Personal Tax Rate Malaysia 2017

Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with effect from year of assessment ya 2017 with the balance being taxed at the 24 rate.

Personal tax rate malaysia 2017. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Useful reference information on malaysian income tax 2017 for year of assessment 2016 for resident individuals. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

To make the payment please go to byrhasil at https. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. Yes you would need to file your income tax for this past year if.

Key malaysian income tax info do i need to file my income tax. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Personal income tax 8 a qualified person defined who is a knowledge worker residing in iskandar malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

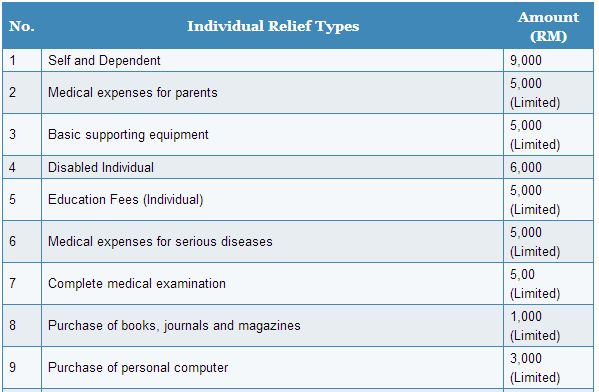

No guide to income tax will be complete without a list of tax reliefs. 1 pay income tax via fpx services. Here are the many ways you can pay for your personal income tax in malaysia. First of all you need an internet banking account with the fpx participating bank.

You spent at least 182 days. The fpx financial process exchange gateway allows you to pay your income tax online in malaysia. Technical or management service fees are only liable to tax if the services are rendered in malaysia. The standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e.