Personal Relief Malaysia 2016

The easiest malaysian income tax relief to be eligible for 1 hybrid computers include microsoft surface windows 8 hybrid laptop refer to devices that possess attributes of a personal computer and a tablet with the use of a convertible detachable keyboard and touchscreen.

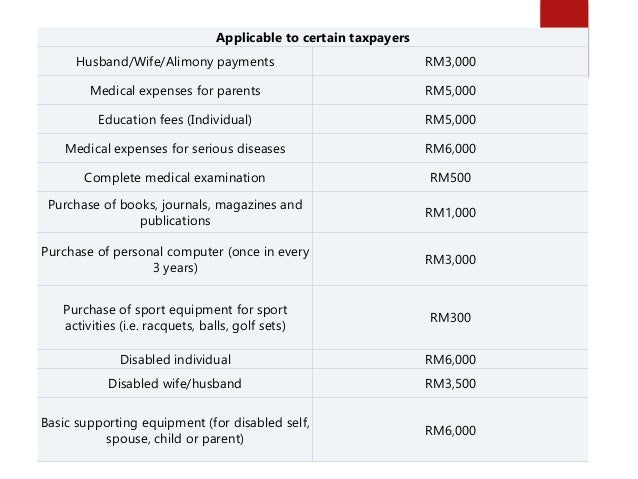

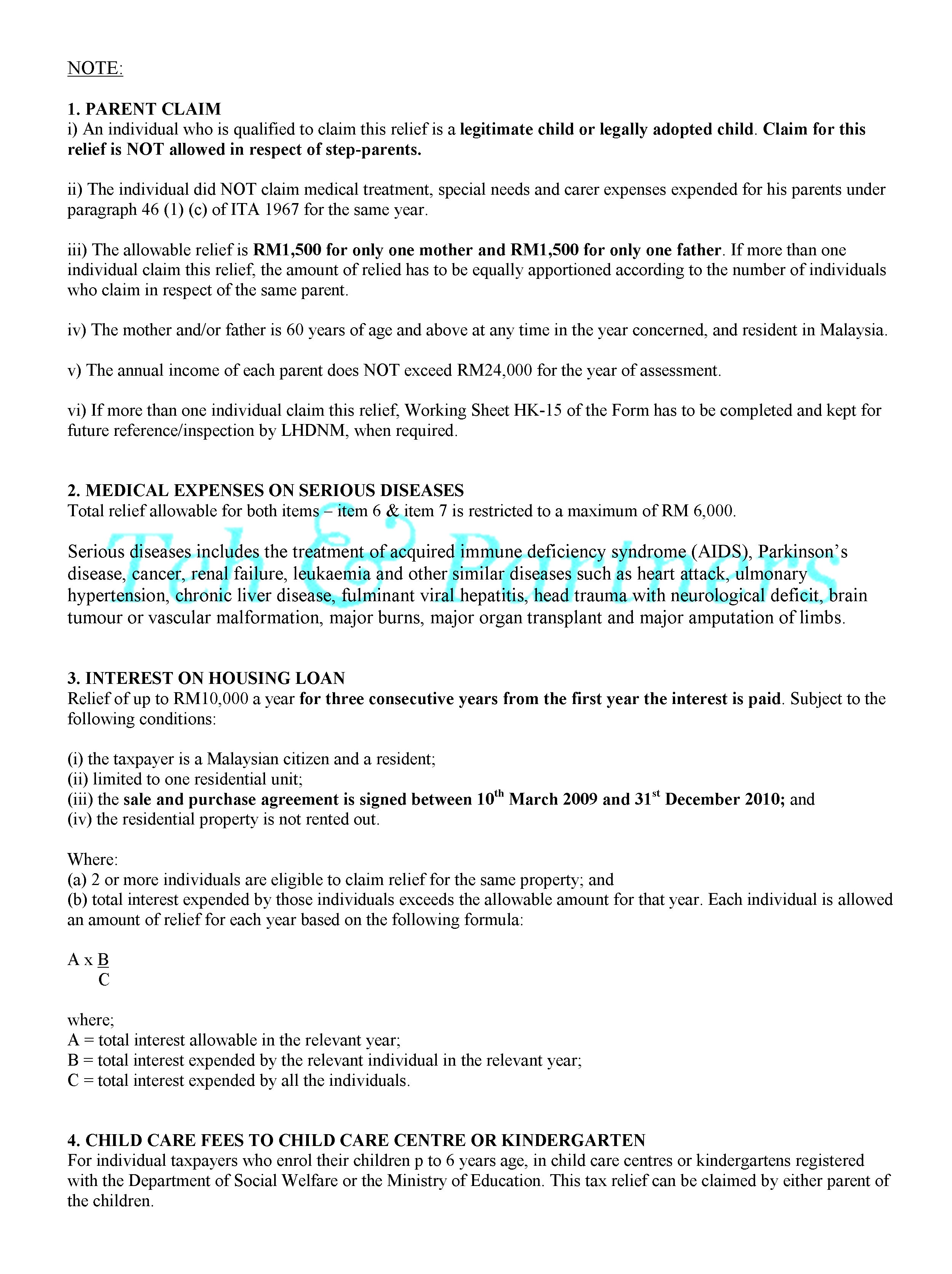

Personal relief malaysia 2016. Medical expenses for parents. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Personal tax reliefs in malaysia reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. 5 000 limited 3.

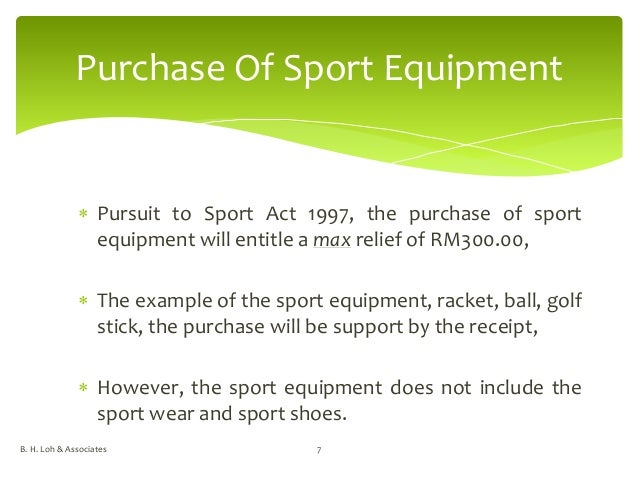

22 august 2016 page 4 of 44 6. Other than the above three common tax reliefs there are many other reliefs tax payers in malaysia can maximise. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Loh associates 3.

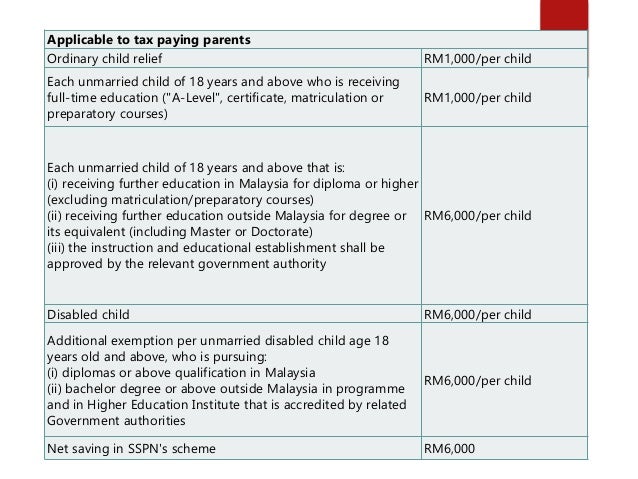

The fixed income tax rate for non resident individuals be increased by 3 from 25 to 28 from ya 2016. Malaysia s 2016 budget proposals offer some relief to lower and middle income taxpayers but increases the tax rate for higher income individuals. Tax relief for each child below 18 years of age is increased from rm1 000 to rm2 000 from year of assessment 2016. The 2016 budget proposals were presented by the country s prime minister yab dato sri mohd najib tun haji abdul razak on 23 october 2015.

This relief is applicable for year assessment 2013 and 2015 only. Now say the government decides that all residents of malaysia should get a personal tax relief of up to rm9 000 per year and the additional rm2 000 for assesment year 2015 as previously mentioned. Individual and dependent relatives rm9 000 relief of rm9 000 for an individual in respect of himself and. 6 2016 date of publication.

Loh associates 2 3. Personal reliefs sec 46 income tax act 1967 deduction for personal reliefs b. Inland revenue board of malaysia group relief for companies public ruling no. Tax relief for individual taxpayer whose spouse has no income is increased from rm3 000 to rm4 000.

Your chargeable income will now be rm25 000 rm36 000 rm9 000 rm2 000 which means that your tax would be up to the 5 bracket. Definition of related companies and eligibility for group relief for the purpose of group relief the meaning of related companies is provided in subsection 44a 3 of the ita. Amount rm 1.