Public Ruling Benefit In Kind

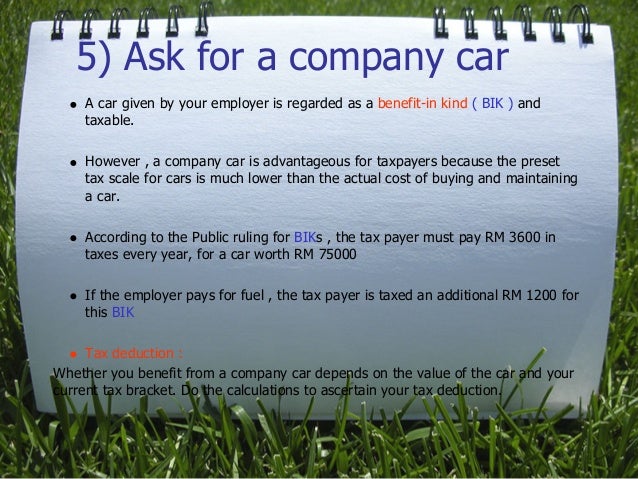

The value of bik provided for an employee may be determined by either of the following methods.

Public ruling benefit in kind. 2 2004 issued on 8 november 2004. 2 2004 issued on 17 january 2006. These benefits in kind are mentioned in paragraphs 4 3 and 4 4 of the public ruling no. Benefits in kind public ruling no.

5 2019 inland revenue board of malaysia date of publication. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia. Benefits in kind bik the irb has issued public ruling 3 2013 for the valuation of bik provided to employees. Perquisites are taxable under paragraph.

Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita. A further clarification on benefits in kind in the form of goods and services offered at discounted prices is explained in the second addendum to the public ruling no. The objective of this ruling is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and b the method of ascertaining the value of bik in order to determine the amount to be taken as gross income from employment of an employee. The objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and b the method of ascertaining the value of bik in order to determine the amount to be taken as gross income from employment of an employee.

8 november 2004 inland revenue board malaysia 5 1 subsection 32 1 of the act provides that the value of bik to be taken as gross income from an employment of an employee is an amount which is just and reasonable in the circumstances. Prescribed value of benefits in kind commonly provided by employers to employees download. 19 april 2010 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board malaysia. 19 november 2019 4 2 perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment.

Prescribed average life span of various assets provided by employers to employees download appendix b. The objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and b the method of ascertaining the value of bik in order to determine the amount to be taken as gross income from employment of an employee. Benefits in kind fourth addendum to public ruling no.