Personal Tax Rate 2018 Malaysia

Basic supporting equipment for disabled self spouse child or parent.

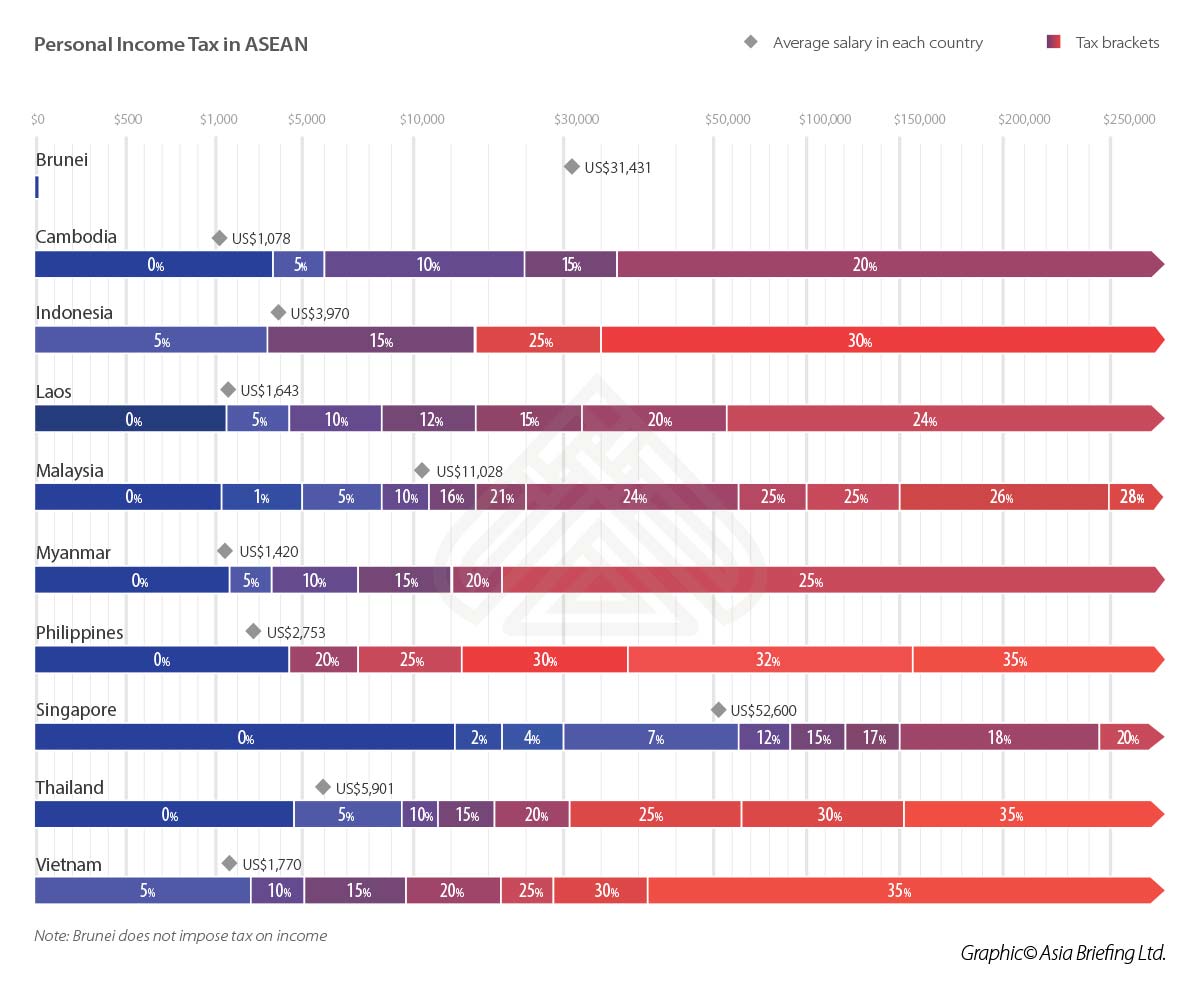

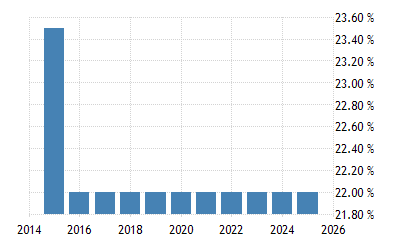

Personal tax rate 2018 malaysia. Malaysia income tax e filing guide. How to pay income. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Personal income tax in malaysia is charged at a progressive rate between 0 28.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Taxable income myr tax on column 1 myr tax on excess over. Malaysia has a fairly complicated progressive tax system.

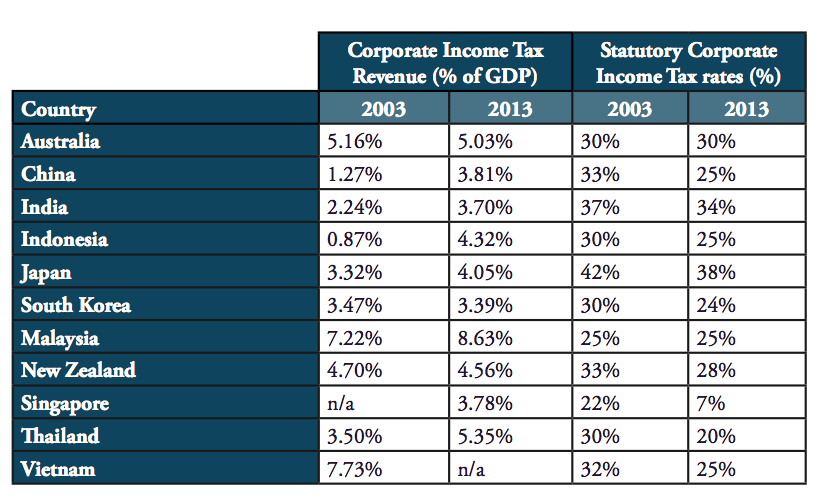

Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. What are the income tax rates in malaysia in 2017 2018. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Education fees self other than a degree at masters or doctorate level course of study in law accounting islamic financing technical vocational industrial scientific or technology. In 2018 some individual tax rates have been slashed 2 for three slabs chargeable income bands 20 001 35000 35001 50 000 50 001 70 000 will now be taxed 3 8 14 respectively. Personal income tax rates. How does monthly tax deduction mtd pcb work in malaysia.

No other taxes are imposed on income from petroleum operations. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. 6 000 restricted 4. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

There s a lower limit of earnings under which no tax is charged and then a progressively higher tax rate is applied based on how much you earn above that level. There are no other local state or provincial. What is tax rebate. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. There are a total of 11 different tax rates depending on your.