Price To Book Value Ratio Formula

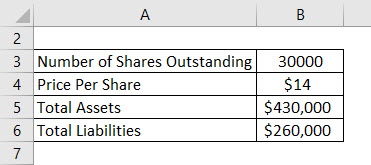

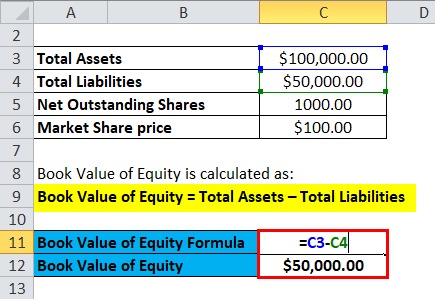

Total assets total liabilities number of shares outstanding.

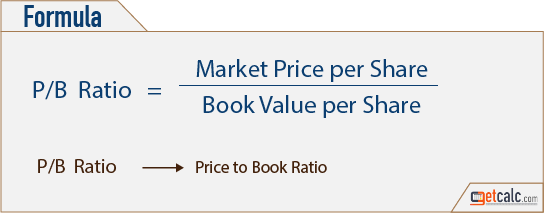

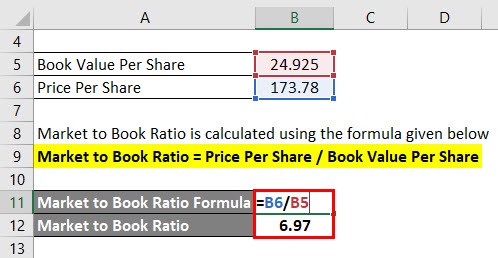

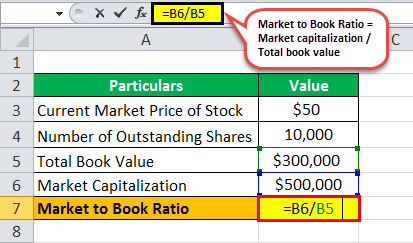

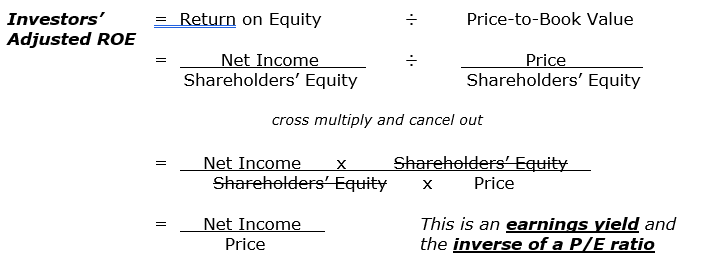

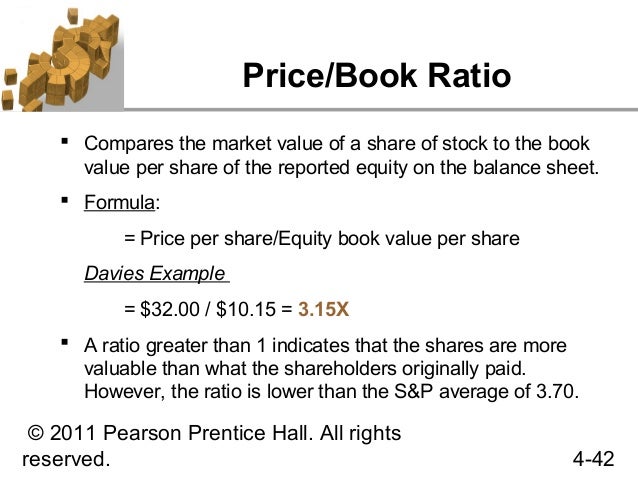

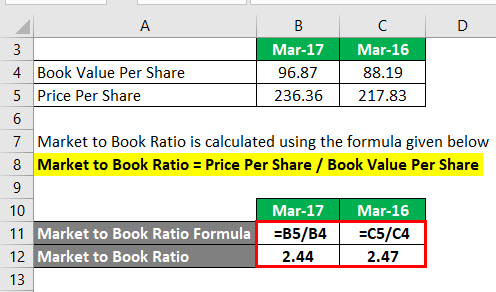

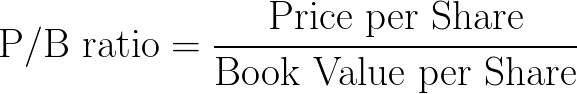

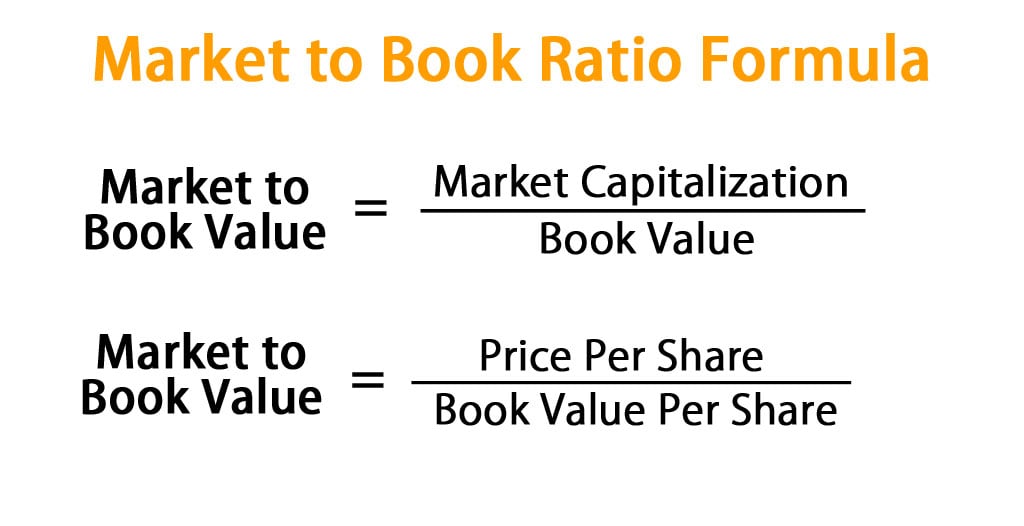

Price to book value ratio formula. P b ratio formula market price per share book value per share or p b ratio 105 84 5 4 1 25. Market capitalization net book value. Here s the price to book value formula. Price to book p b stock price per share book value per share.

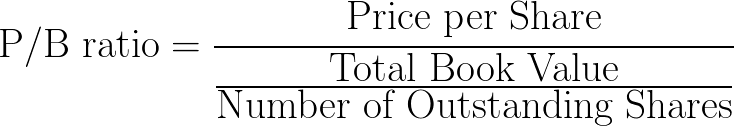

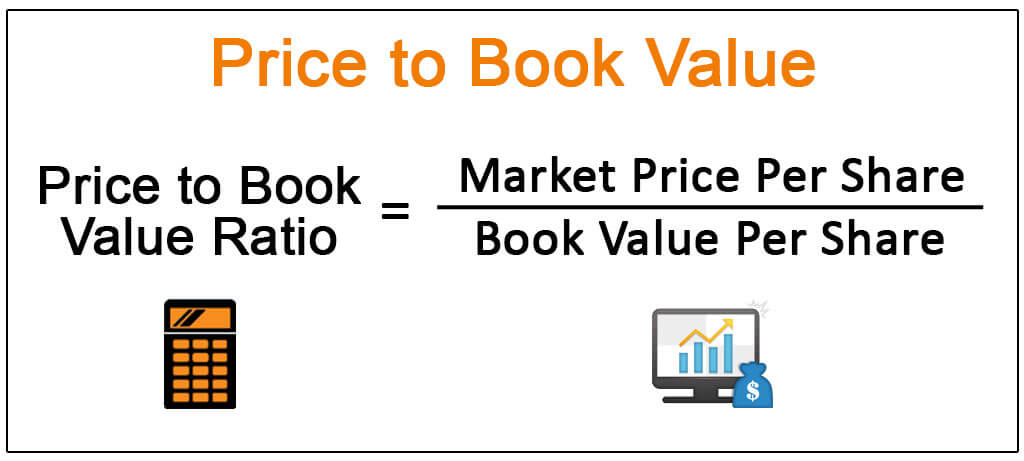

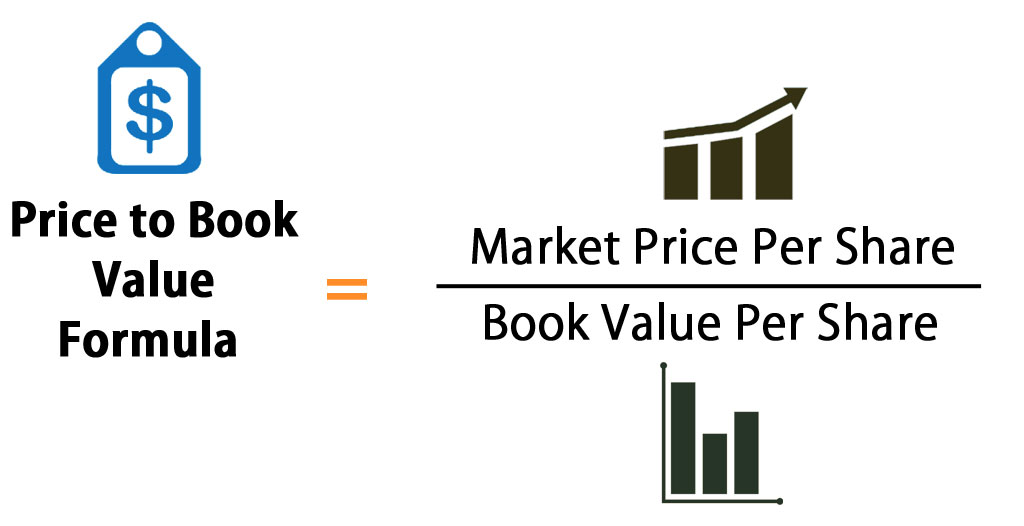

This has been a guide to book value formula. The formula to measure the price to book value is as follows. The price to book ratio formula is calculated by dividing the market price per share by book value per share. Formula the price to book ratio formula is calculated by dividing the market price per share by book value per share.

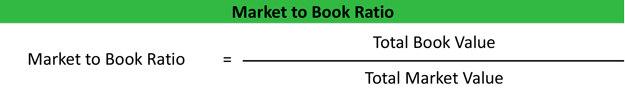

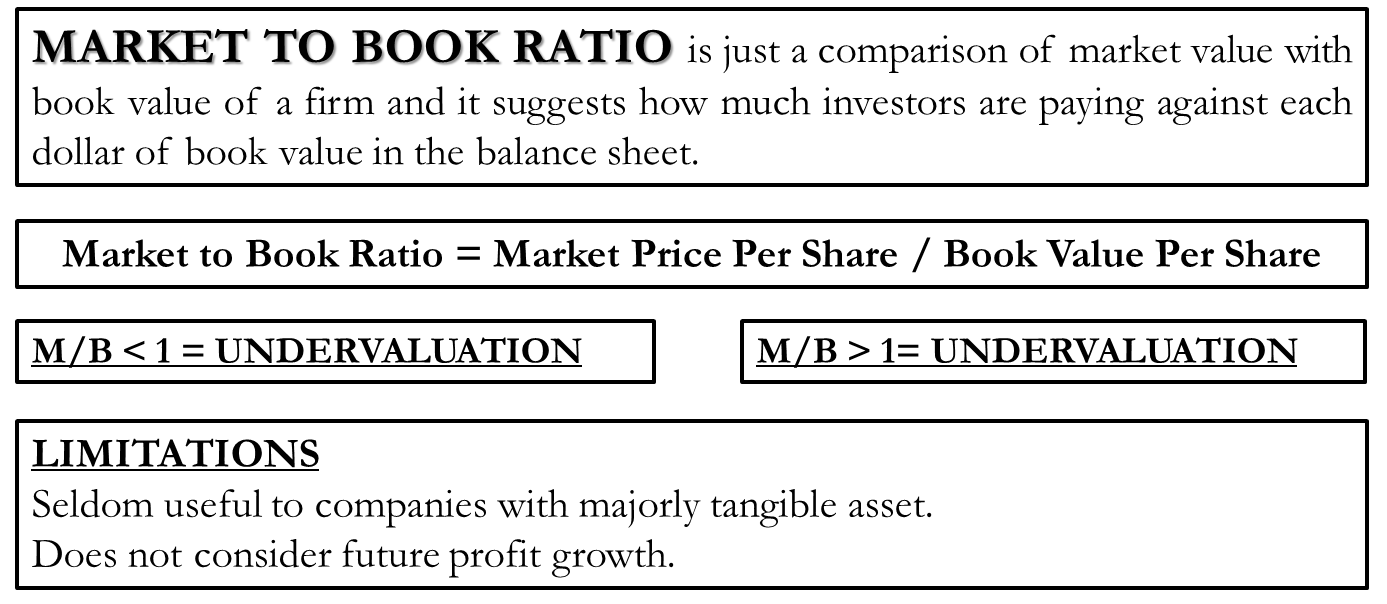

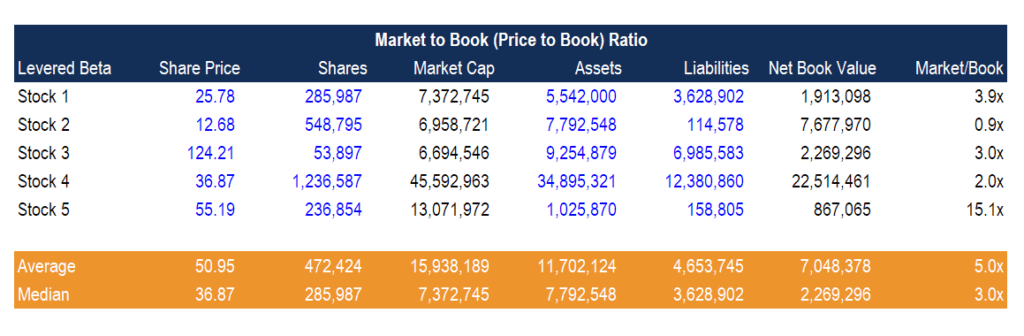

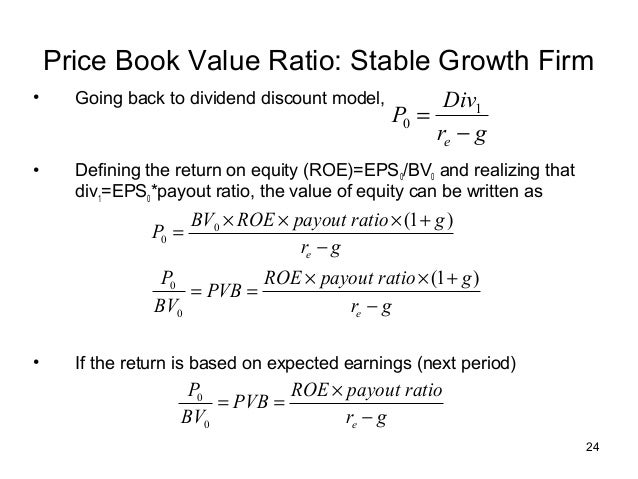

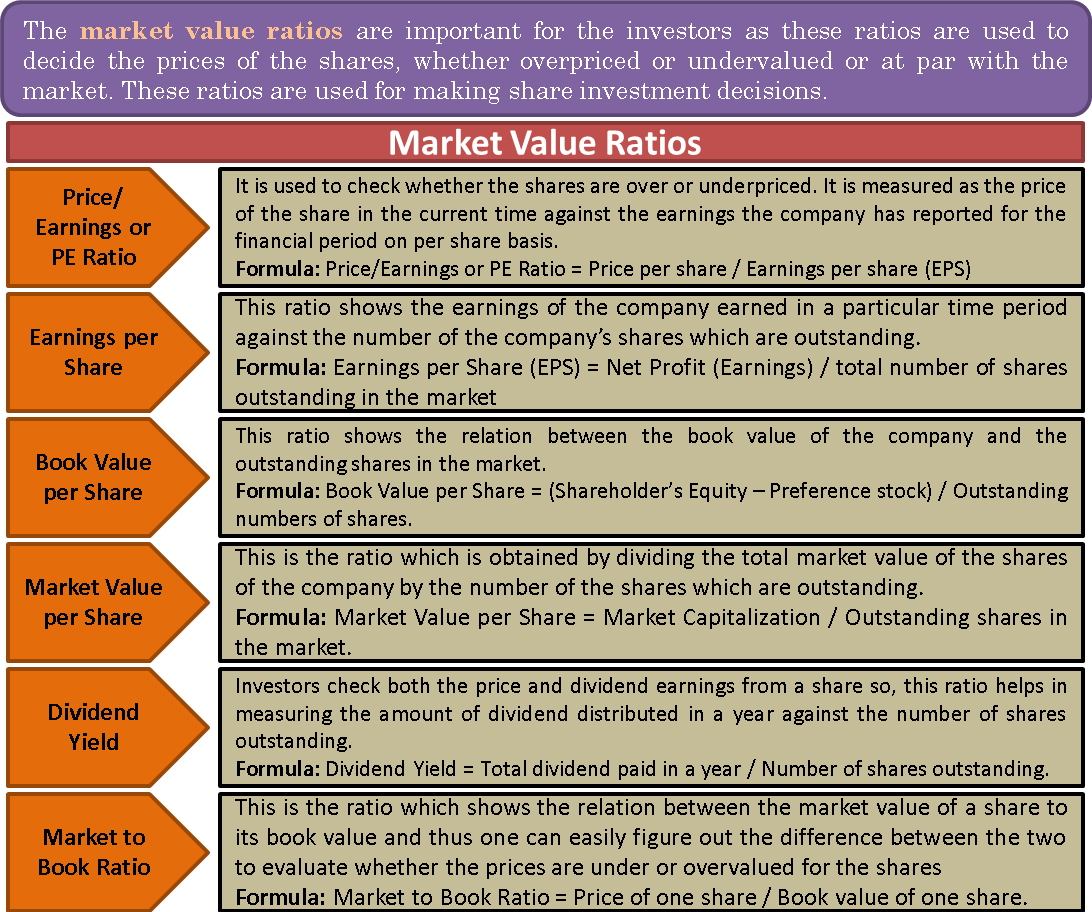

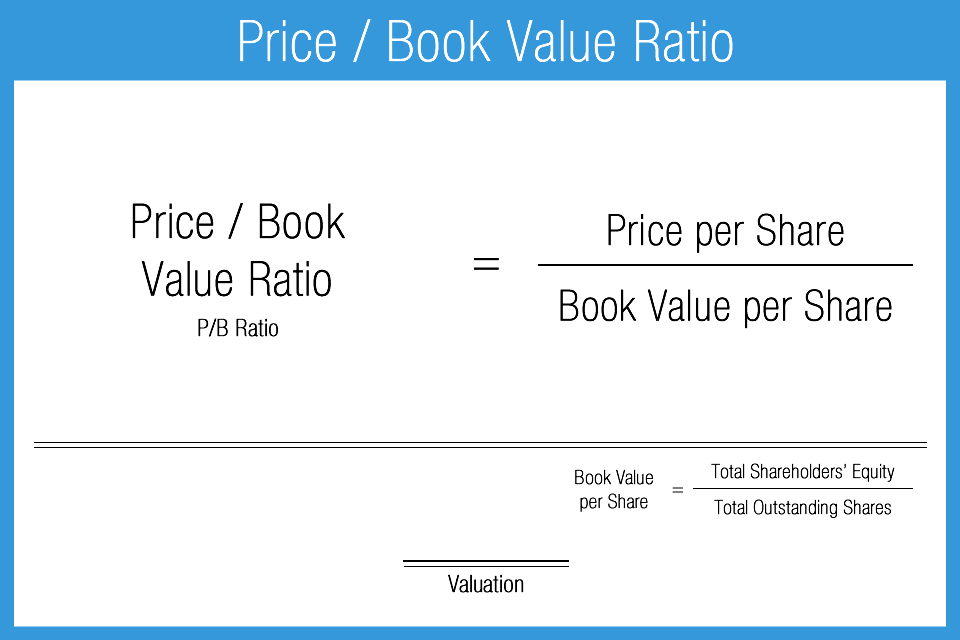

Price to book value formula the price to book value can be defined as a market value of a firm s equity divided by the book value of its equity. Book value per share total assets total liabilities number of outstanding shares. Market value per share is. The price to book ratio formula sometimes referred to as the market to book ratio is used to compare a company s net assets available to common shareholders relative to the sale price of its stock.

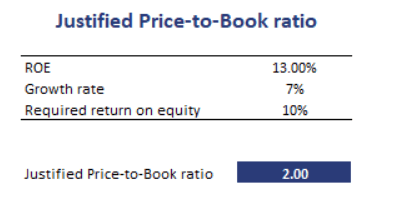

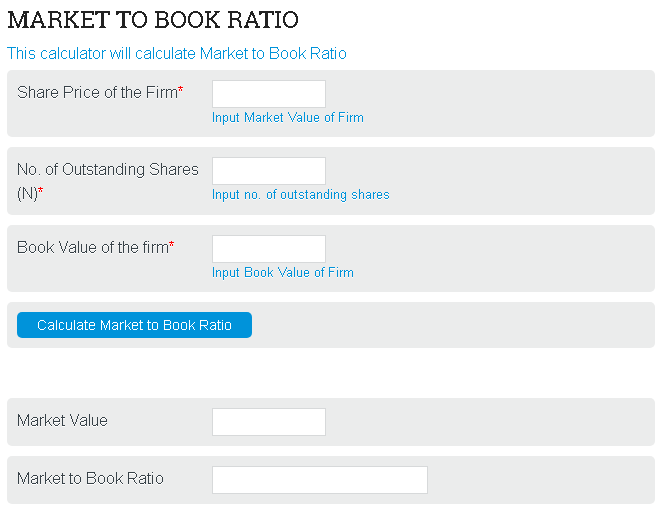

It is also called market to book ratio. The book value per share is a little more complicated. The price to book ratio is a popular metric that estimates the relationship between the market price of a business shares and the actual value of such shares. The market to book ratio is calculated by dividing the current closing price of the stock by the most current quarter s book value per share.

The formula for price to book value is the stock price per share divided by the book value per share. Market to book ratio formula the market to book formula is. Formula and calculation of p b ratio in this equation book value per share is calculated as follows. Price to book ratio market price per share book value per share for example a stock with a pvb ratio of two means that we pay 2 for every 1 of book value.

Formula of price to book value. The book value of a share is derived from the company s balance sheet by dividing the total shareholder s equity by the number of shares outstanding. Here we learn how to calculate the book value ratio of a company using its formula along with practical industry examples and downloadable excel template.

/pbratio-38e5cff99f884633a152df2a61dcb31e.jpg)