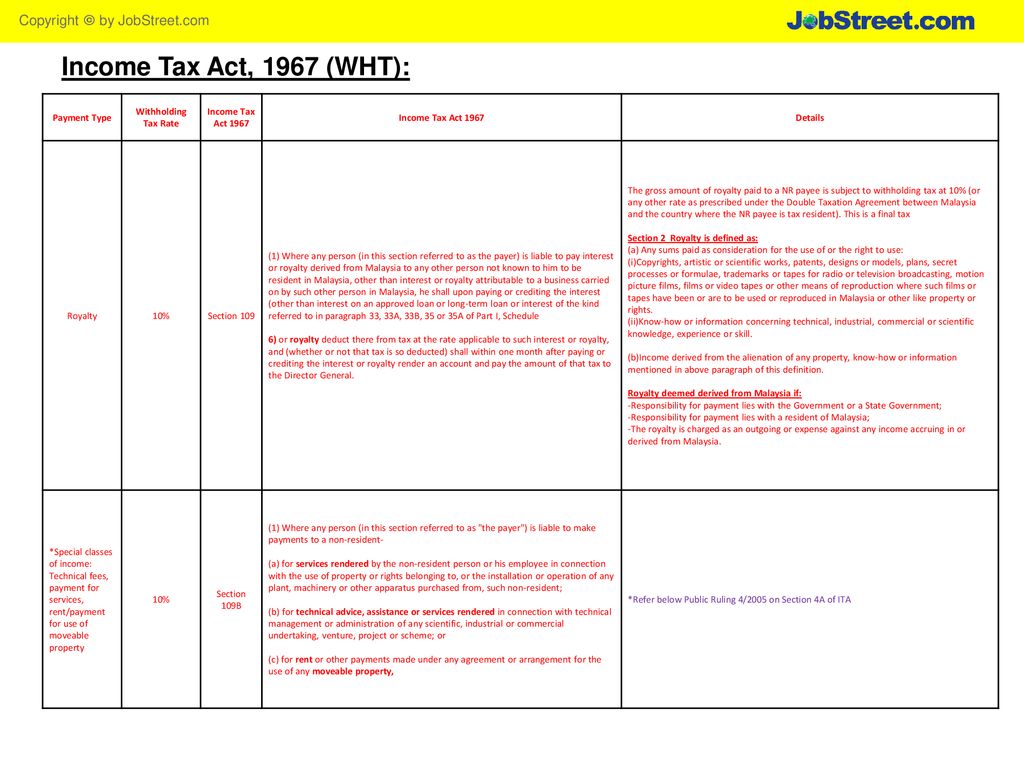

Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita. Box 13528 austin texas 78711 3528. I letting of real property as a business source under paragraph 4 a of the income tax act 1967 ita. Tax policy division p o.

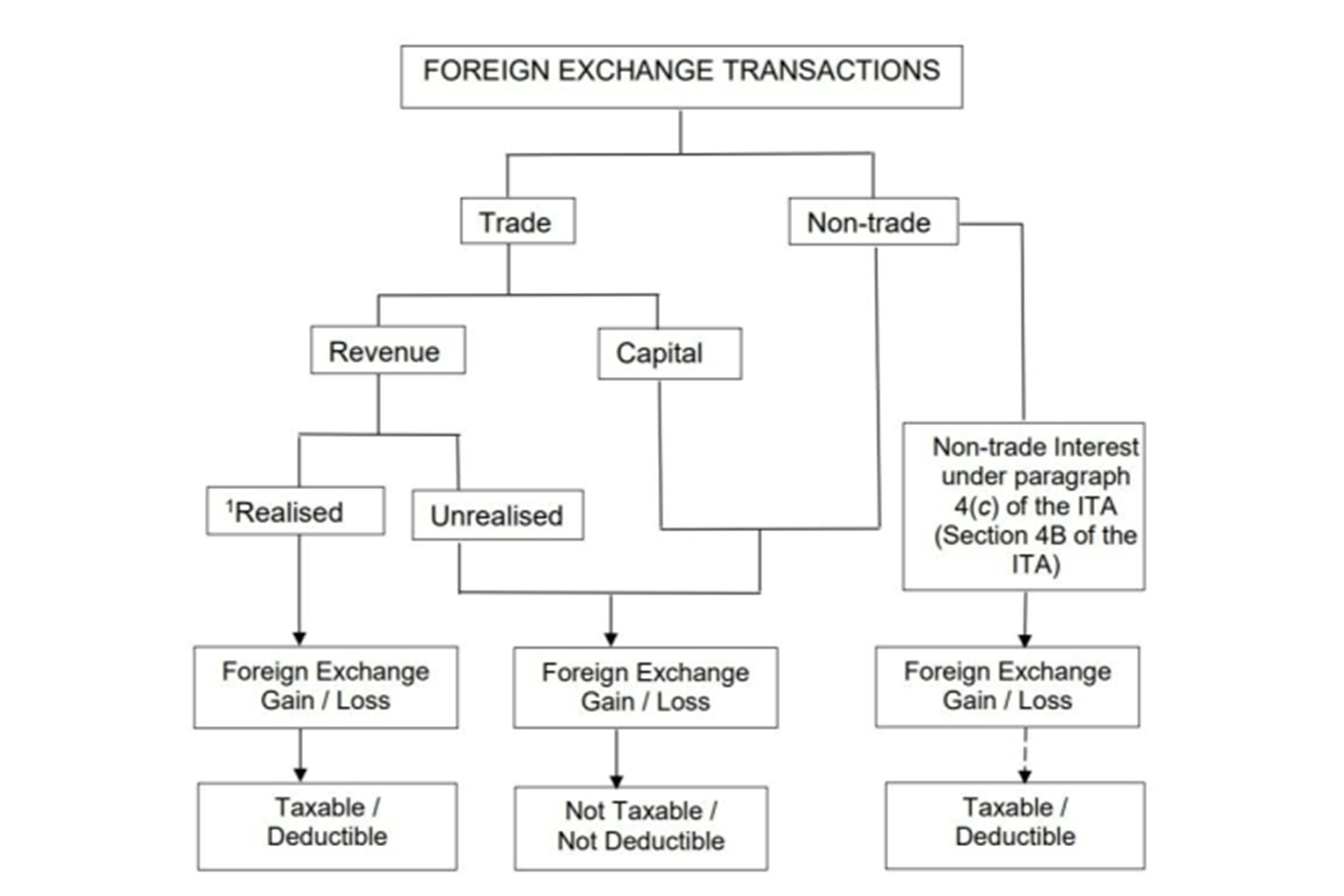

19 december 2018 from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita. This pr which supersedes pr no. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. 3 6 rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation.

The taxes imposed by this chapter do not apply to the rental of a motor vehicle to a public agency.