Price To Book Value Per Share Formula

Use of book value per share.

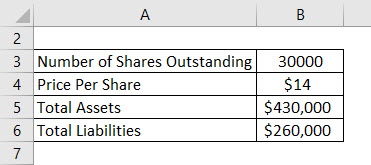

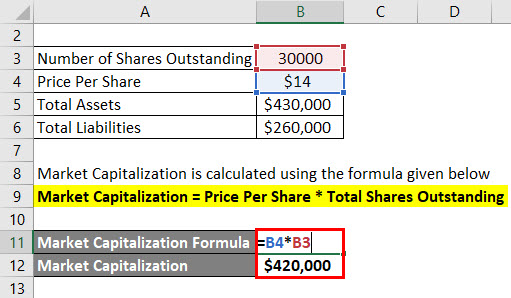

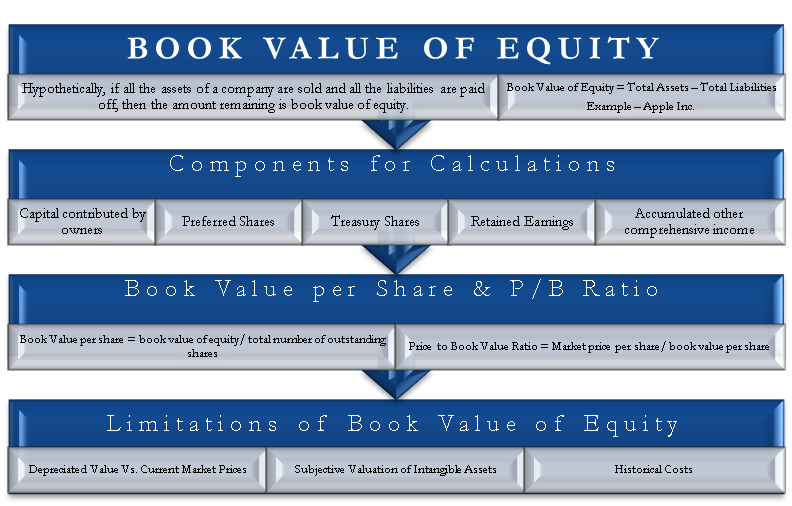

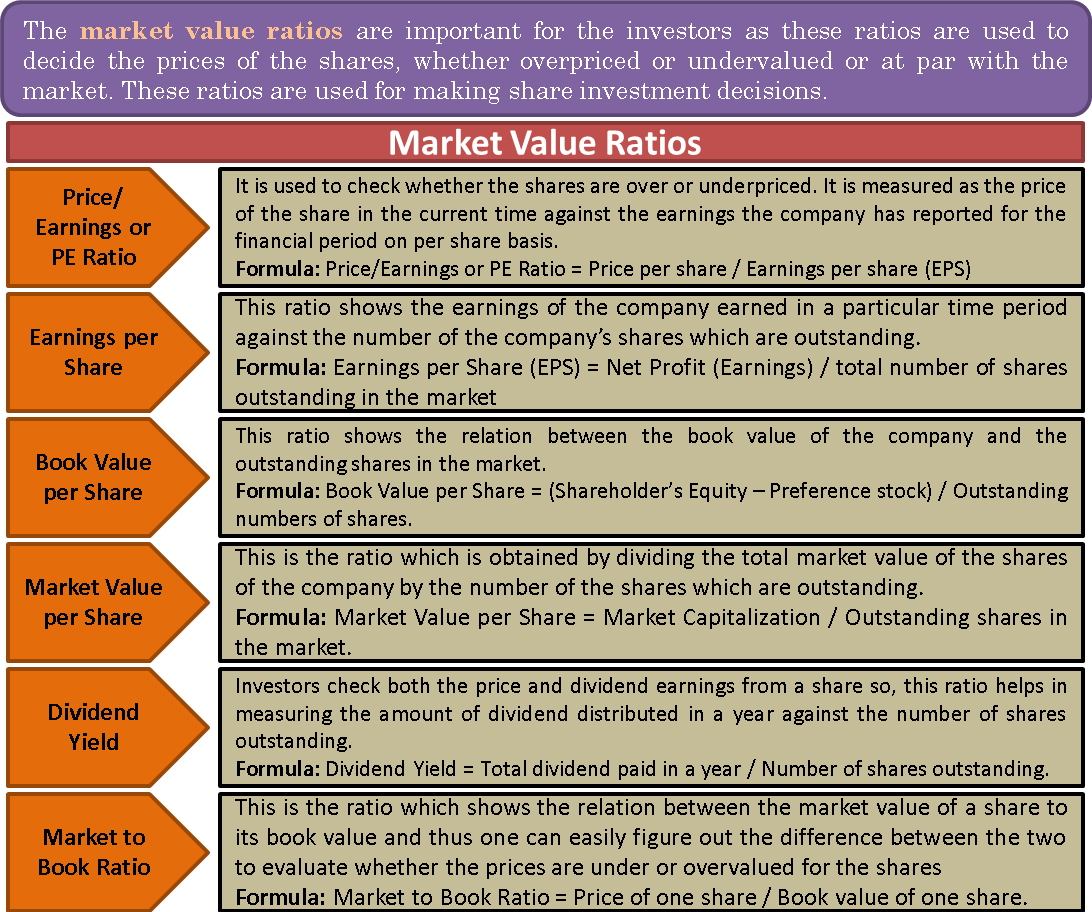

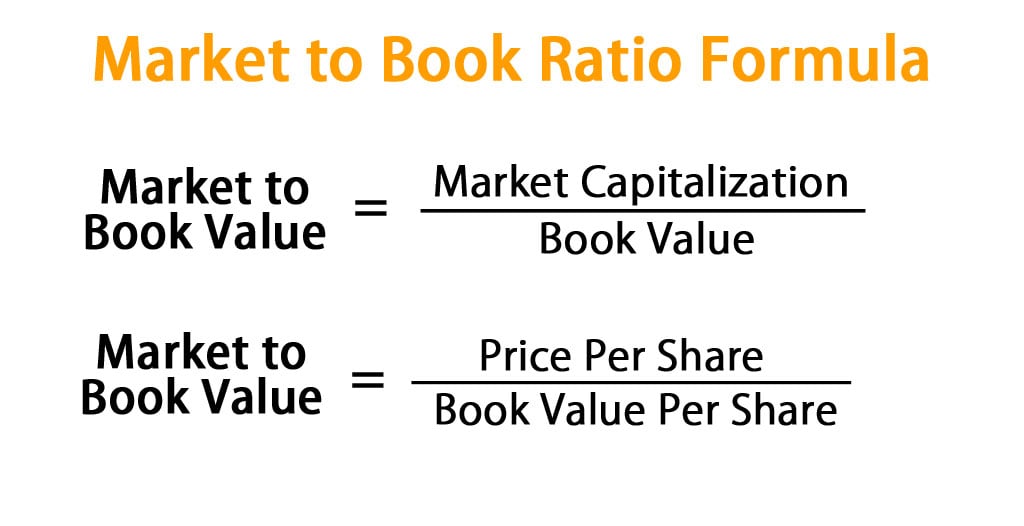

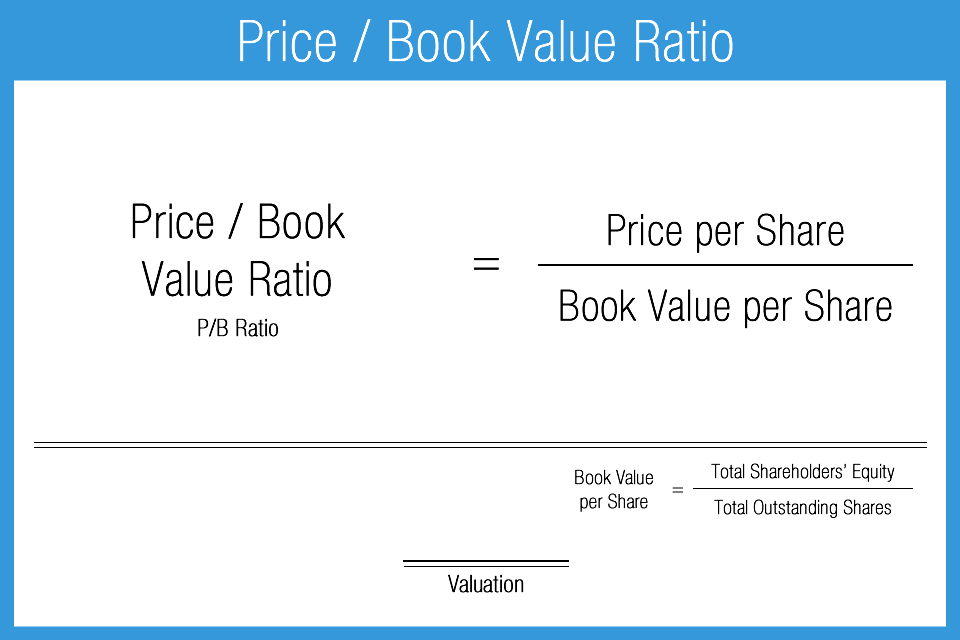

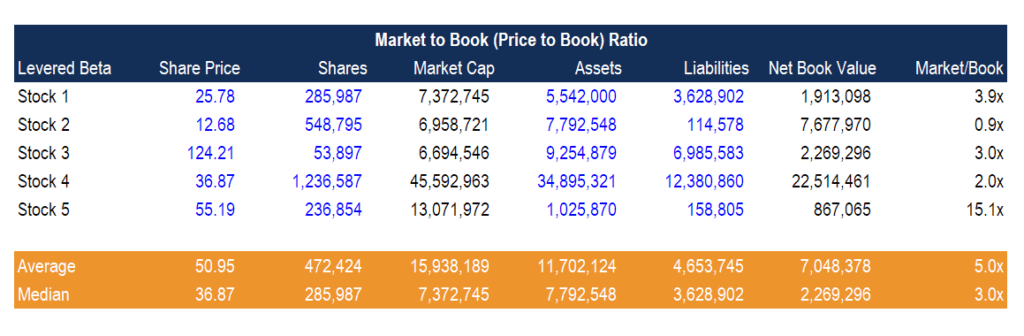

Price to book value per share formula. Formula the formula to measure the price to book value is as follows. Book value of equity total assets total liabilities book value of equity total shareholder s equity in the company assuming book value of assets for company x rs 30 million. Investors need to look at both book value and market value of the share. The market price per share is simply the current stock price that the company is being traded at on the open market.

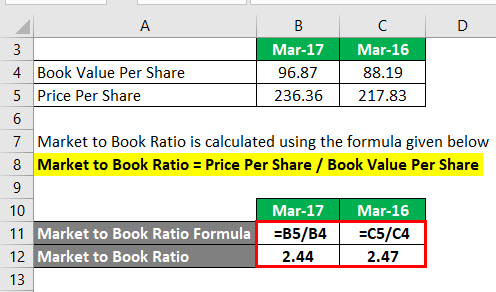

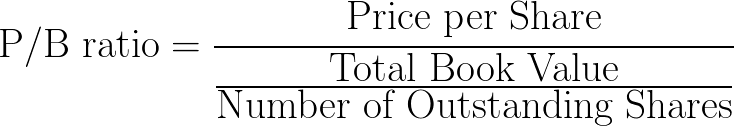

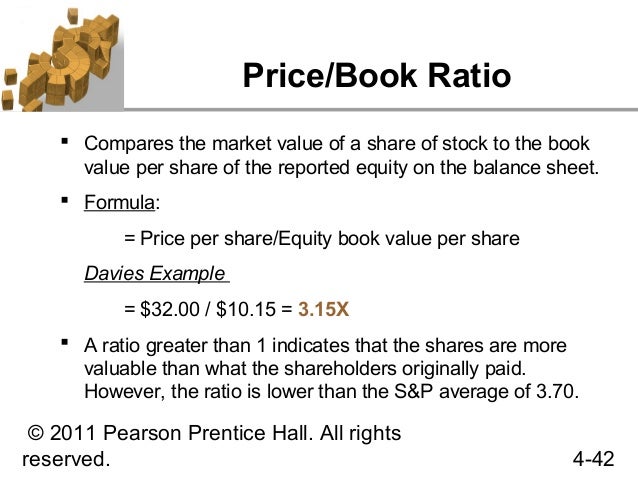

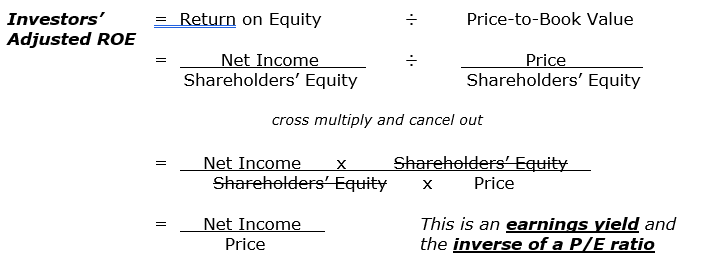

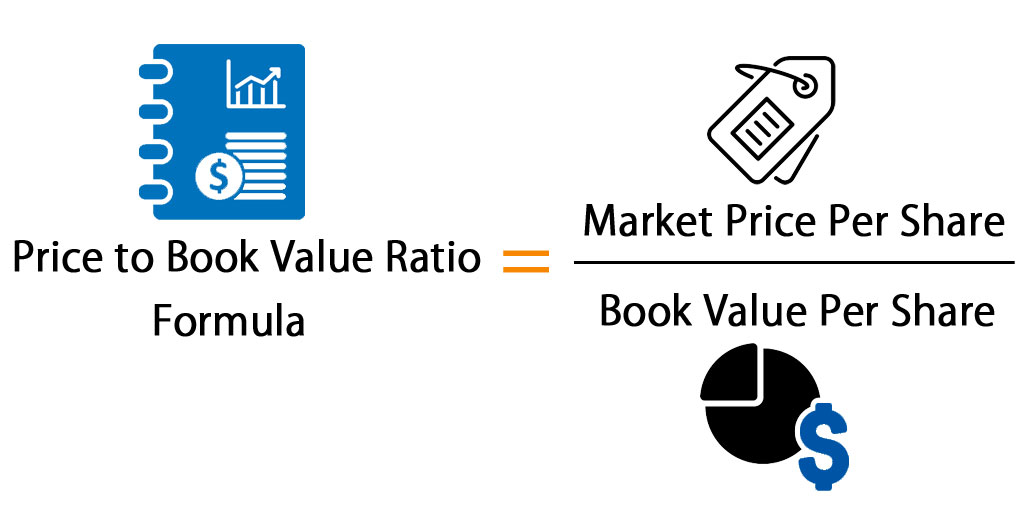

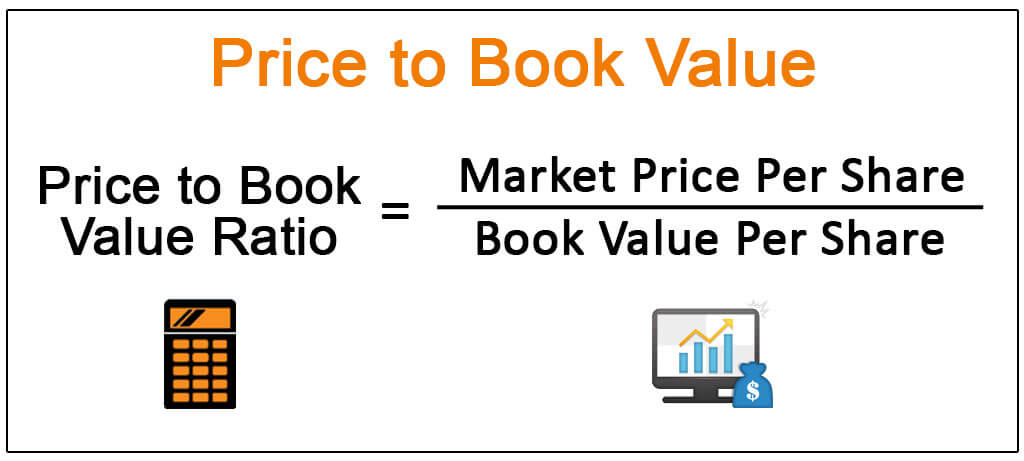

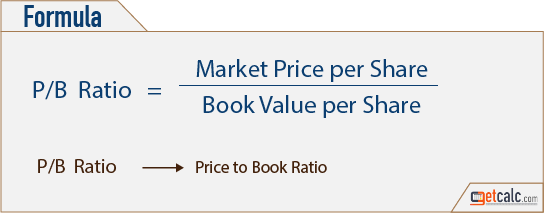

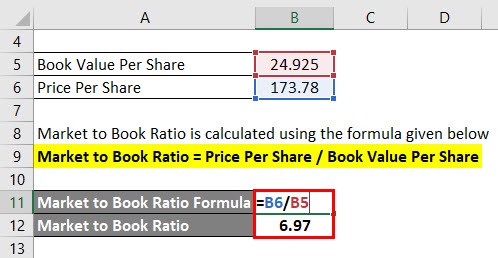

Using the p b ratio formula we get p b ratio formula market price per share book value per share. The book value per share is calculated using historical costs but the market value per share is a forward looking metric that takes into account a company s earning power in the future. Or p b ratio 105 84 5 4 1 25. Price to book value ratio of citigroup.

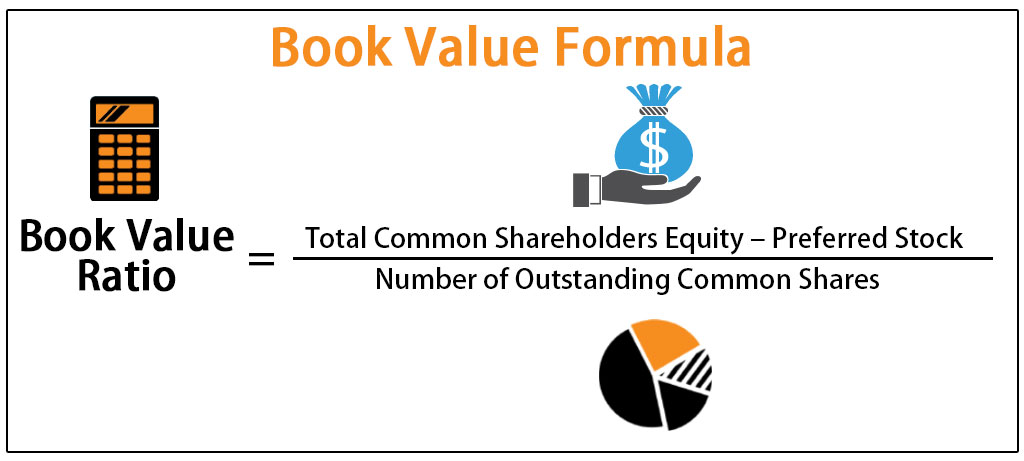

The book value per share may be used by some investors to determine the equity in a company relative to the market value of the company which is the price of its stock. If the investors can find out the book value of common stocks she would be able to figure out whether the market value of the share is worth. Book value per share formula of utc company shareholders equity available to common stockholders number of common shares. The book value per share bvps is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding.

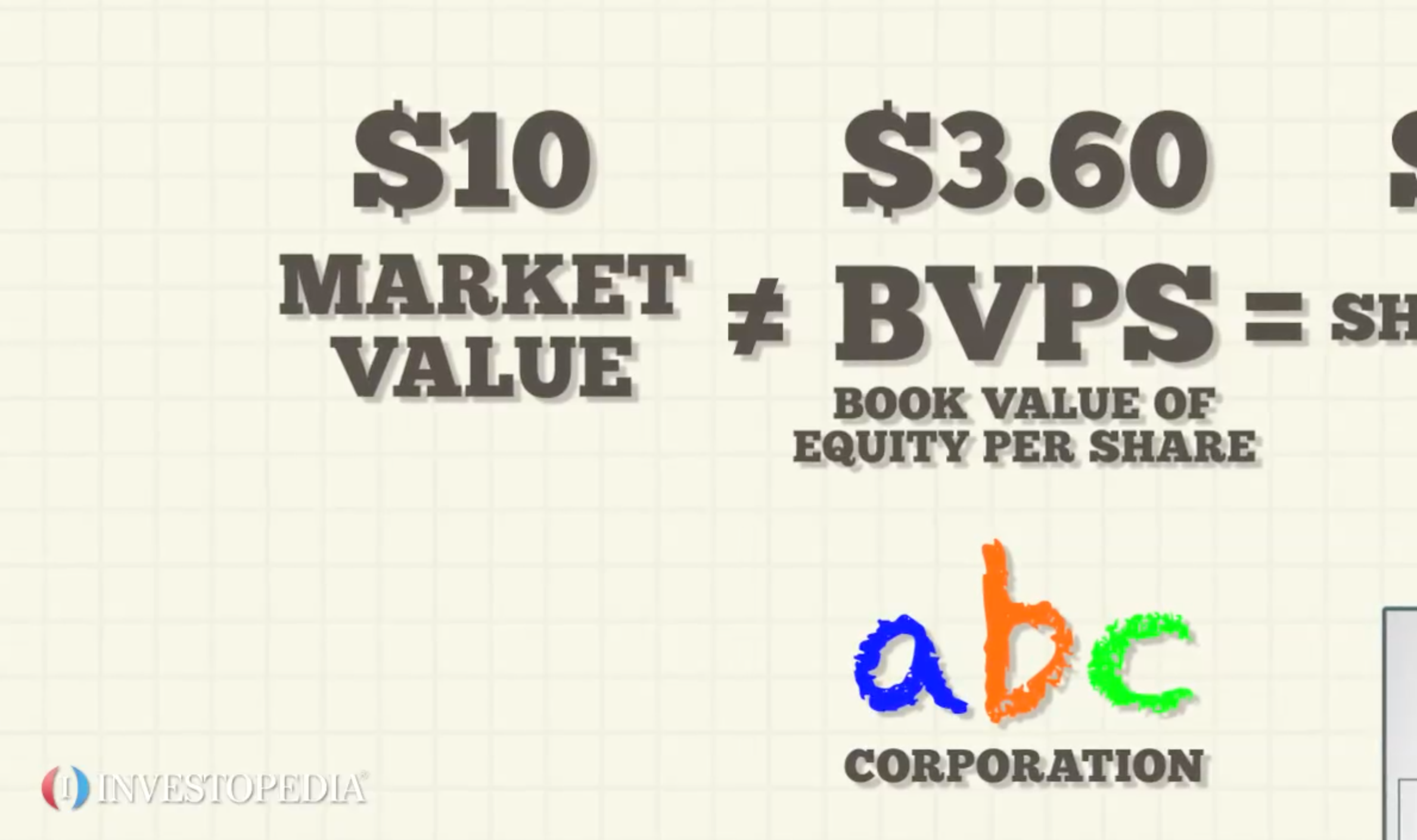

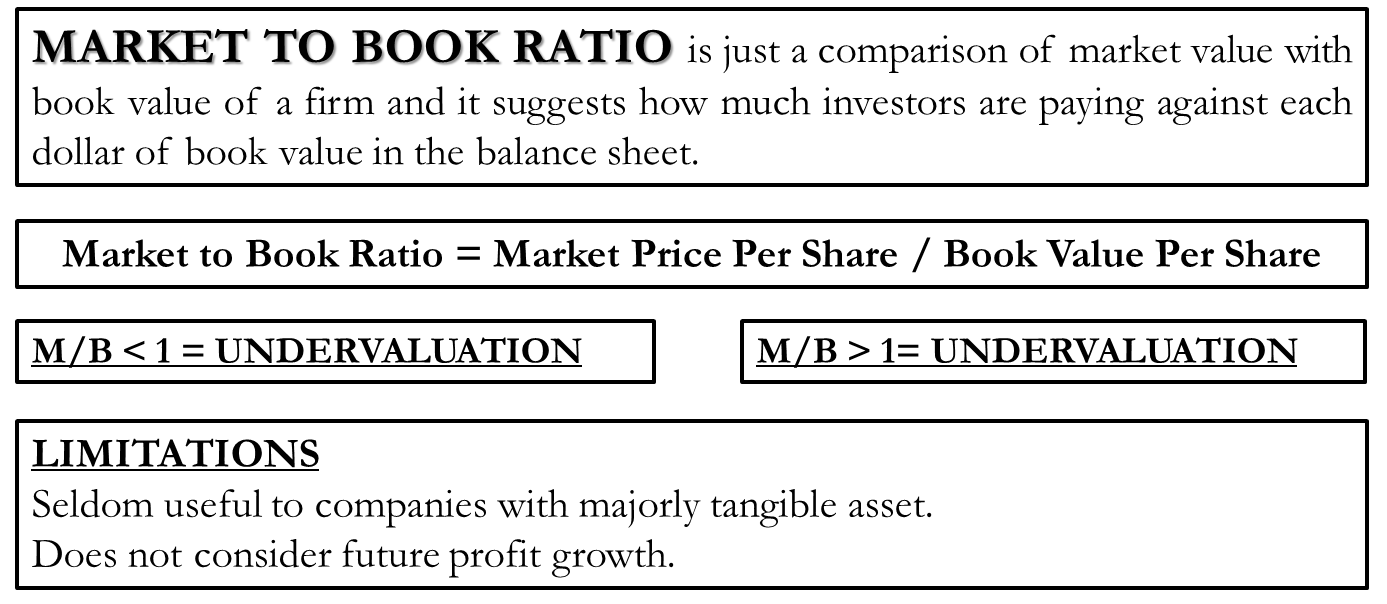

If the value of bvps exceeds the market value per share the company s stock is deemed undervalued. To find out the p b ratio formula we need the market price per share and book value per share. When compared to the current market value per share the book value per share can provide information on how a company s stock is valued. In the above example we know both.

For example a company that is currently trading for 20 but has a book value of 10 is selling at twice its equity. The book value per share can be found out by dividing the book value of equity of the company divided by the total shares outstanding in the market. The stock price per share can be found as the amount listed as such through the secondary stock market. The book value per share is a little more complicated.

Bvps 50 000 2000 25 per share. Total assets total liabilities number of shares outstanding. The price to book ratio formula is calculated by dividing the market price per share by book value per share. Market value per share is.

Price to book p b stock price per share book value per share book value per share total assets total liabilities number of outstanding shares.

/pbratio-38e5cff99f884633a152df2a61dcb31e.jpg)

:max_bytes(150000):strip_icc()/BookValuePerShareFormula-fa6b9180c3614174981e4860d3672ff5.png)