Personal Tax Rate 2016

For tax year 2016 the personal exemption amount is 4 050 compared to 4 000 in 2015.

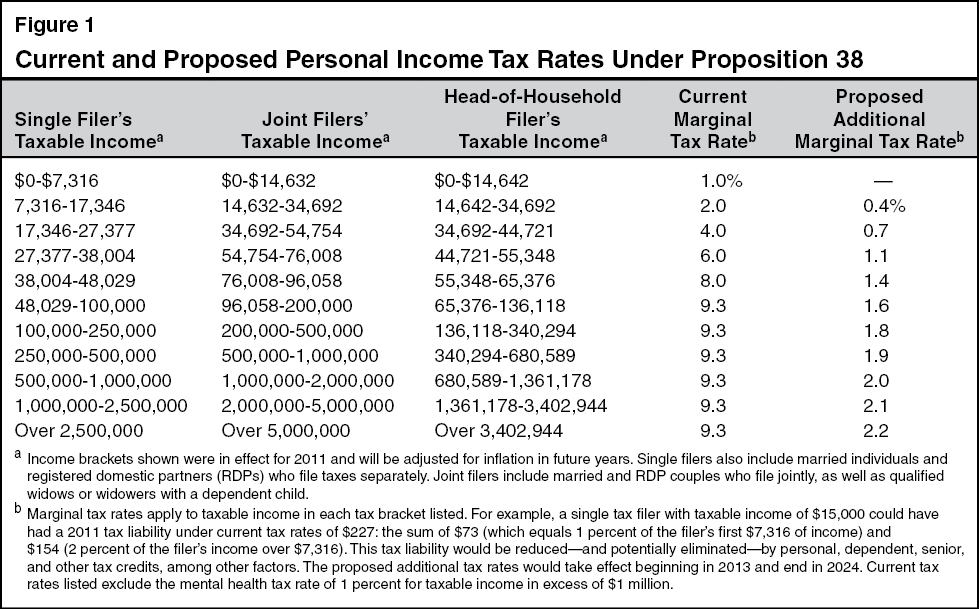

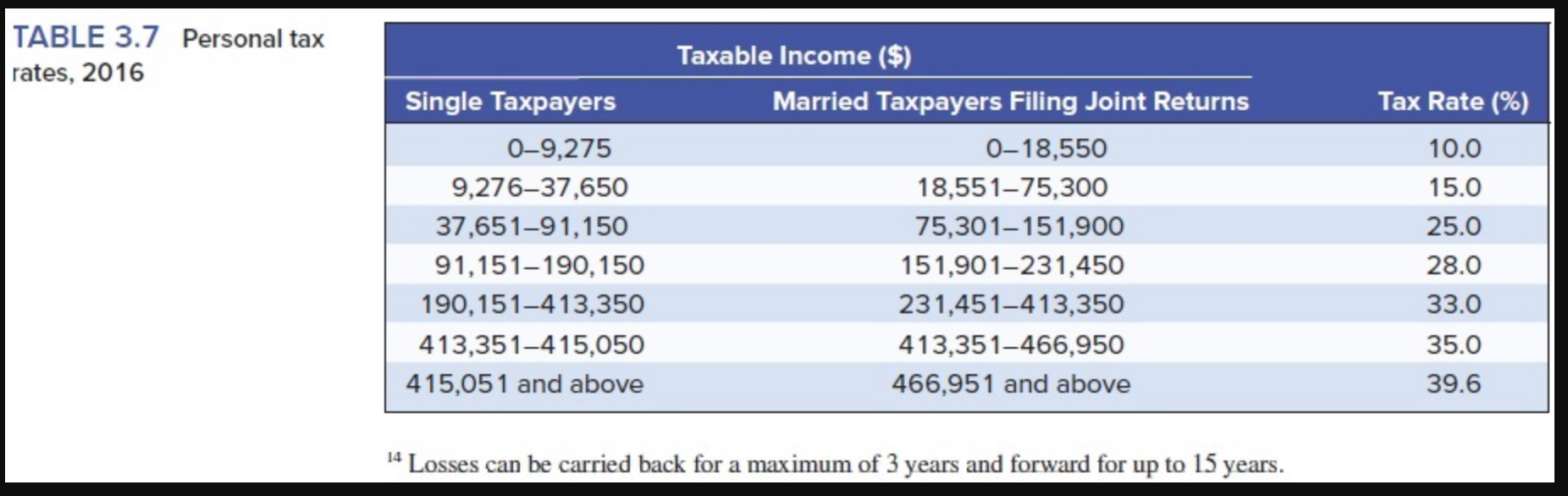

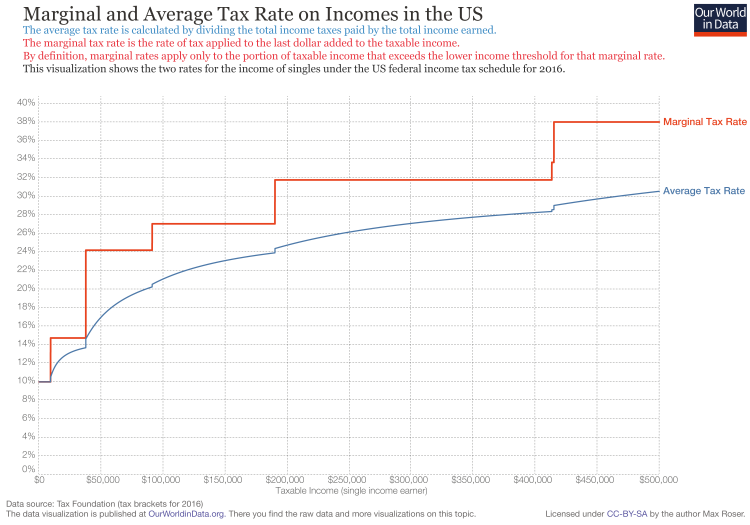

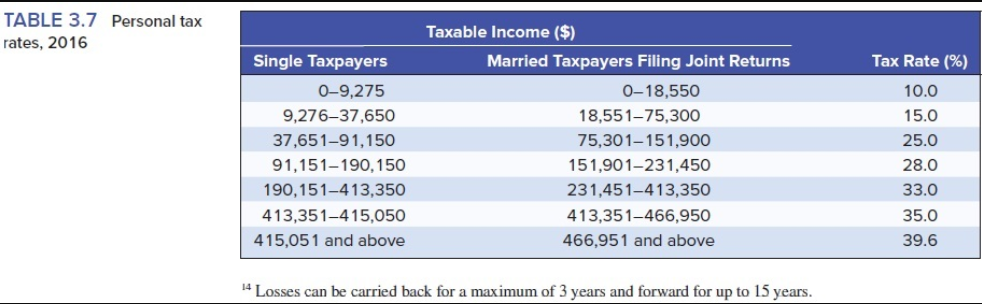

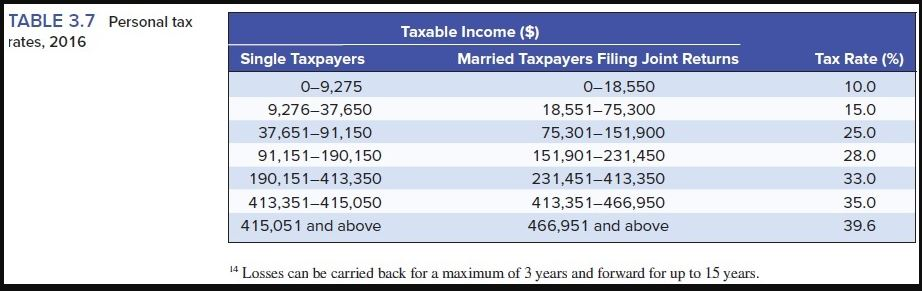

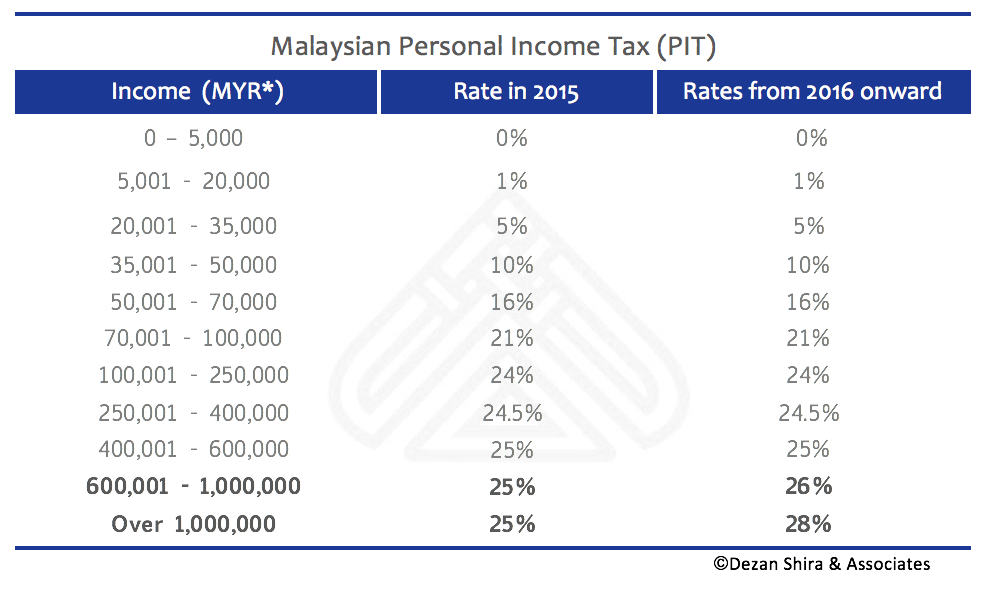

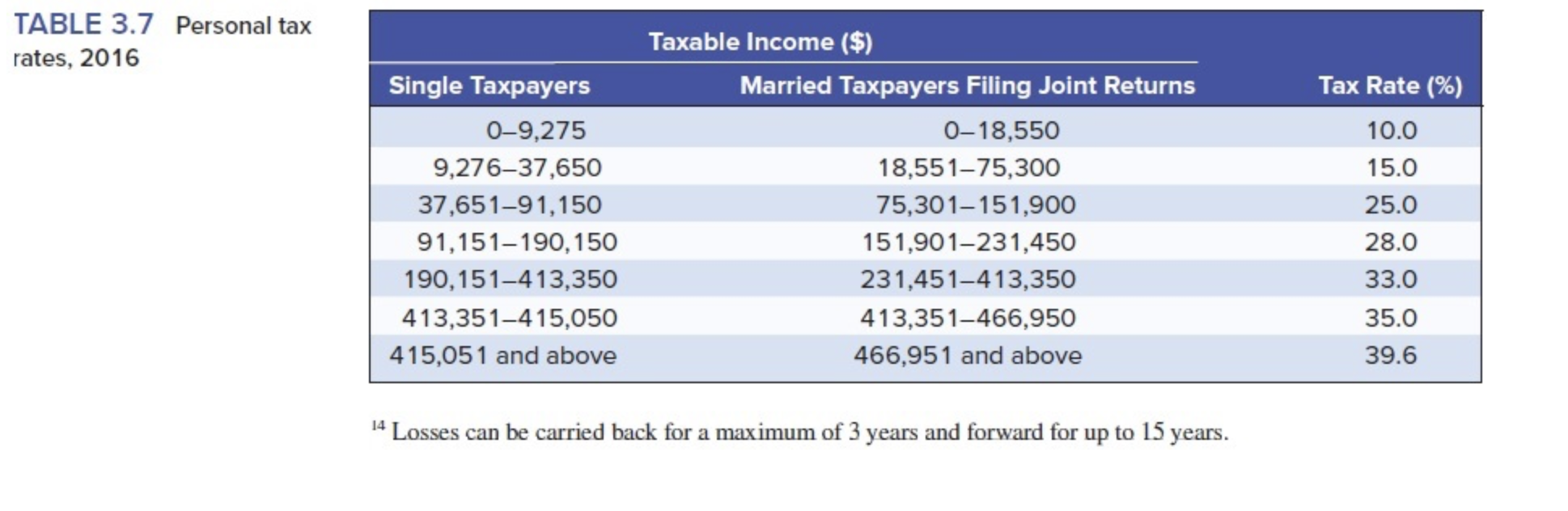

Personal tax rate 2016. The amount of tax you owe depends on your income level and filing status. On the first 2 500. The top marginal income tax rate of 39 6 percent will hit taxpayers with taxable income of 415 050 and higher for single filers and 466 950 and higher for married filers. On the first 5 000 next 15 000.

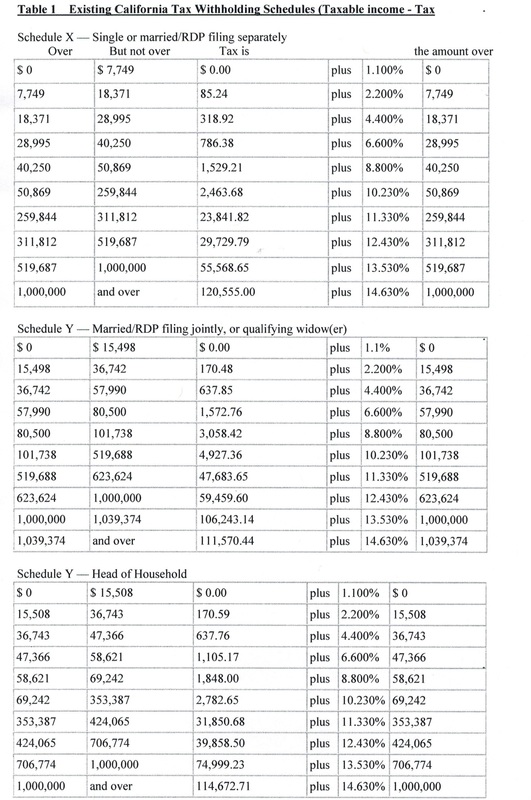

Calculations rm rate tax rm 0 5 000. 2016 california tax table 79 2016 california tax rate schedules 84. It s important to understand that moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate. 10 15 25 28 33 35 and 39 6.

Your total tax bill would be 13 459. 2016 income tax brackets the federal income tax has 7 brackets. You are allowed to claim one personal exemption for yourself and one for your spouse if married. F r a n c h i s e t a x b o a r d cover graphics omitted for downloading speed.

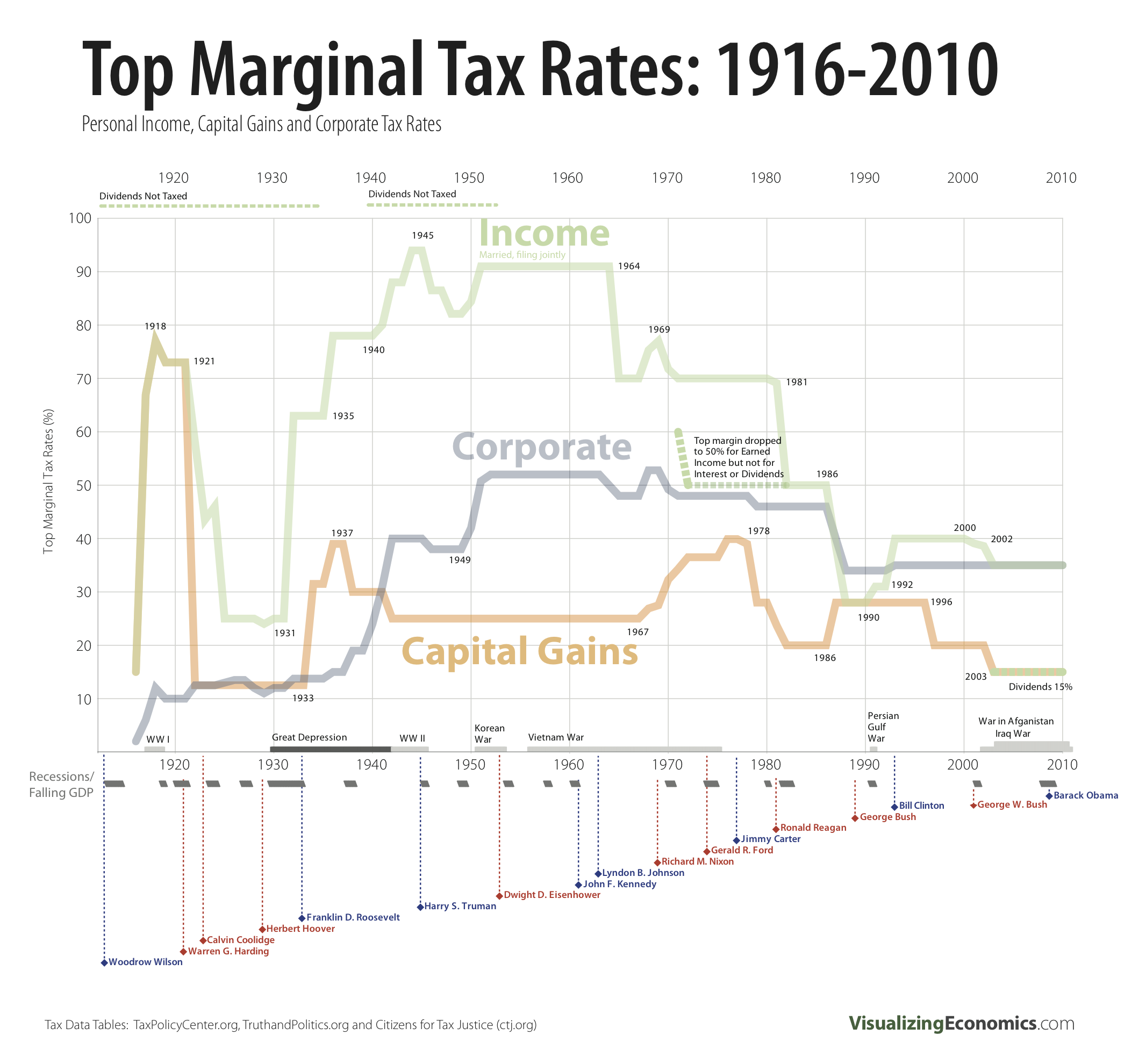

Choose your province or territory below to see the combined federal provincial territorial marginal tax rates. 2016 personal income tax booklet members of the franchise tax board betty t. Tax rates marginal income tax rates for 2015 and 2016 personal income tax rates for canada and provinces territories for 2015 and 2016. These tax rates started at 10 in 2016 and increased to a top rate of 39 6 other taxes applied as well.

2016 personal exemption amounts. Personal income is taxed on a graduated scale. In 2016 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Fiona ma cpa member.

For example in the 2016 tax year single individuals pay 39 6 only on income above 415 050 above 466 950 for married filing jointly. From april 2016 the new personal savings allowance means that basic rate taxpayers will not have to pay tax on the first 1 000 of savings income they receive and higher rate taxpayers will not.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)