Penalty For Underestimated Tax Malaysia

Tax offences an offence is committed under the income tax act 1967 under the following section.

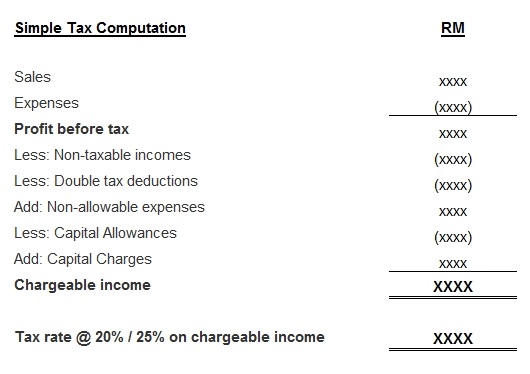

Penalty for underestimated tax malaysia. 112 1 200 to 2 000 or imprisonment or both. Underestimation of tax estimate for a ya by more than 30 of actual tax payable. Penalty payment for composite. 114 1 1 000 00 to 20 000 00 imprisonment for a term not exceeding 3 years both and 300 of tax undercharged.

112 1 200 to 2 000 or imprisonment or both. Fail to give notice of changeability to tax. 1 000 00 to 10 000 00 and 200 of tax undercharged. The irb is empowered under the income tax act 1967 to impose a 100 penalty for offenses involving an underpayment of tax.

Any company which without reasonable excuse fails to submit the estimate of tax payable for a year of assessment shall be guilty of an offence and upon conviction be liable to a fine ranging from rm200 to rm20 000 or face imprisonment for a term not exceeding six months or both. Penalty payment for section 108. Additional 5 on any unpaid tax and penalty that is outstanding after 60 days the additional 5 ceases w e f. Penalty payment for section 103a 103.

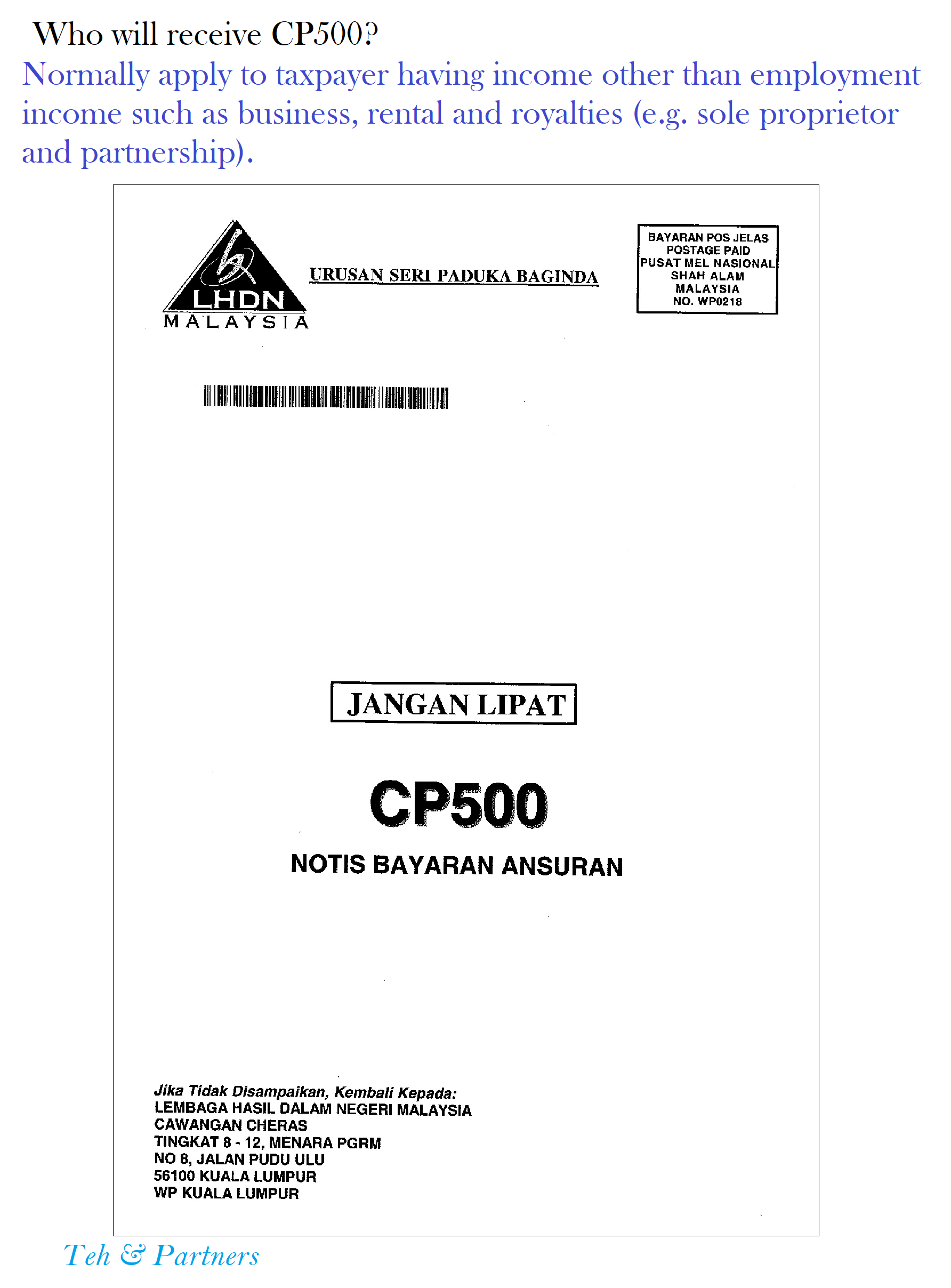

Amount of fine rm fail to furnish an income tax return form. Real property gain tax payment rpgt 5. Income tax payment excluding instalment scheme 7. 10 of tax payable.

Tax offences and penalties 1. Penalty payment for section 107c 9 107b 3 12. 10 of outstanding tax instalment amount. Monthly tax deduction mtd 6.

However the maximum penalty currently imposed is 35. Late payment of tax instalment. Assist or advise without reasonable care others to under declare their income. 2018 2019 malaysian tax booklet 16 offences penalties late payment of tax instalment 10 of outstanding tax instalment amount underestimation of tax estimate for a ya by more than 30 of actual tax payable 10 of the difference exceeding 30 of the actual tax payable failure to furnish country by country report rm20 000 to rm100 000.

A section 77 1 failure to furnish a return by individual b section 77 3 failure to give notice of chargeable income by individual arrives in malaysia. Provisions under ita 1967.

/468015879-F-56a938403df78cf772a4e144.jpg)