Personal Tax Rate 2018

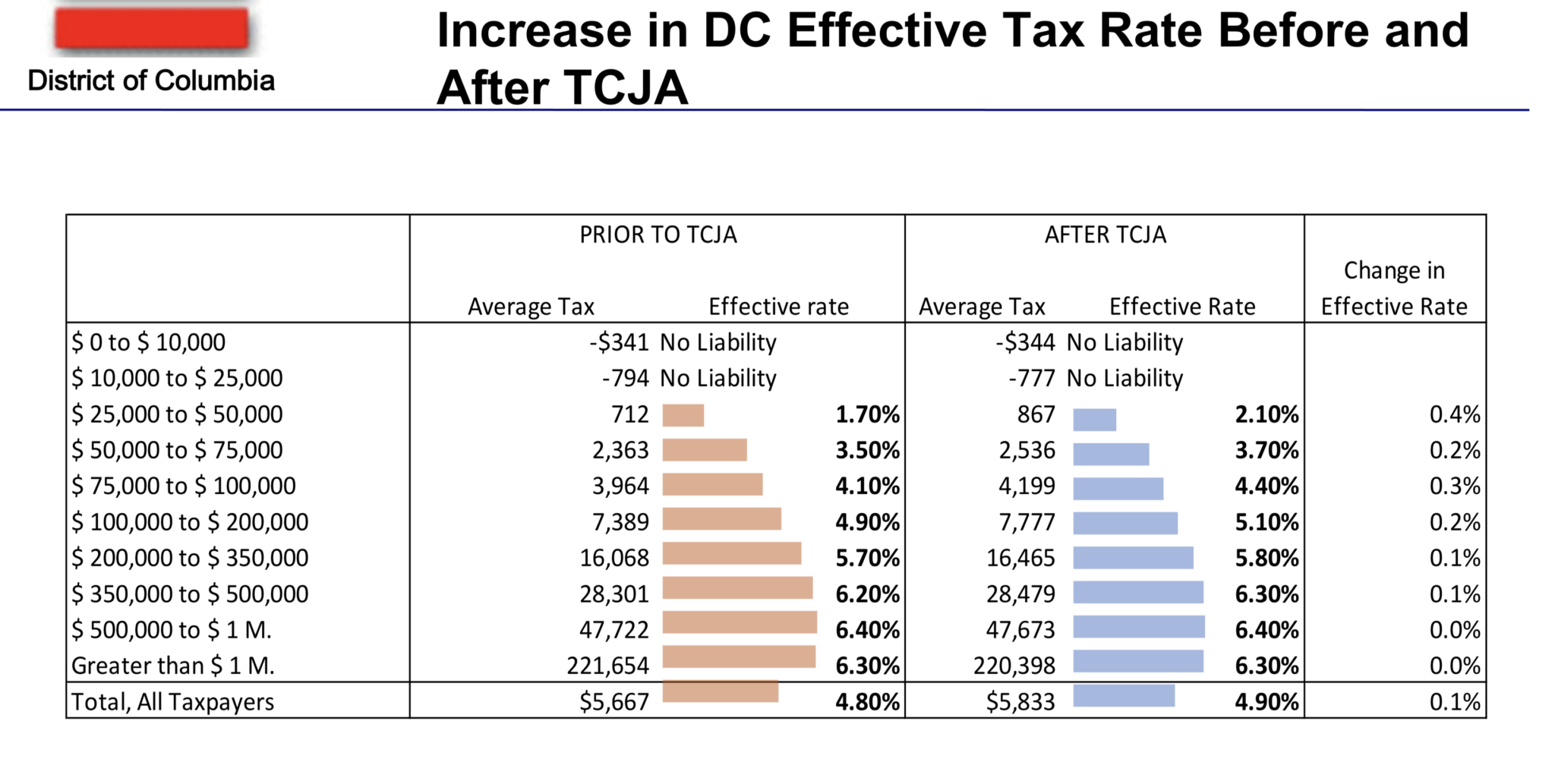

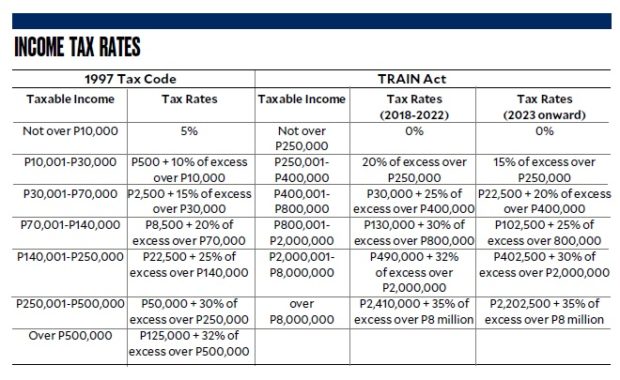

For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018.

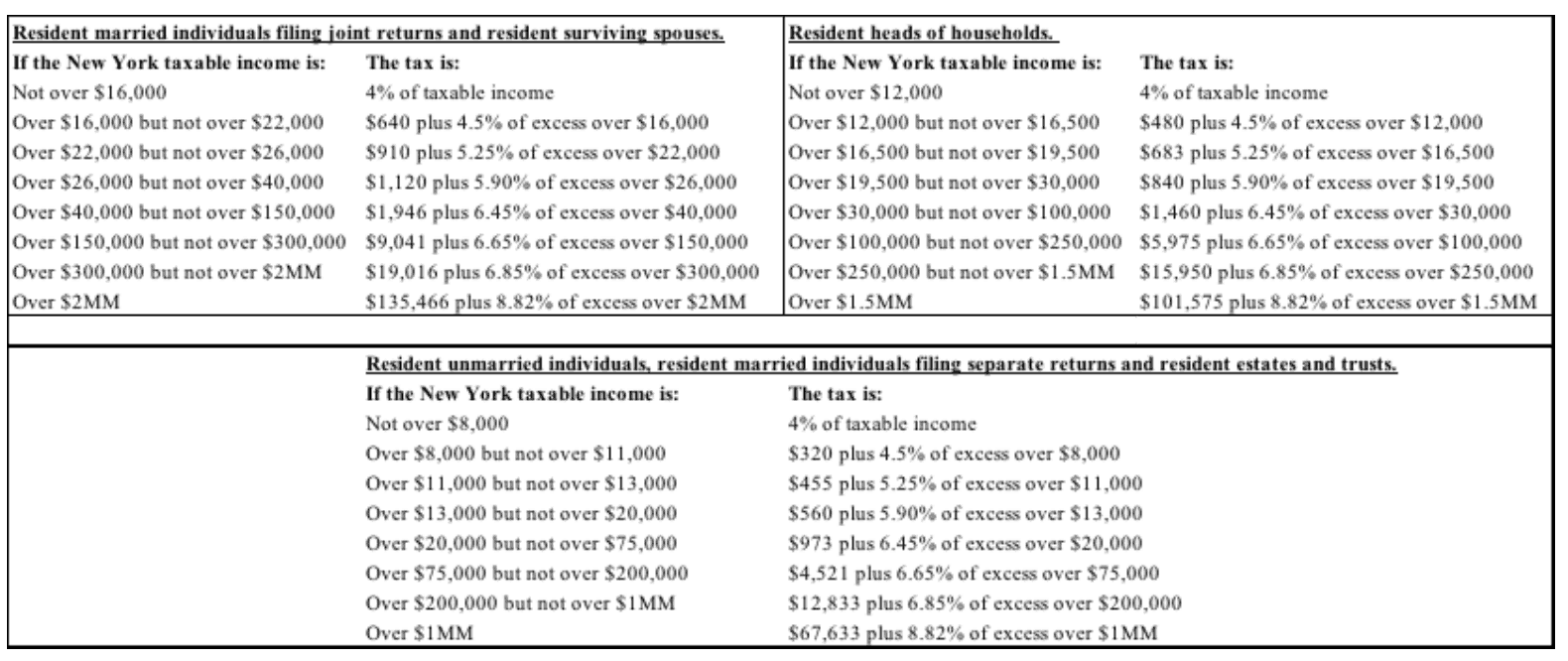

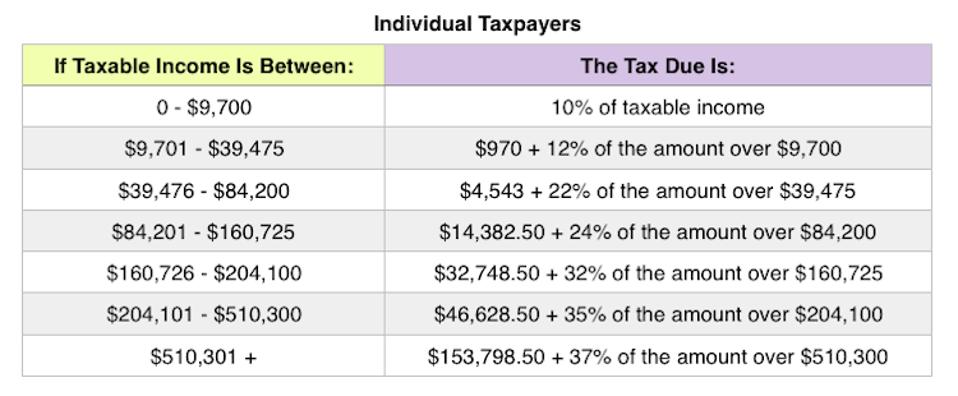

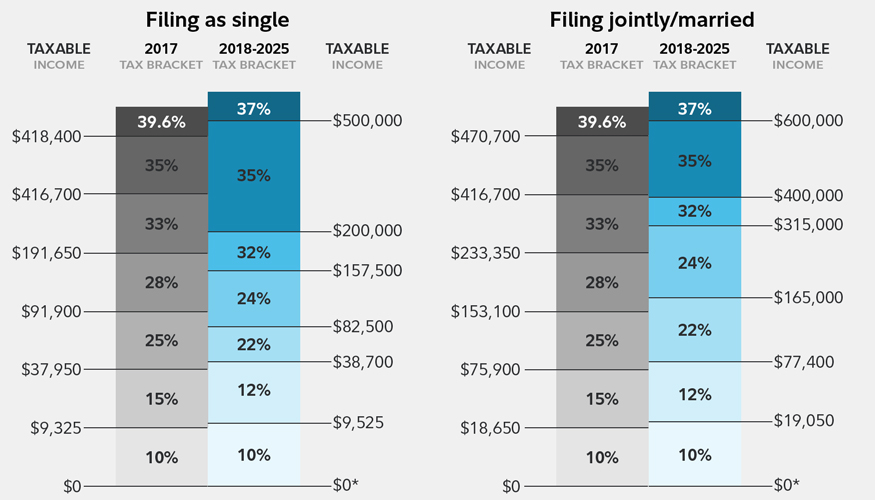

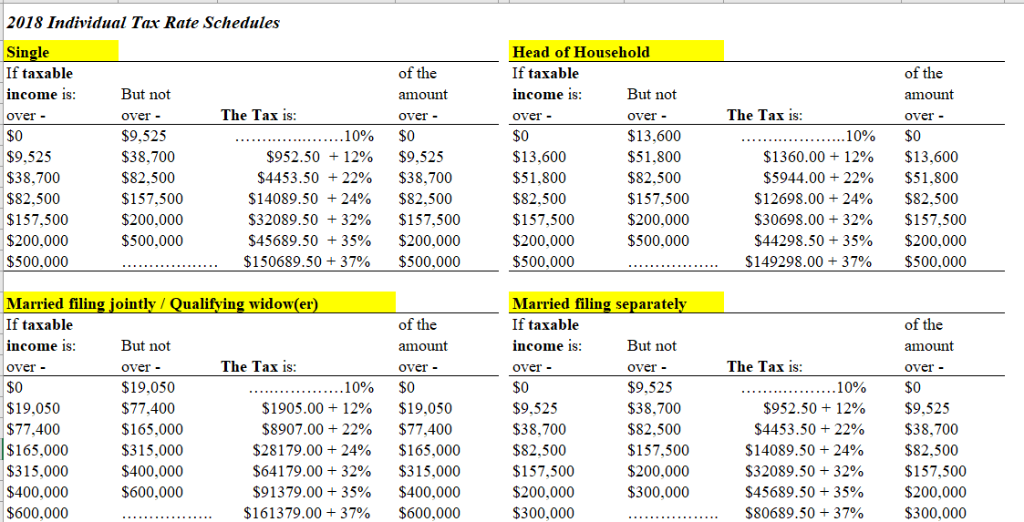

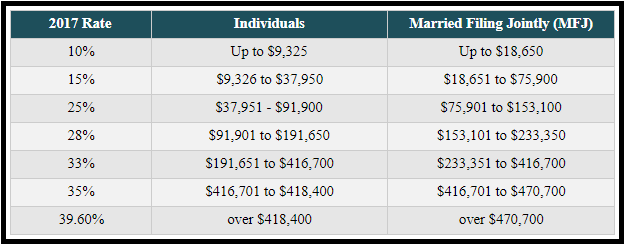

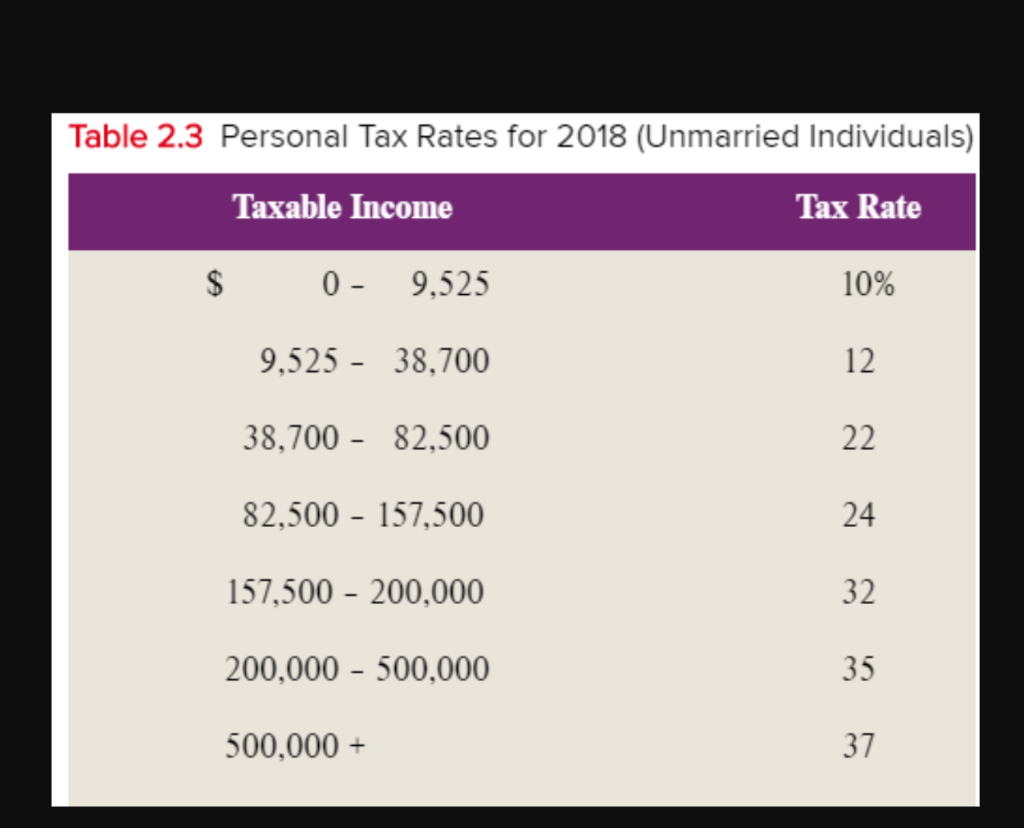

Personal tax rate 2018. These tax rates are new and come from the tax jobs and cuts act of 2017 which was signed into law by president trump on december 22 2017. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly. The standard deduction in 2018 as the law currently exists is 13 000 for a couple filing jointly. 105 429 36 of taxable income above 445 100.

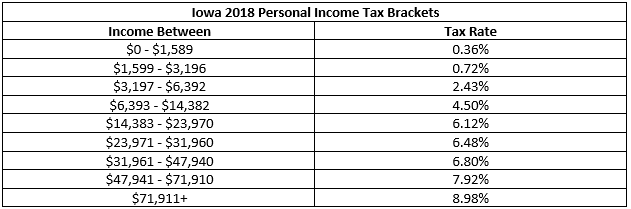

445 101 584 200. 10 12 22 24 32 35 and 37. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. 33 of taxable income over 214 368.

37 062 26 of taxable income above 205 900. That number will jump to 24 000. On the first 5 000. 19c for each 1 over 18 200.

3 572 plus 32 5c for each 1 over 37 000. The amount of tax you owe depends on your income level and filing status. 67 144 31 of taxable income above 321 600. Tax on this income.

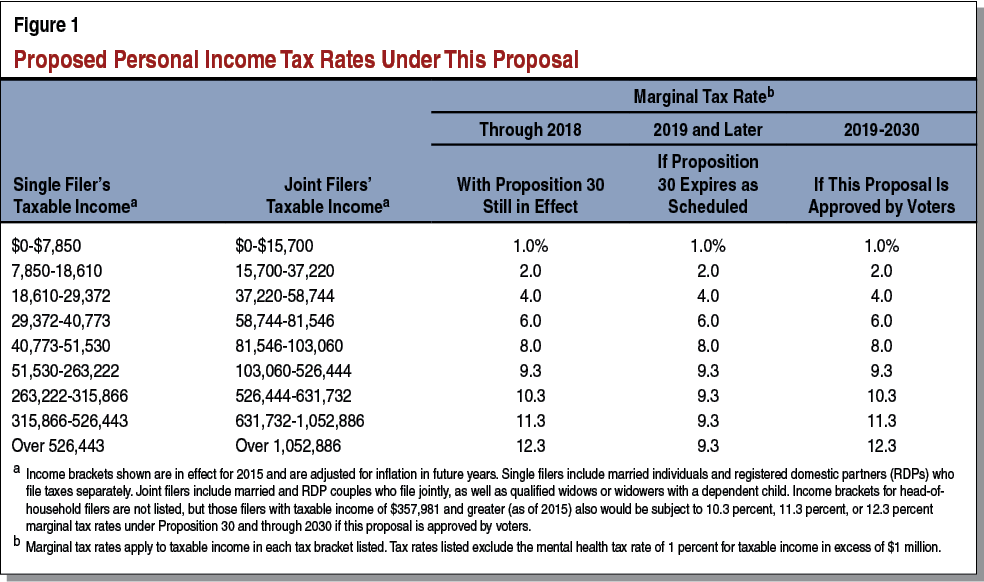

In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2. The tax cuts and jobs act that went into effect on jan. 29 on the next 63 895 of taxable income on the portion of taxable income over 150 473 up to 214 368 plus. Tax rm 0 5 000.

2018 individual income tax brackets the federal income tax has 7 rates. Calculations rm rate. 205 901 321 600. The chart below reproduces the calculation on page 7 of the income tax and benefit return to calculate net federal tax.

18 of taxable income. 1 2018 retained seven tax brackets but lowered some of the tax rates and raised some of the income thresholds for those rates. Rates of tax r 1 205 900.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)