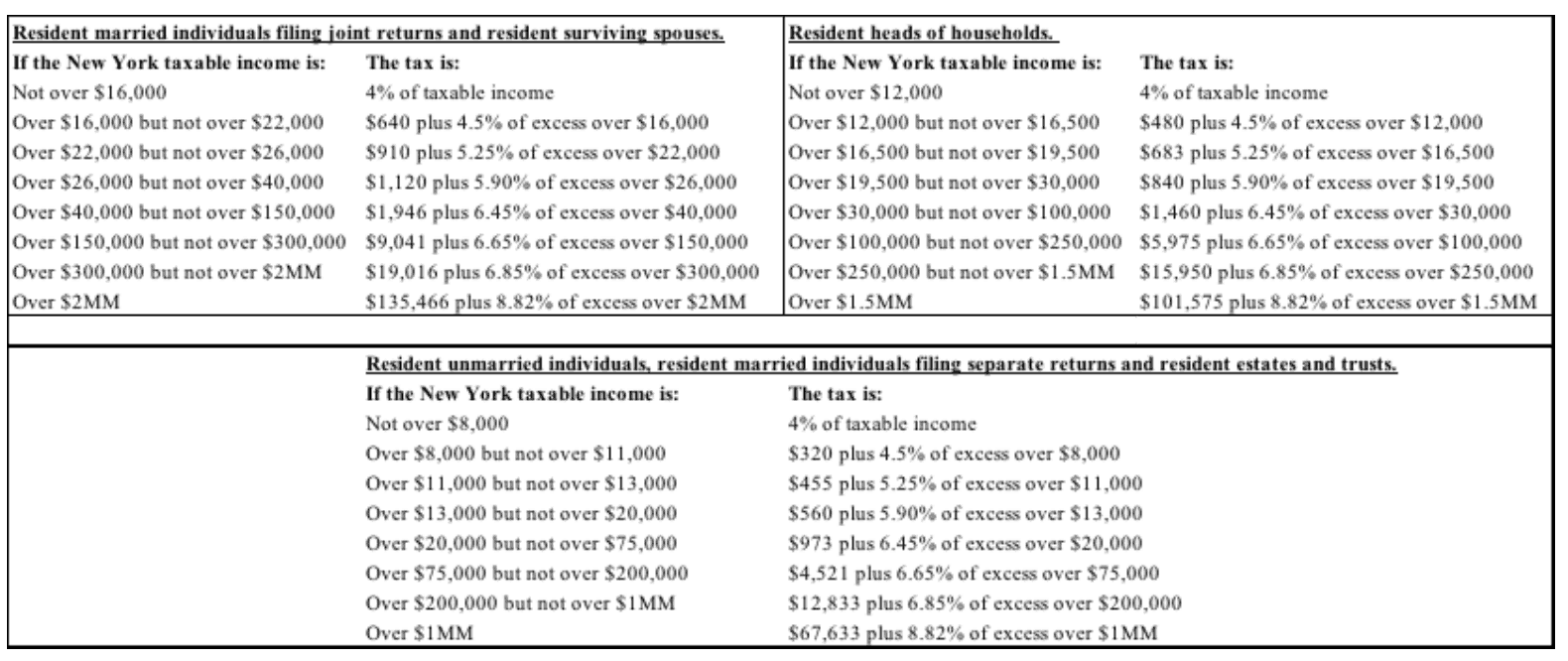

Personal Tax Rate 2019

33 of taxable income over 214 368.

Personal tax rate 2019. Calculations rm rate tax rm 0 5 000. For ya 2019 a personal tax rebate of 50 of tax payable up to maximum of 200 is granted to tax residents. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. What is a tax exemption.

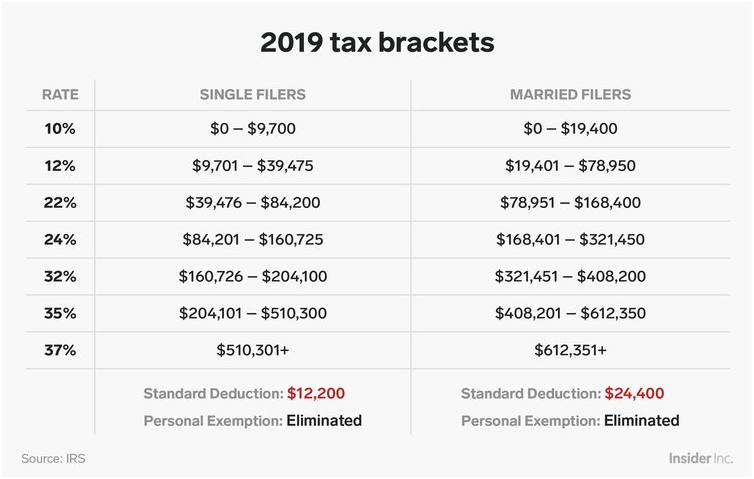

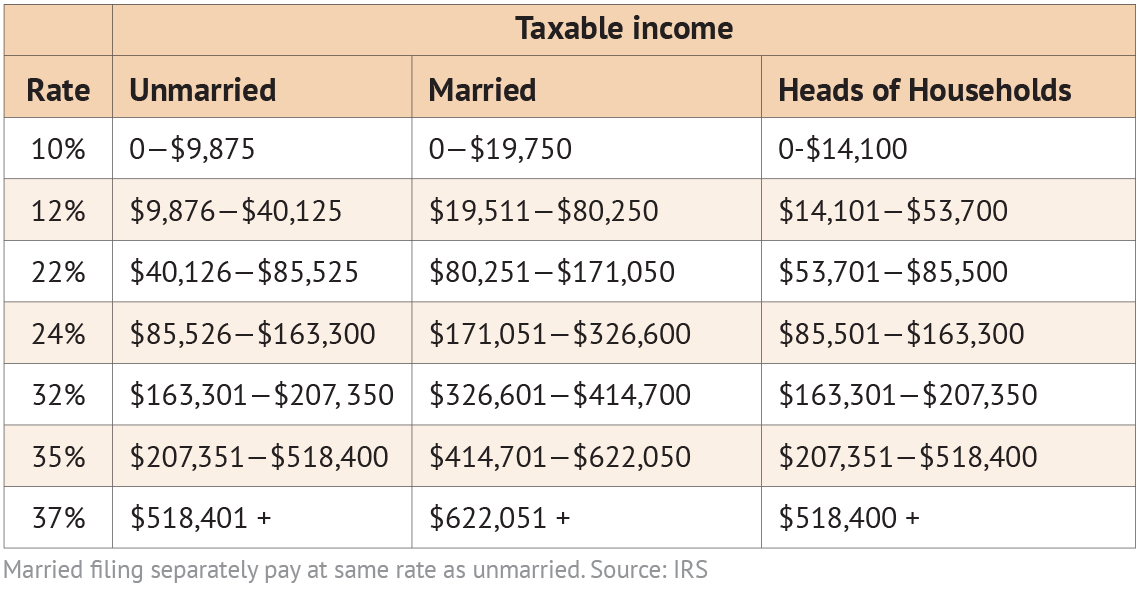

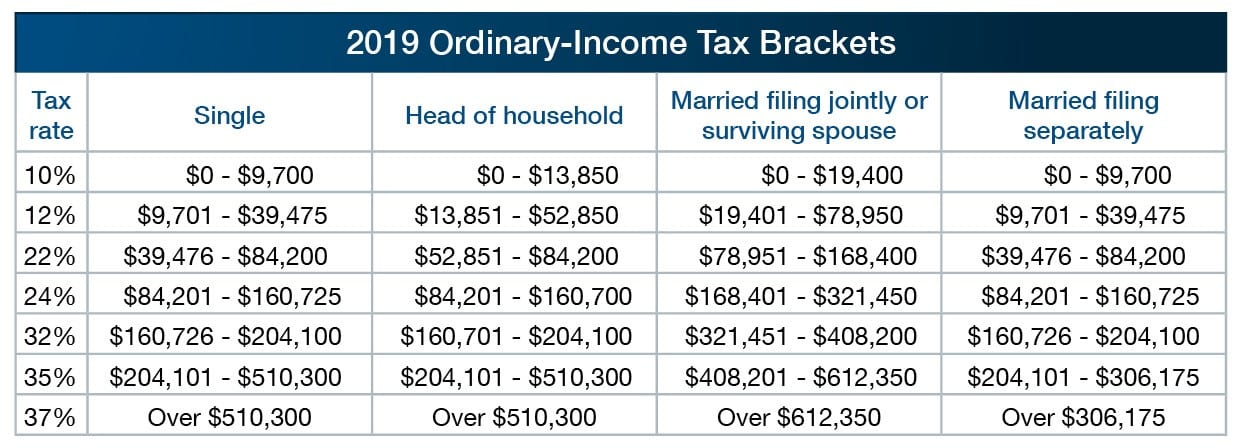

What is tax rebate. The chart below reproduces the calculation on page 7 of the income tax and benefit return to calculate net federal tax. This article gives you the tax rates and related numbers that you will need to prepare your 2019 income tax return. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. However the deductible cannot be more than 7 000 up 150 from the limit for tax year 2018. Irs tax brackets deduction amounts for tax year 2019. Your total tax bill would be 13 459.

In general 2019 personal income tax returns are due by monday april 15 2020. What is a tax deduction. Divide that by your earnings of 80 000 and you get an effective tax rate of 16 8 percent which is lower than the 22 percent bracket you re in. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

Malaysia personal income tax guide for 2020. Ya 2017 for ya 2017 a personal tax rebate of 20 of tax payable up to maximum of 500 is granted to tax residents. Income tax brackets and rates. On the first 5 000 next 15 000.

For tax year 2019 participants with family coverage the floor for the annual deductible is 4 650 up from 4 550 in 2018.