Personal Tax Relief Malaysia 2018

On the first 2 500.

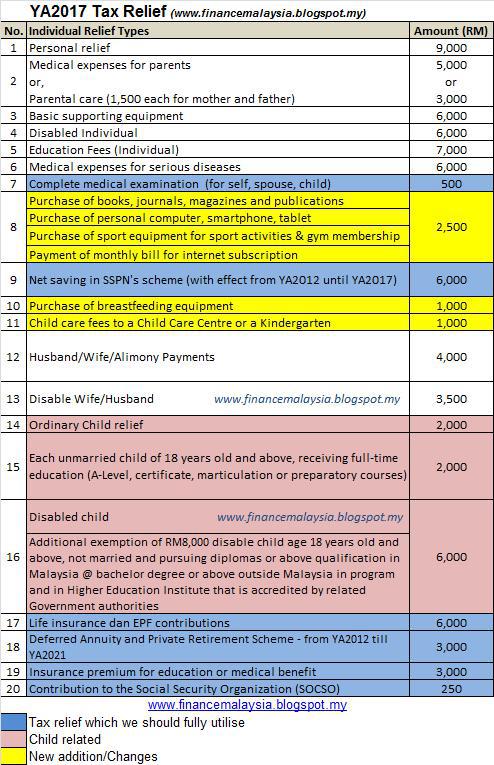

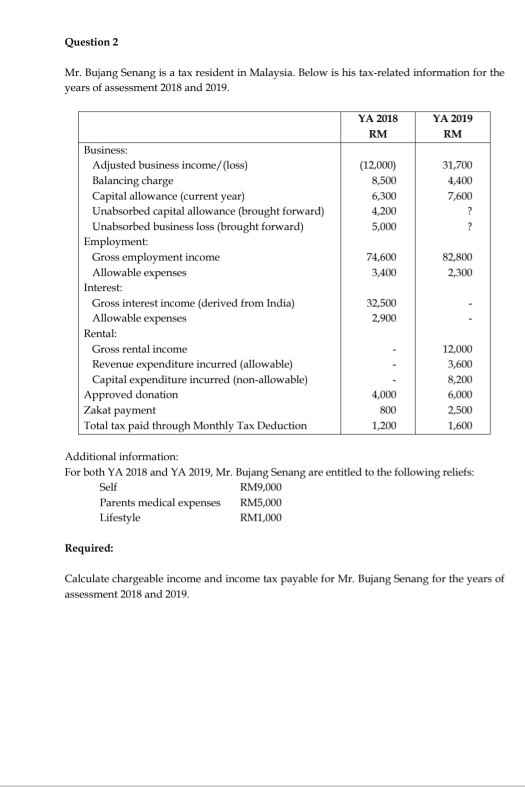

Personal tax relief malaysia 2018. Wow sounds like a lot of stuff. Personal tax reliefs in malaysia. Amount rm 1. Calculations rm rate tax rm 0 5 000.

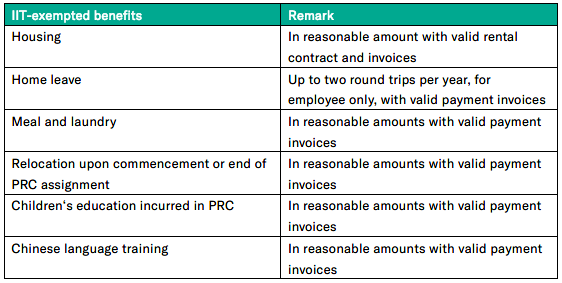

The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. Things to do now to maximise income tax relief lifestyle.

To help make things a little clearer we run through the list of all items eligible for tax relief with explanations for some of the more confusing entries. Companies are not entitled to reliefs and rebates. Medical expenses for parents. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure.

Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. Books journals magazines printed. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Refer to this list of the income tax relief 2018 malaysia.

Effective ya 2017 if a spouse has income from foreign sources or overseas which is not subject to tax in malaysia and the spouse is elected to be a combined assessment the taxpaying spouse is not qualified to claim this spouse s relief. Tax filing season has begun in malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing. If planned properly you can save a significant amount of taxes. Below is the summary of all tax reliefs available.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Under this category items that are applicable include books magazines printed newspapers purchase of personal computer smartphone or tablet buying sports equipment or gym memberships and your monthly internet subscription. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Now this tax relief is probably one that we would use the most.

Did you know that in 2016 the reading material and personal computer slash smartphone income tax relief used to have a combined worth of rm4 000. On the first 5 000 next 15 000. 5 000 limited 3.