Private Retirement Scheme Tax Relief

The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability.

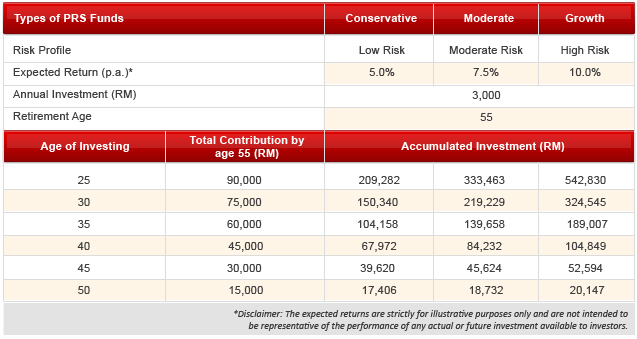

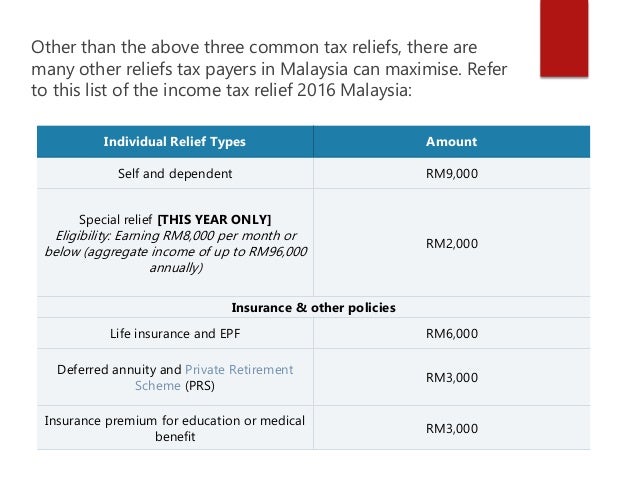

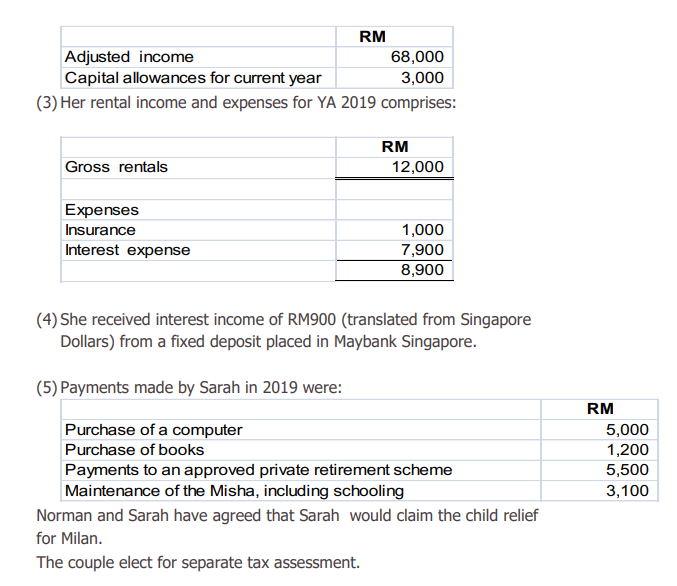

Private retirement scheme tax relief. In scotland income tax is banded differently and pension tax relief is applied in a slightly alternative way. Let s look at the table above which illustrates the amount of tax saving an individual get after personal tax relief and rm6 000 epf life insurance tax relief. Prs income tax relief besides being an additional retirement pot the prs is also income tax deductible. 5 000 limited 3.

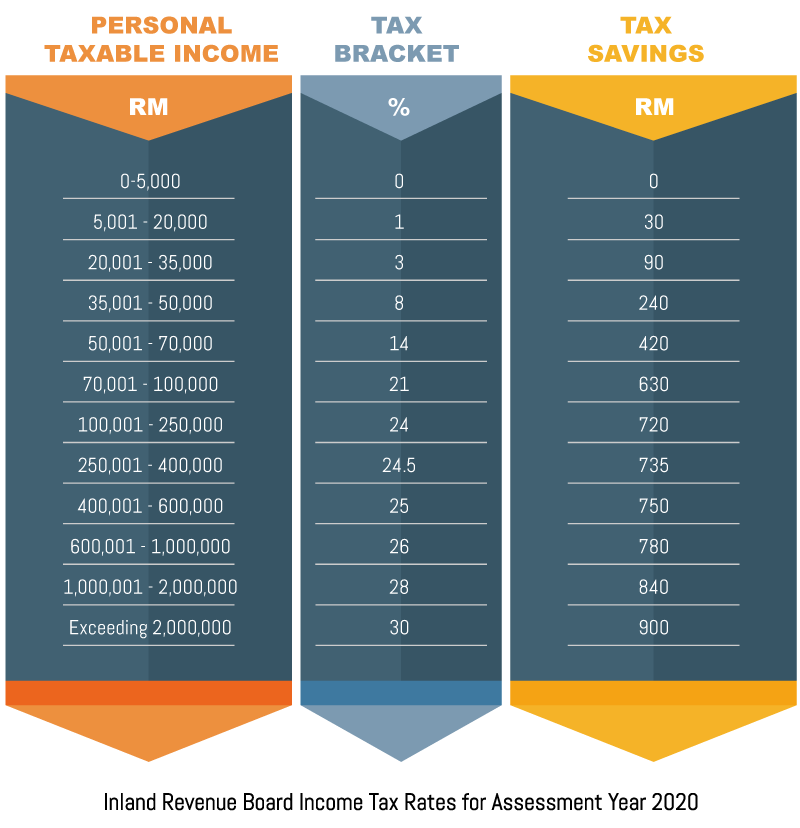

Few other employers appear to have publicly rsvp ed to trump s payroll tax deferral party. For high tax bracket individuals you can save up to rm780 annually. Assuming a maximum rm3 000 prs relief the amount of tax saving depends on your level of income. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

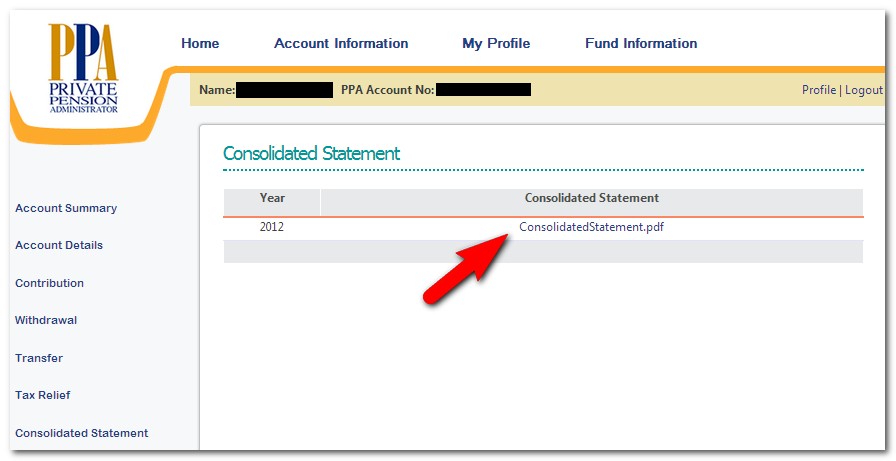

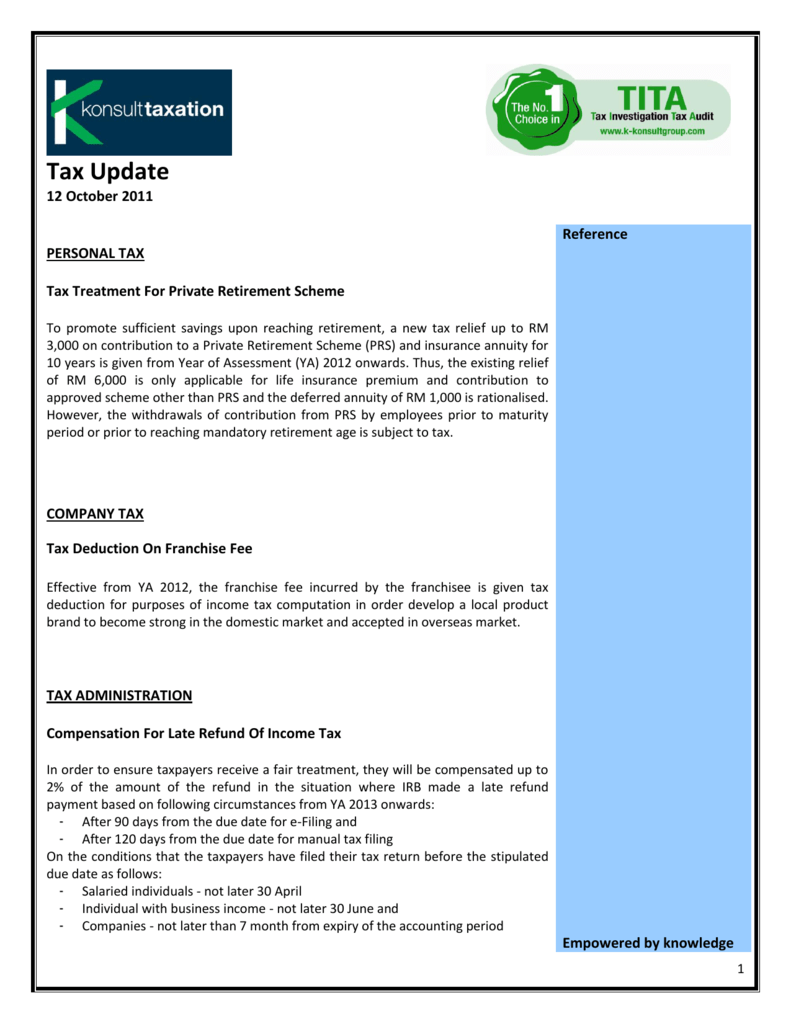

This tax incentive is available for a period of 10 years ending year 2021. Enjoy personal tax relief of up to rm3 000 per year terms apply. Earnings generated by the prs funds will also be exempted from tax charges. Medical expenses for parents.

You will be able to deduct up to rm3 000 from your taxable income which will count towards your final tax payable. The scheme is such a head scratcher that even employees at the irs the agency that collects payroll. Additional rate taxpayers can claim 45 pension tax relief. Contributing in prs may be one of the best things you can do for your retirement.

Amount rm 1. Basic rate taxpayers get 20 pension tax relief. Higher rate taxpayers can claim 40 pension tax relief. Private retirement scheme prs faqs page 2 employers tax deduction employers are allowed to claim tax deduction from the business income based on the prs contributions made on behalf of their employees up to 19 of the.

The good news is an individual who makes contribution to his or her prs funds is allowed to claim tax relief of up to rm3 000 by the inland revenue board of malaysia. This relief is applicable for year assessment 2013 and 2015 only.

.jpg)