Prs Tax Relief 2017

The credit for nonbusi.

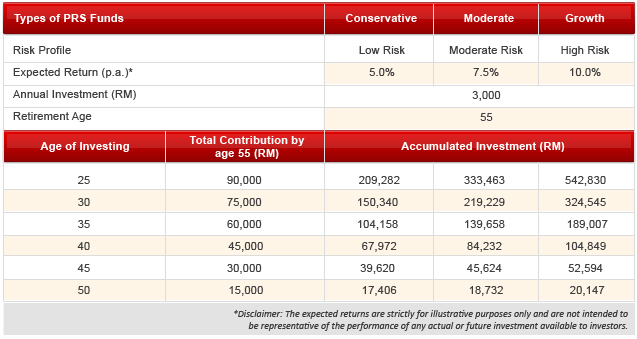

Prs tax relief 2017. Under budget 2017 rm165 million was allocated to the prs youth scheme for those aged 20 to 30. Refer to this list of the income tax relief 2018 malaysia. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. The incentive is paid into a specific prs gov sub account a.

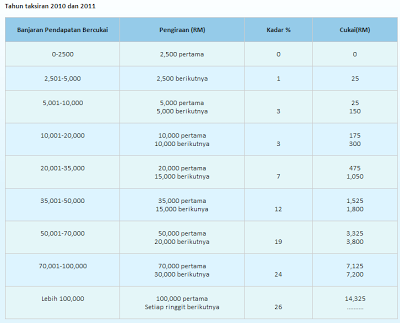

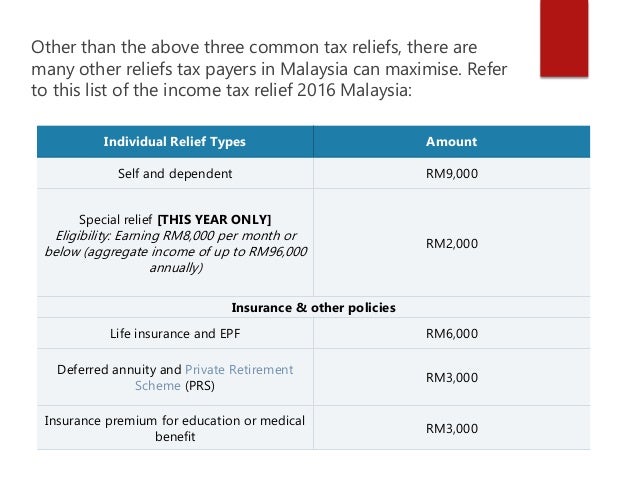

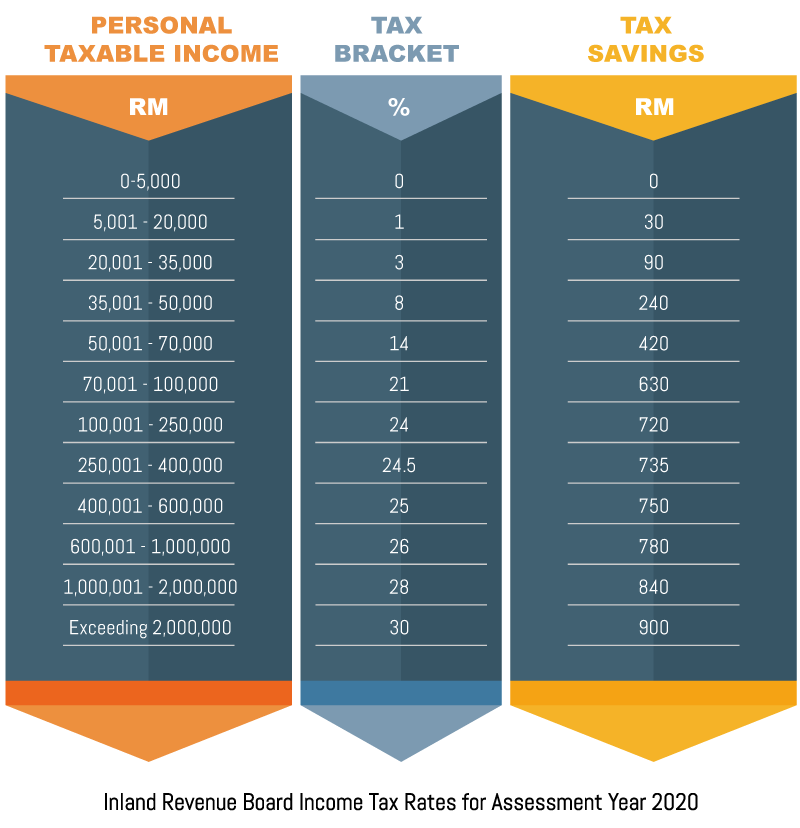

The good news is an individual who makes contribution to his or her prs funds is allowed to claim tax relief of up to rm3 000 by the inland revenue board of malaysia. Provide additional tax relief for those affected by hurri cane harvey irma or maria and tax relief for those affec ted by other 2017 disasters such as the california wild fires. Malaysian government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. The amount of tax relief 2017 is determined according to government s graduated scale.

Shareholders by deeming those earnings to be repatriated. The tax relief for year 2017 as below. Year of assessment 2019. Section 965 of the internal revenue code enacted in december 2017 imposes a transition tax on untaxed foreign earnings of foreign corporations owned by u s.

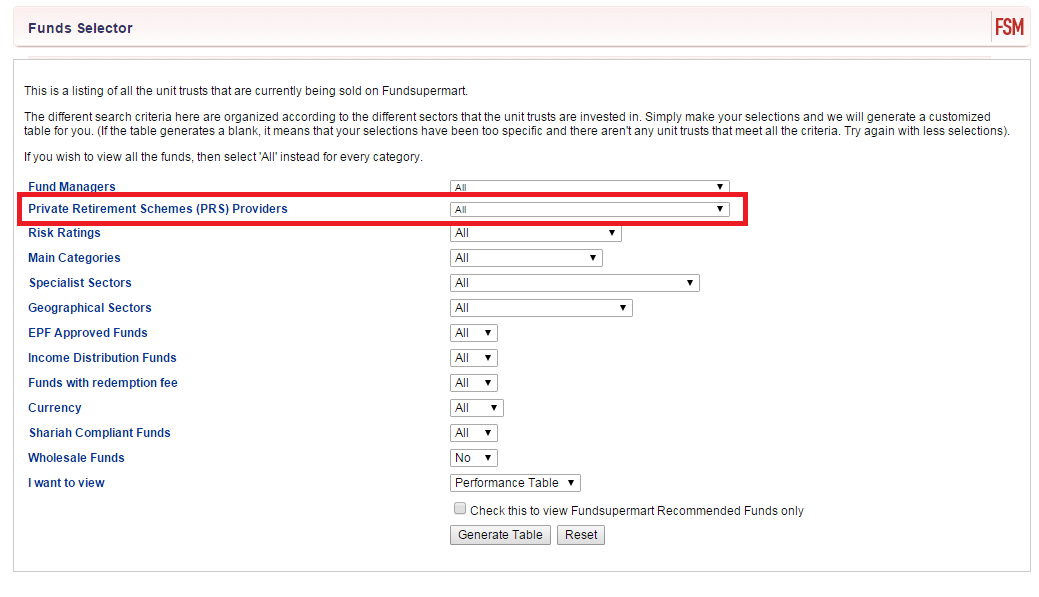

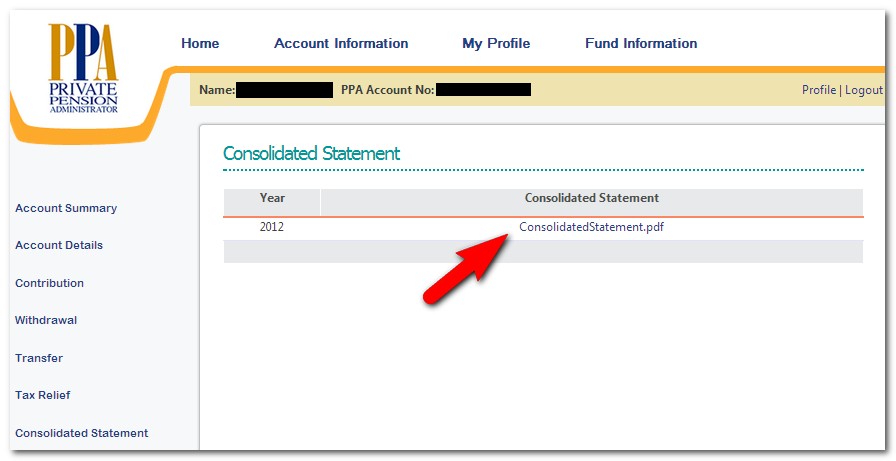

If you did contribute some money into a prs scheme in 2012 congratulations you re entitled to prs tax relief for ya2012. The prs tax relief was specially introduced to encourage you to save more for your retirement. In 2014 the government will contribute rm500 into the prs accounts of youths who have accumulated rm1 000 within a year. Tax relief for resident individual.

If you haven t no worry you still got time to start contributing before the end of this year. These supplement 14 existing questions and answers that provide detailed guidance to taxpayers on reporting and paying the tax. Amount rm 1. Extend certain tax benefits that expired at the end of 2016 and that currently can t be claimed on your 2017 tax return such as.

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. With effect from year assessment 2012 until year assessment 2017. In 2017 the incentive has been increased to rm1 000 for those who contribute at least rm1 000 in a singleprs fund from 2017 2018. Those who pay the highest tax rate of 26 could reduce their taxable income to rm780 if they applied for a rebate.

However effective from jan 1 this year the withdrawal of contributions from a prs by an individual before he reaches the age of 55 would be subject to a withholding tax at the rate of 8.