Paragraph 127 3 B Income Tax Act

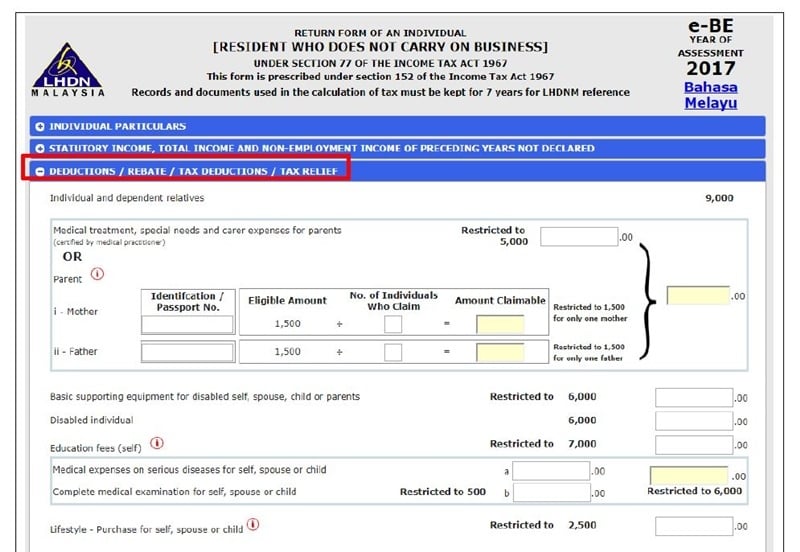

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

Paragraph 127 3 b income tax act. Non chargeability to tax in respect of offshore business activity 3 c. Following sections of the income tax act 1967. In pn 2 2018 the irb clarifies that the scope of exemption granted under section 127 under a non application provision covers exemptions granted under the following sub sections. Expatriate posts based on the requirements of the ipc rdc.

Tax exemption of statutory income for 10 years under section 127 of the income tax act 1967 act 53 dividends paid from the exempt income will be exempted from tax in the hands of its shareholders ii an approved ipc rdc status company will enjoy the following benefits. The revised guideline is available on mida s website www mida gov my resources forms and. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. 100 647 set out as a note under section 1 of this title.

99 514 to which such amendment relates see section 1019 a of pub. Section 127 3 b exemptions made under gazette orders section 127 3a exemptions given directly by the minister of finance usually via a letter to the taxpayer. 100 647 effective except as otherwise provided as if included in the provision of the tax reform act of 1986 pub. Section 127 3 b for tier 1 and value added income incentives via a gazette order.

Amendment by section 1011b a 31 b of pub. Interpretation part ii imposition and general characteristics of the tax 3. C declare any part of the armed forces to be a reserve force for the purposes of paragraph 9 of part i of schedule 6 in addition to the forces mentioned in that paragraph. 3 laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1.

Logging tax deduction 127 1 there may be deducted from the tax otherwise payable by a taxpayer under this part for a taxation year an amount equal to the lesser of a 2 3 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and b 6 2 3 of the taxpayer s income for the year from. Commissioners appeals appellate assistant commissioners inspecting assistant commissioners and income tax officers to perform such functions in respect of such area or of such classes of persons or of such classes of income as may be specified in the notification and thereupon the functions so specified shall cease to be performed in respect of the area or classes of persons or classes of income by the other authorities under section. Charge of income tax 3 a. 127 5 notwithstanding any other provision of this act but subject to subsection 120 4 3 and section 127 55 where the amount that but for section 120 would be determined under division e to be an individual s tax payable for a taxation year is less than the amount determined under paragraph a in respect of the individual for the year.

Section 127 in the income tax act 1995.