Public Bank Personal Loan Malaysia

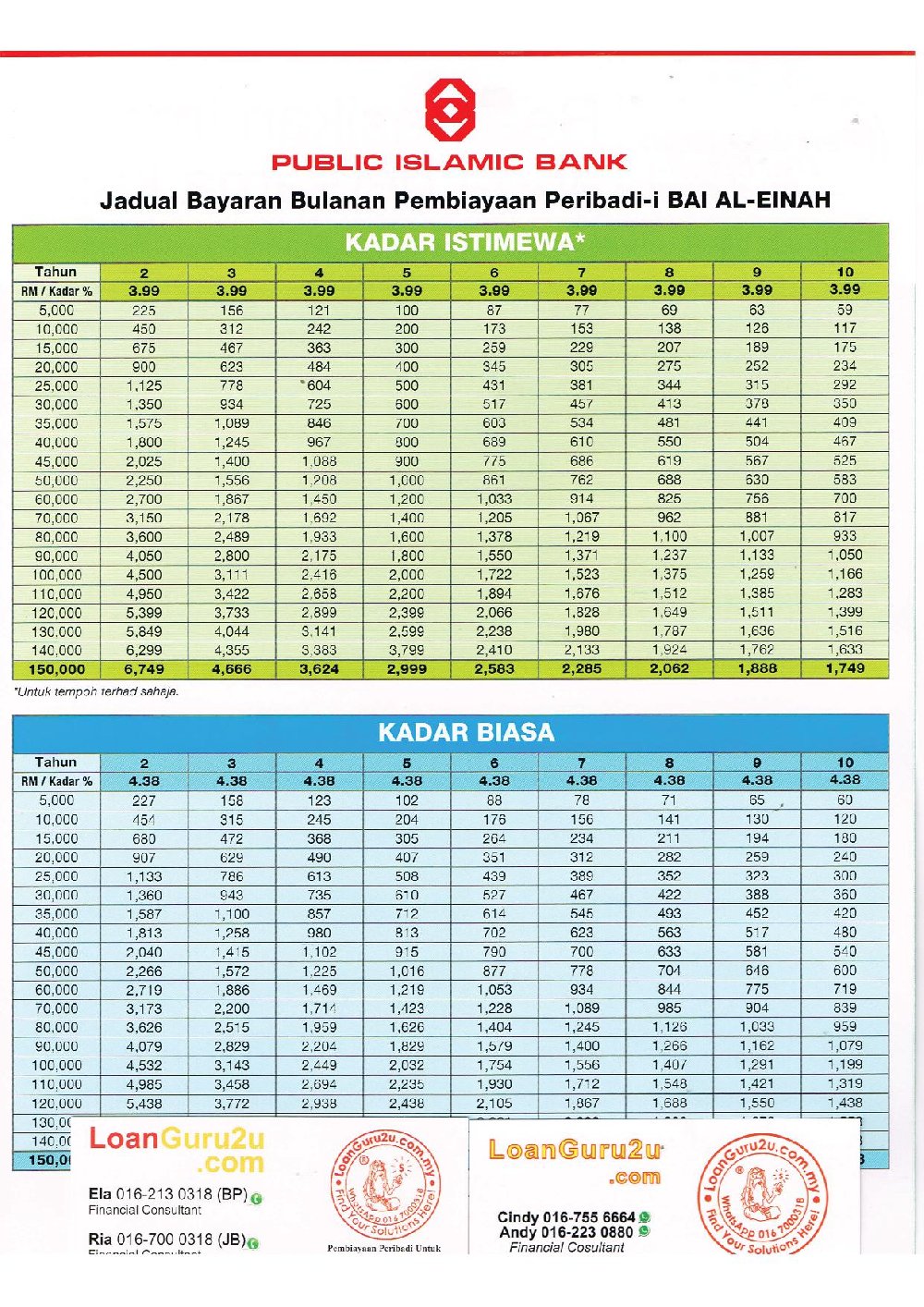

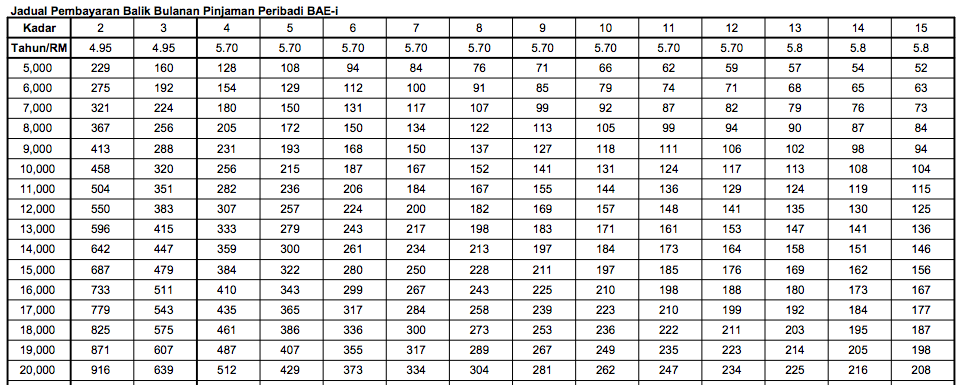

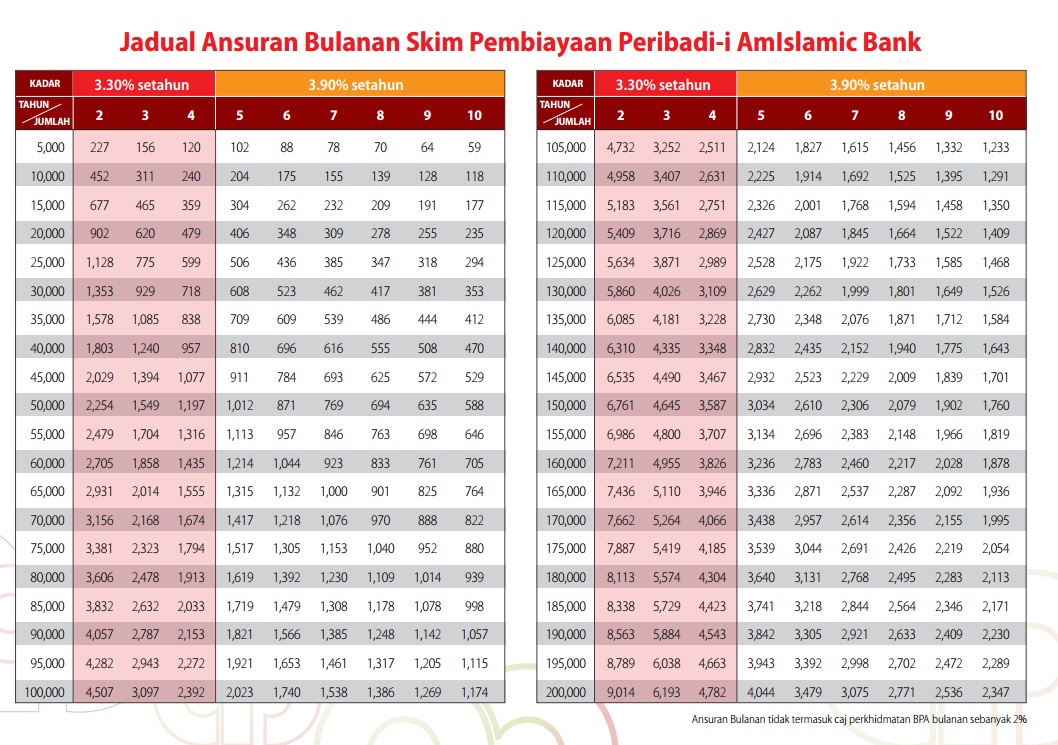

In malaysia one can be able to get access to personal loans which can be as low as rm 1000 with some even exceeding the rm 150 000 mark.

Public bank personal loan malaysia. Public bank has been around for 50 years and has grown to become one of the largest financial providers in malaysia. Otherwise payment of 3 months interest on the amount redeemed is applicable. Public bank and public islamic bank are participating financial institutions of rm2 0 billion penjana sme financing psf scheme to support small medium enterprises smes that are adversely impacted by the covid 19 pandemic. Salient features of the psf.

Rhb islamic bank pensioner personal financing i. Public bank berhad personal banking public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. No charges fees to be imposed provided 3 months written notice is given to the bank prior to the early settlement. Disbursement charges for loans under contract.

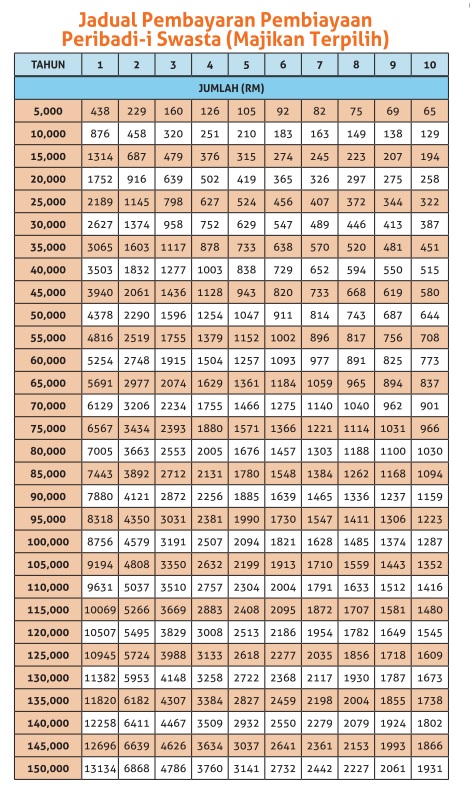

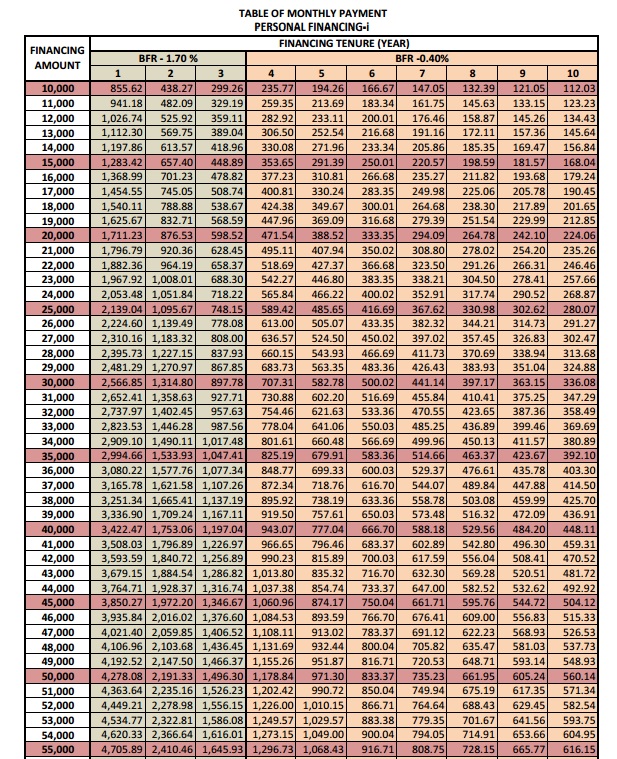

On the arrears of outstanding for each facility daily rest basis early settlement. With bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a. The minimum loan tenure is 2 years and the maximum will be 10 years. Public bank personal loan.

Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Based on the eligibility customers who apply for the loan will be eligible to get loans from rm 5 000 to rm 150 000 to ease customers payment method public bank will deduct the loan monthly payment from the customers salary. Set up fee for homesave shopsave loan account. Loan financing up to rm500 000 per sme.

It also comes with a minimum income requirement of rm2 000. Retrieval of loans and securities documents in bank s custody. This personal loan is only offered to public sector employees from federal and state level government staffs. Rhb islamic bank pensioner personal financing i has a flat interest rate starting from 5 p a.

Rm200 00 one off payment 11. The loan amount that one can be able to access is determined by the individual needs as well as their ability to repay the loan. Financing rate of 3 5 fixed per annum. Monthly maintenance fee for homesave shopsave loan account.

Applicable to personal loan 1 p a. Founded in 1966 public bank entered it s 50th year of operation in 2016 and has since grown to service over 9 million customers across the region.