Personal Loan Agro Bank

Copy of nric front and back 3 months most current salary slips.

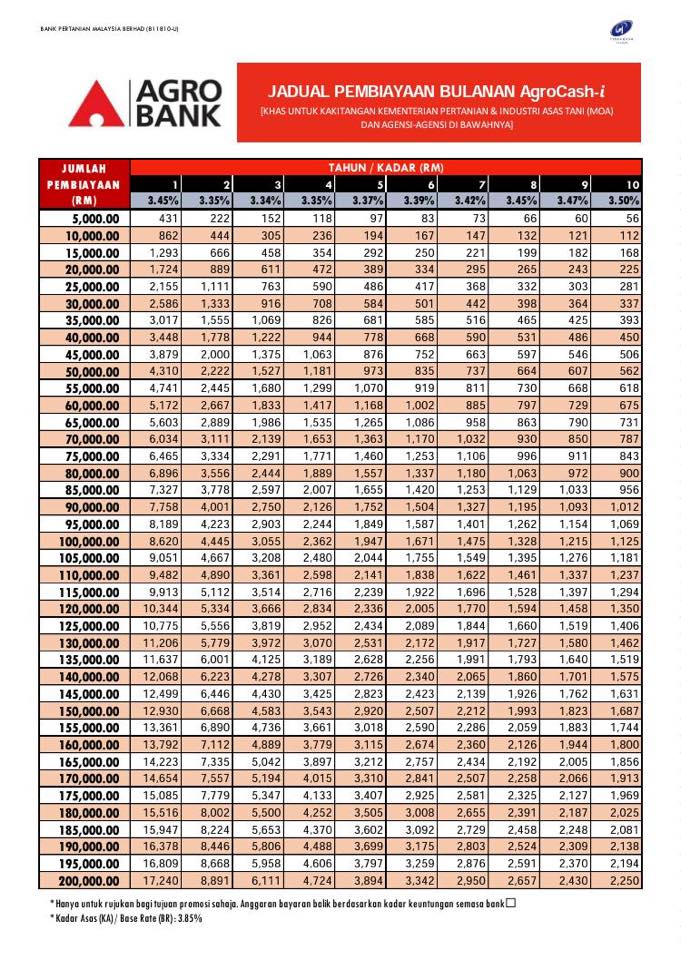

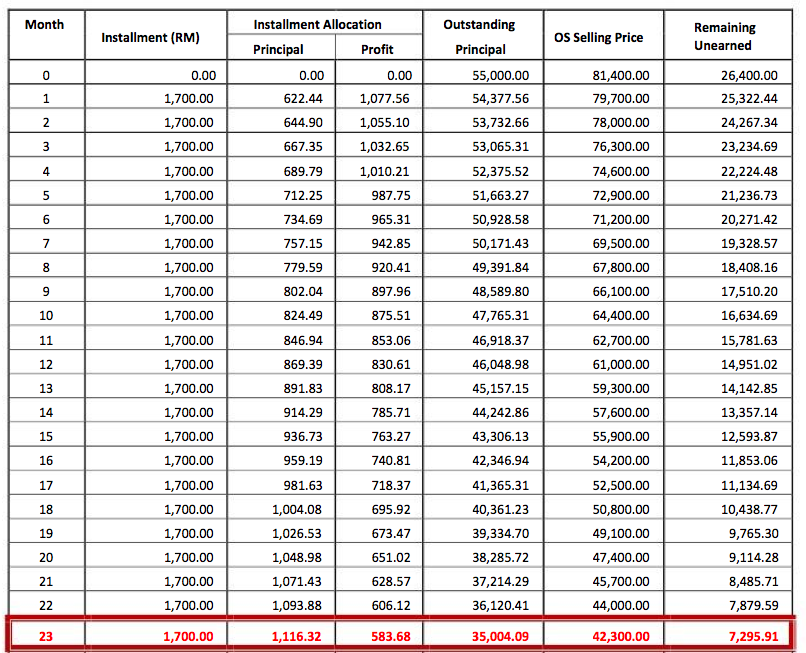

Personal loan agro bank. You are required to furnish the following documents for your financing application. 2 35 effective 10 july 2020 the benchmark cost of fund cof used to determine the br is the bank s fixed. To 5 70 p a whereas glc employees will also get different profit rates such as below. The maximum amount you can borrow from agrocash i is rm200 000 both for government servants and glc employees.

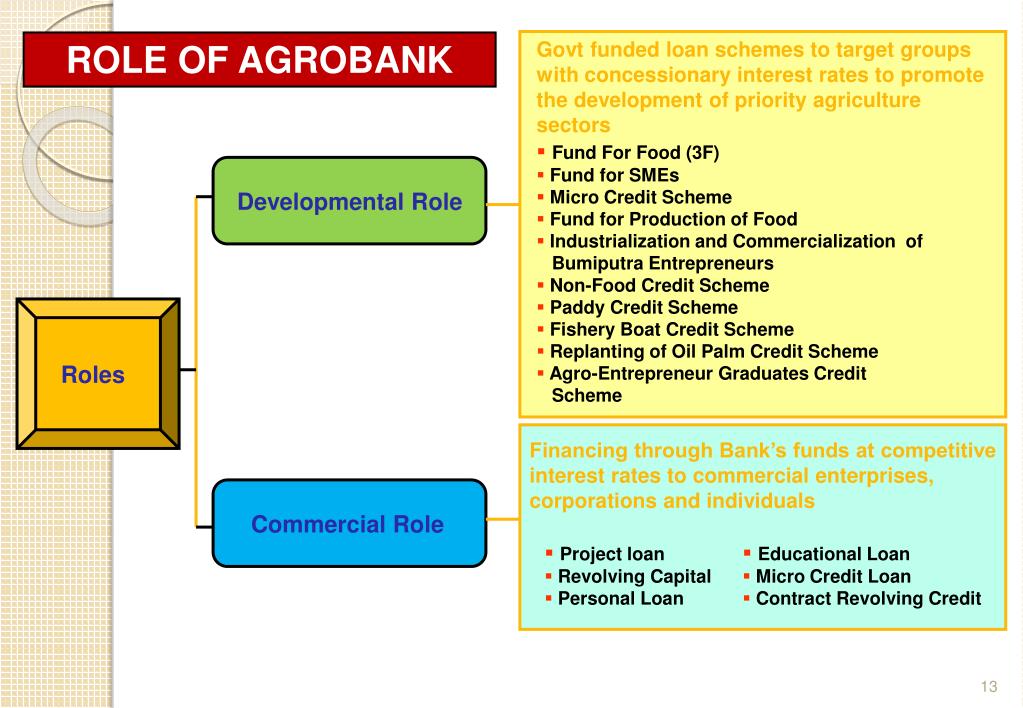

Kredit mikro tanaman semula kelapa sawit i sawit i term financing i. Agrocash i agrocash i is a personal financing facility for customers for the purpose of consumer financing mainly related to agriculture and agro based activity. Base financing rate bfr. Agrobank sebenarnya menawarkan banyak produk dan perkhidmatan perbankan islam.

To be eligible for an agrobank personal loan you have to meet the following criteria. Agrobank provides financing for fishermen to own affordable homes. Agrobank agrocash i adalah pelan pinjaman peribadi yang ditawarkan oleh agrobank atau juga dikenali sebagai bank pertanian malaysia. How much can i borrow from this agrobank islamic personal loan.

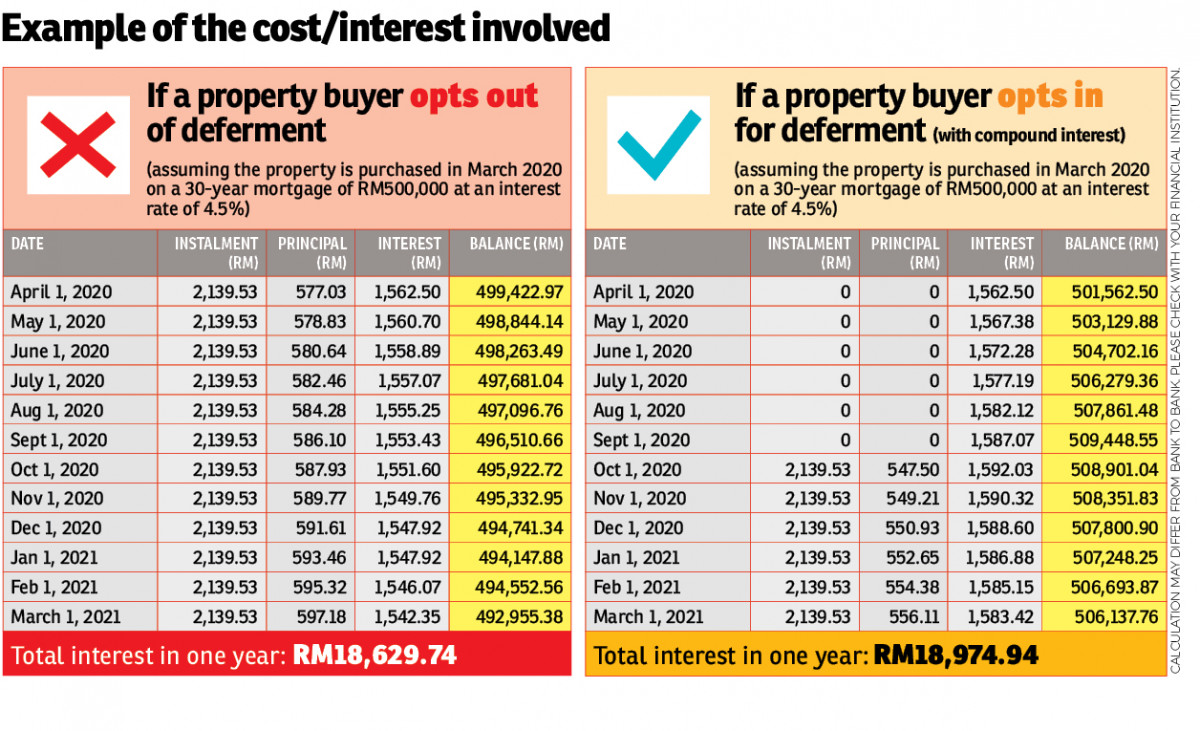

Applicant working in the government sector will enjoy competitive profit rates between 5 20 p a. The implementation of the product is based on tawarruq transactions. Agrobank is a continuity of the former bank pertanian malaysia which has 40 years of experience in agricultural banking and an excellent track record in shaping and developing successful entrepreneurs. Agrobank is a government owned bank under the minsiter of financing incorporated mfi with over 40 years in agricultural banking and a track record in shaping and developing successful entrepreneurs.

Special advance for investment assets i safia i business. Personal financing facilities. 5 50 effective 10 july 2020 base rate br. Business financing facilities.

Be at least 18 government employees or 21 glc staff to 60 years of age. Announcement 19 jun 2020 notis perubahan waktu operasi cawangan kiosk ar rahnu. Sahabat agro hartani i tawarruq ar rahnu agrocash i. Term financing i is an islamic financing facility provided to the customer for carrying out the activities or projects that have relevance to the agricultural sector this product is based on the tawarruq transactions.