Private Retirement Scheme Malaysia Review

Prs is a voluntary long term investment and saving scheme designed to help you save adequately for retirement.

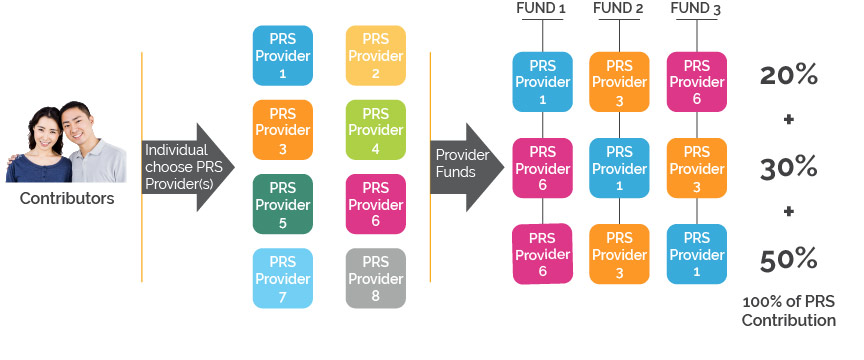

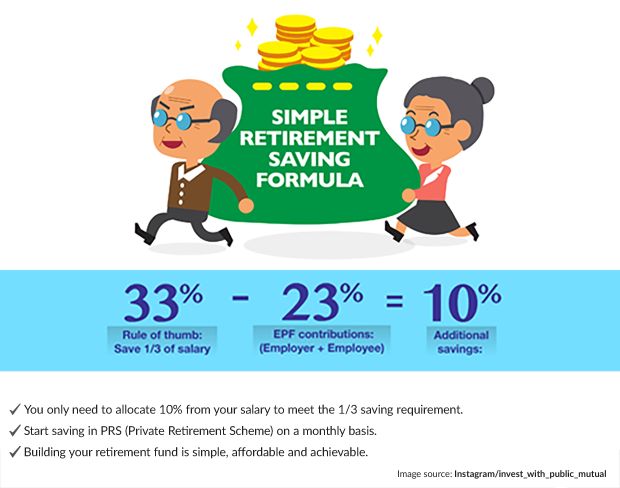

Private retirement scheme malaysia review. The ultimate guide for beginners to invest gold in malaysia. Sub account a and sub account b. Each prs offers a choice of retirement funds from which individuals may choose to invest in based on their own retirement needs goals and risk appetite. Prs complements the mandatory contributions made to epf.

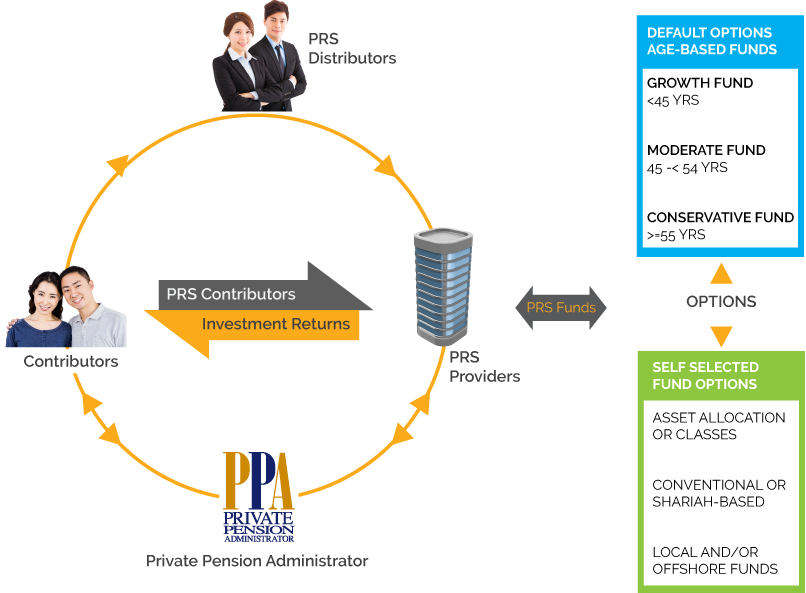

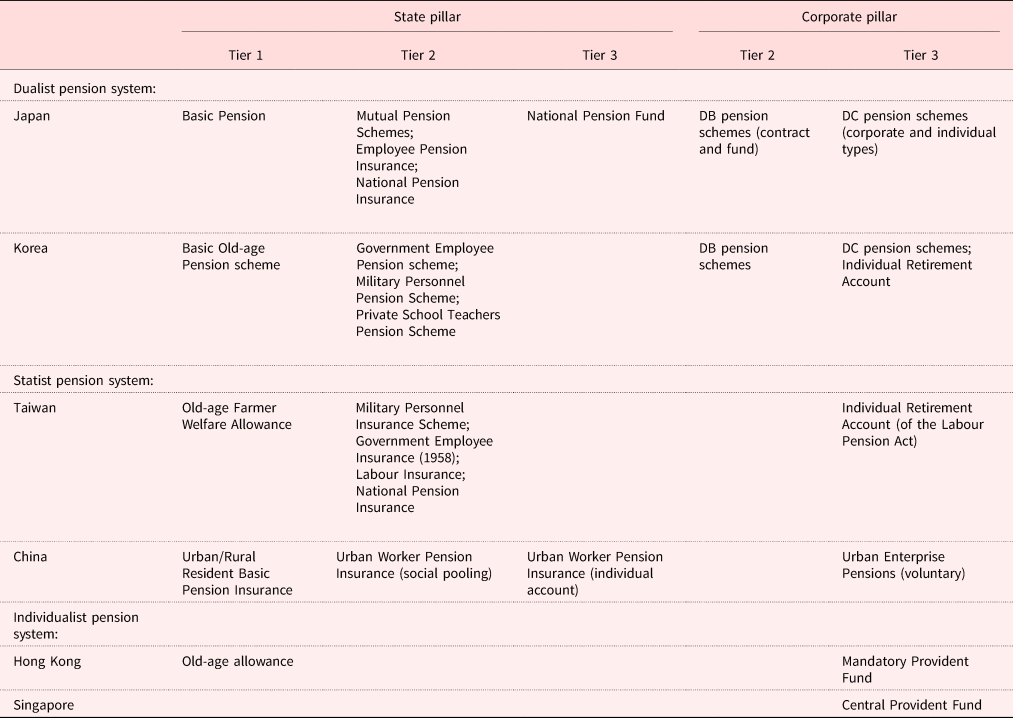

Prs offers the safest most flexible and regulated retirement saving scheme to accumulate your retirement funds. The malaysian pension system now has a number of different institutions that fall into five different areas serving mostly dif ferent constituencies. The mechanism of private retirement scheme malaysia. Only upon reaching the retirement age of 55 years or in the case of death or emigration can withdrawals be made from the prs account.

The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Hellogold review everything you need to know before investing. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment.

The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Prs is made available to all malaysians who are employed and self employed. Like with epf prs contributions are also divided 70 30 into two sub accounts. A tax funded defined benefit db pension scheme for public servants.

It acts perfectly as an extra layer of safety net after your retirement. The contents contained shall not be disseminated reproduced or used either in part or in. Prs is similar to the employees provident fund epf in that it is a retirement scheme. Malaysia s retirement income system is predominantly based on the epf which covers all private sector employees and non pensionable public sector employees.

It is high time for industry and community groups to look into private retirement schemes prs and other ways to boost long term savings he adds. Thus an additional regulated structured scheme like the prs can be incredibly beneficial to all malaysians hoping to improve their finances for retirement. 5 key factors to choose the best reit stock today. How to choose the best private retirement scheme malaysia.

Public and private sector pension schemes introduced in 1951 even before indepen dence from the united kingdom in 1957. As the name implies prs is privately managed by asset management companies also known as prs providers.