Property Stamp Duty Malaysia

Next rm 400 000 2.

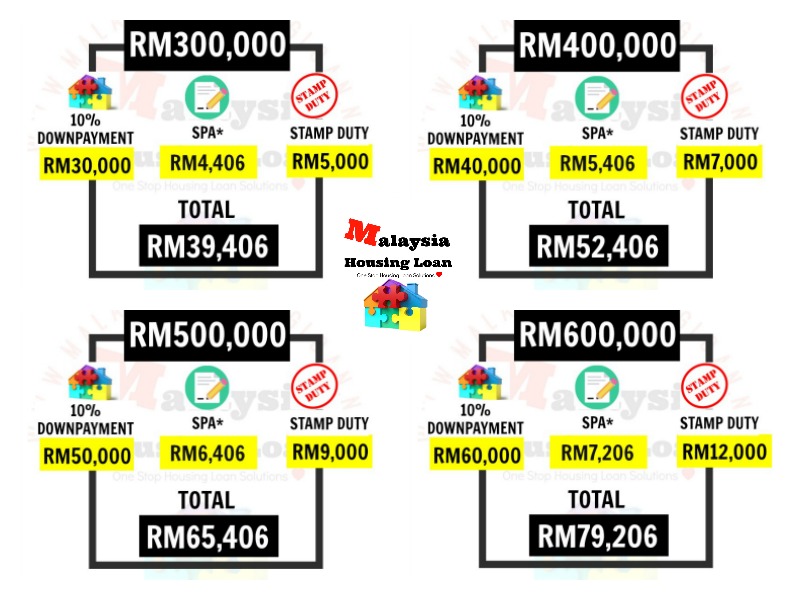

Property stamp duty malaysia. Latest update 2020 professional legal fees. Remission of 50 of stamp duty chargeable on the instrument of transfer of immovable property operating as voluntary disposition between parent and child and vice versa. First rm 100 000 1. Rm7000 the actual stamp duty rm5000 maximum stamp duty exemption amount rm2000 00 this is because rm5000 is stamp duty for rm300 000 property value and this is also the maximum amount of the exemption.

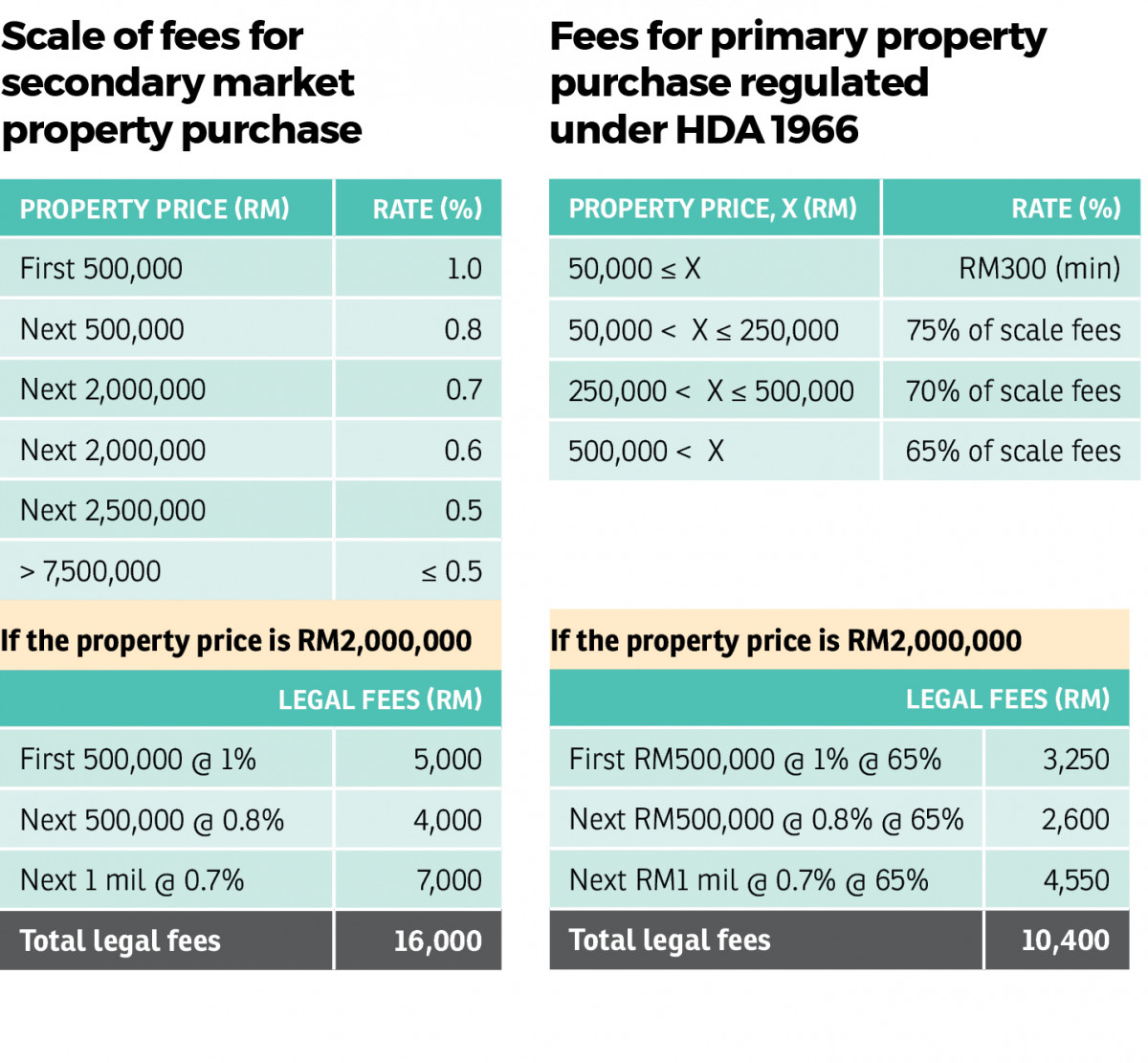

During the tabling of malaysia s budget 2019 it was announced that first time homebuyers would be able to enjoy a stamp duty exemption on the first rm300 000 of the property price on the instrument of transfer and the loan agreement executed between 1 january 2019 and 31 december 2020. And if you re wondering what the scale fees looks like do refer to the following. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019.

Next rm 500 000 3. The schedule below as a reference of stamp duty and legal fees when purchasing a house. 2 charge from rm100 001 to rm500 000. However for real property transfers executed from 1 january 2020 the 50 stamp duty remission is restricted to malaysian citizens only.

When buying a house in malaysia everyone is required to pay for property stamp duty. 1 on the first rm100 000 of the property price. Property law in malaysia stamp duty for transfer of properties stamp act 1949 ad valorem stamp duty finance act 2018 stamp duty exemption remission of stamp duty conveyancing. The property stamp duty fee for the first rm100 000 will be 100 000 x 1 rm1 000 the property stamp duty fee for the remaining amount will be 300 000 100 000 x 2 rm4 000.

The tiers are as follows with effect from 2019. For the first rm100 000 1. Spa stamp duty and legal fees for malaysian property. The property stamp duty scale is as follow.

This means that for a property at a purchase price of rm300 000 the property stamp duty will be rm5 000. 3 charge from rm500 001 to rm1 million. 4 charge for everything above rm1 million. For the next rm2 000 000 00 0 70.