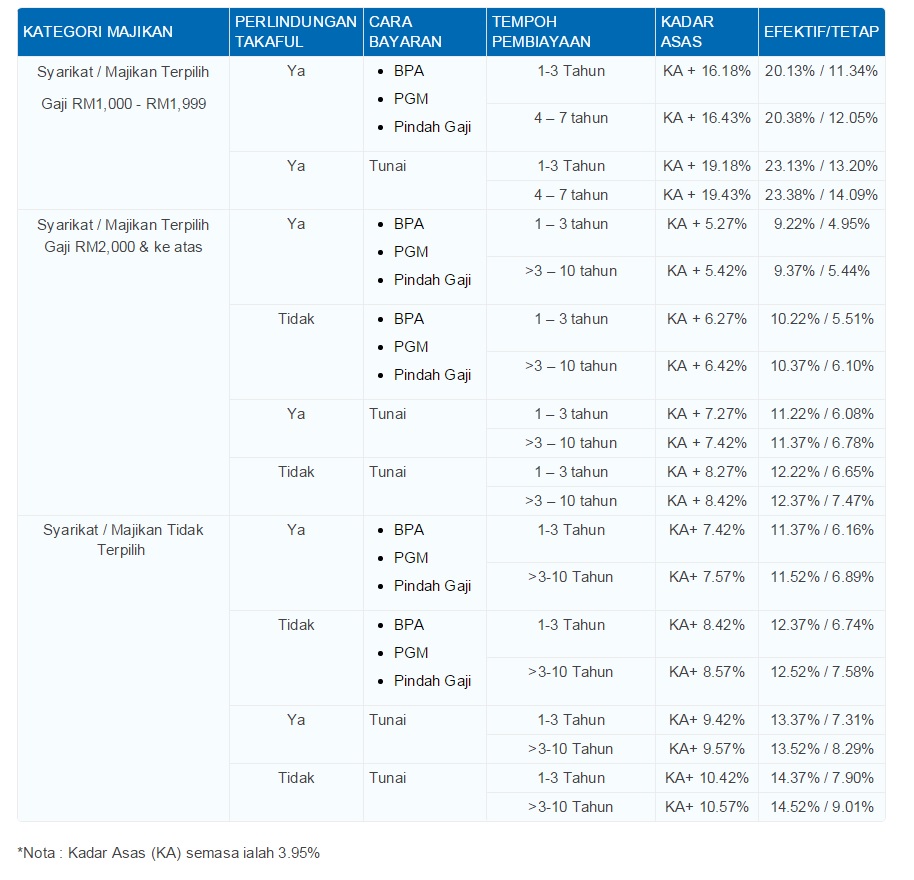

Personal Loan Malaysia Private Sector

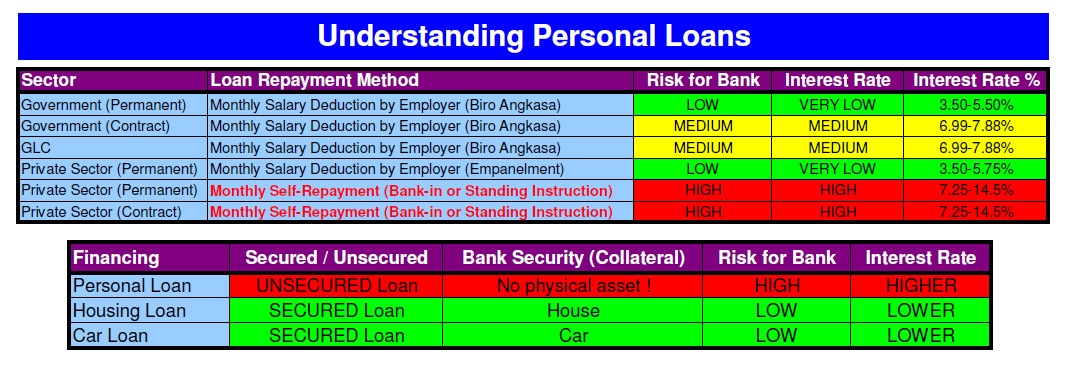

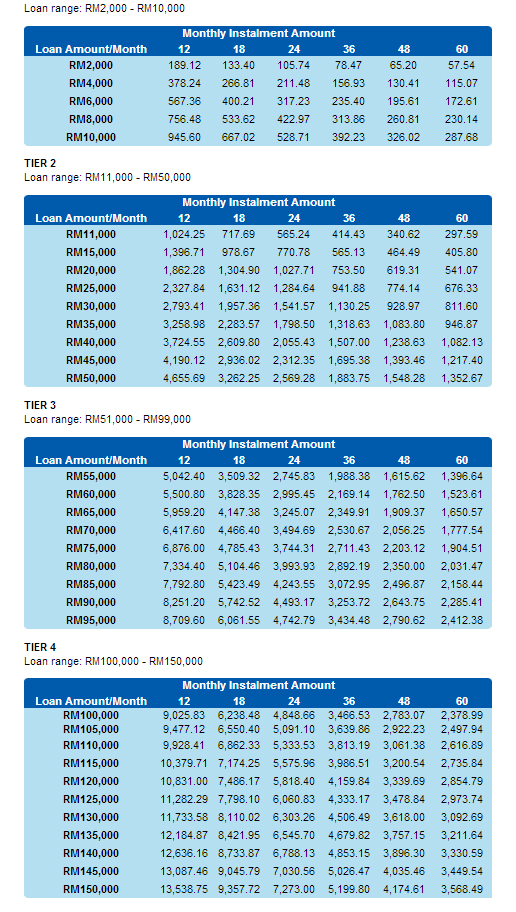

Rhb bank offers personal loans to salaried self employed and even commission earners in the private or government sectors with the condition of having a minimum income as low as rm1 500 gross salary.

Personal loan malaysia private sector. Rhb bank s loan approvals and loan disbursements are instant therefore it is ideal for people who need immediate funds. 21 60 years. If you are a private sector employee earning at least rm3 000 a month alliance bank offers the lowest profit rates starting at 5 33 a month. You can use imoney s loan calculator to compare dozens of personal loan plans at a glance.

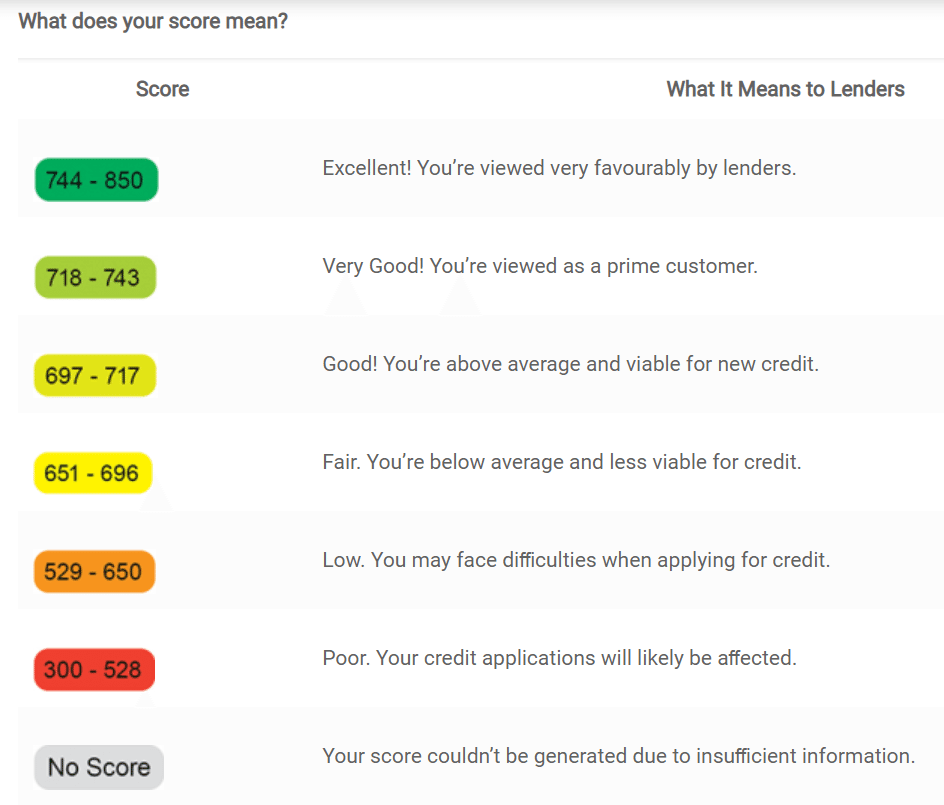

Personal loan in malaysia is a website cater to those looking to apply for personal financing in malaysia. Fixed contract commission basis. To qualify for a personal loan application you must first meet the eligibility criteria as set out by the bank including but not limited to. Salaried employee public private sector or self employed.

A malaysian citizen aged between 18 and 60 years old minimum gross monthly income of rm1 000 have a permanent job with at least 3 months of service. Loans to private sector in malaysia averaged 948217 16 myr million from 1996 until 2020 reaching an all time high of 2015752 70 myr million in july of 2020 and a record low of 289998 myr million in january of 1996. Malaysian permanent resident or foreigner. Loans to private sector in malaysia increased to 2015752 70 myr million in july from 2005805 75 myr million in june of 2020.