Personal Income Tax Rate

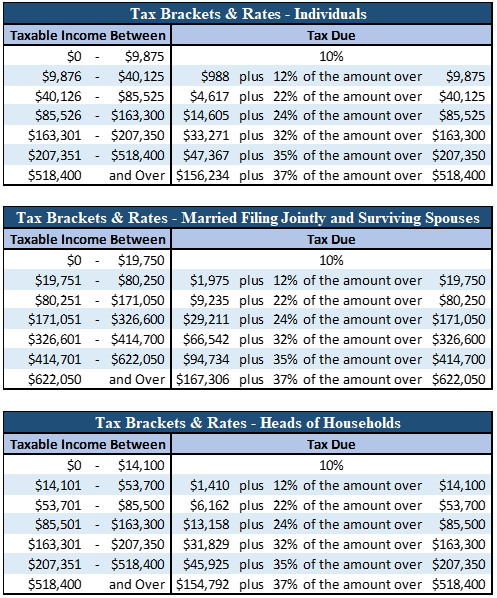

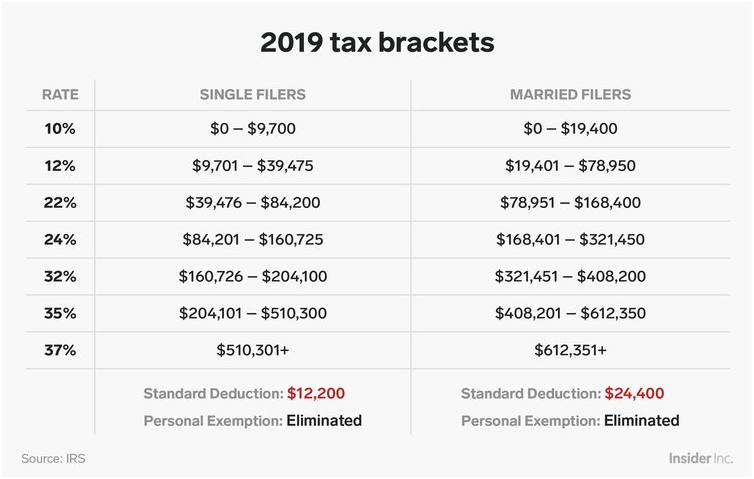

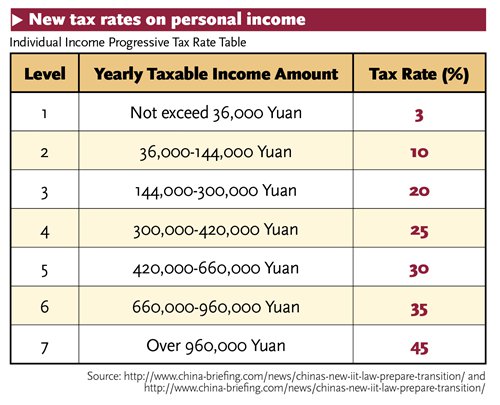

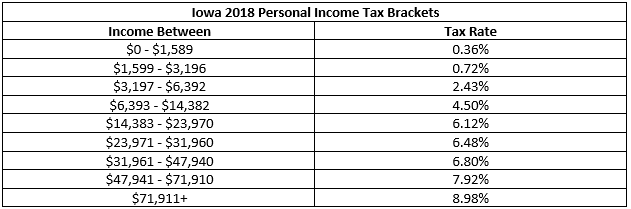

There are seven tax brackets for most ordinary income.

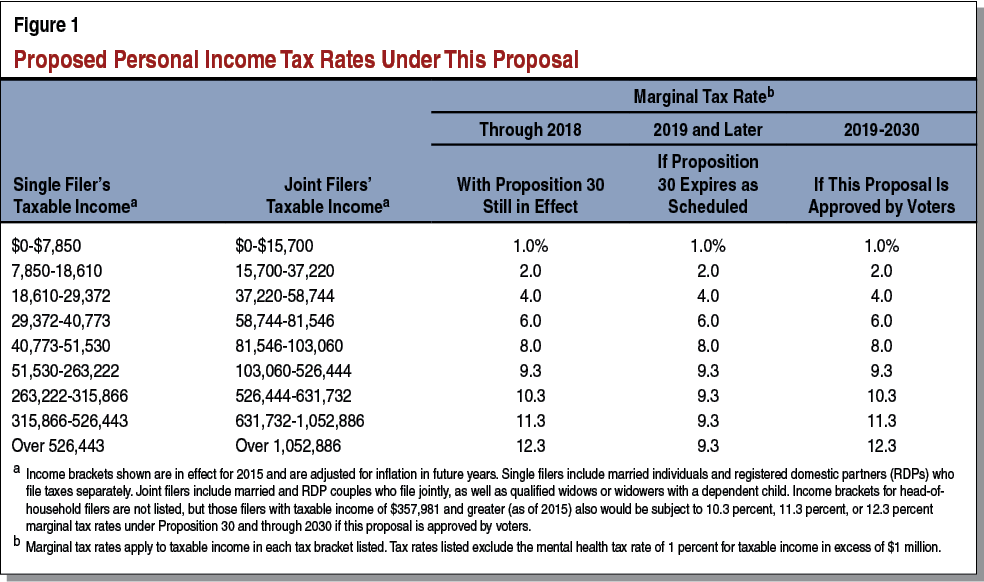

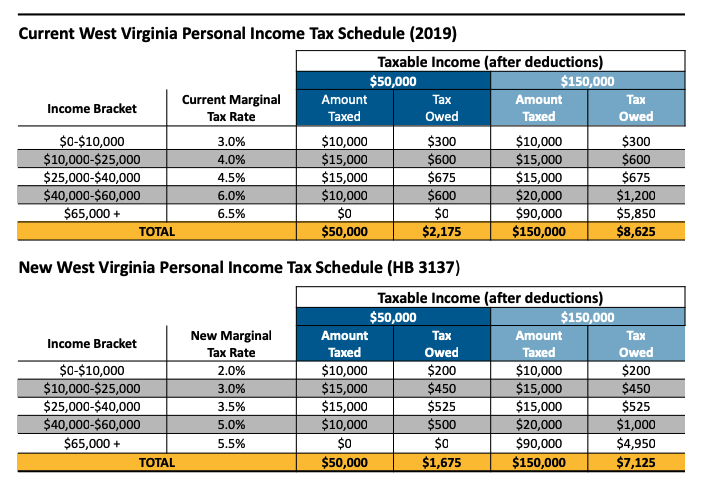

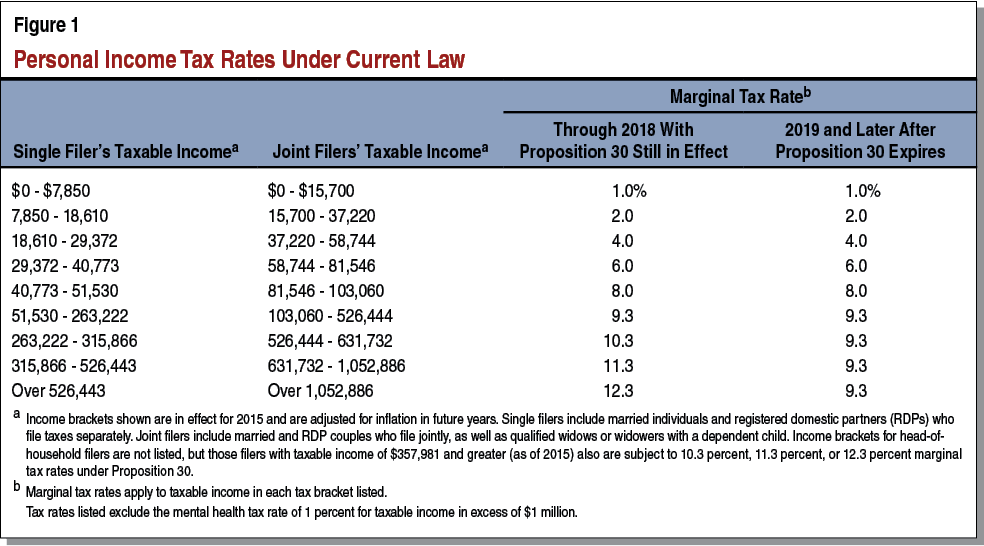

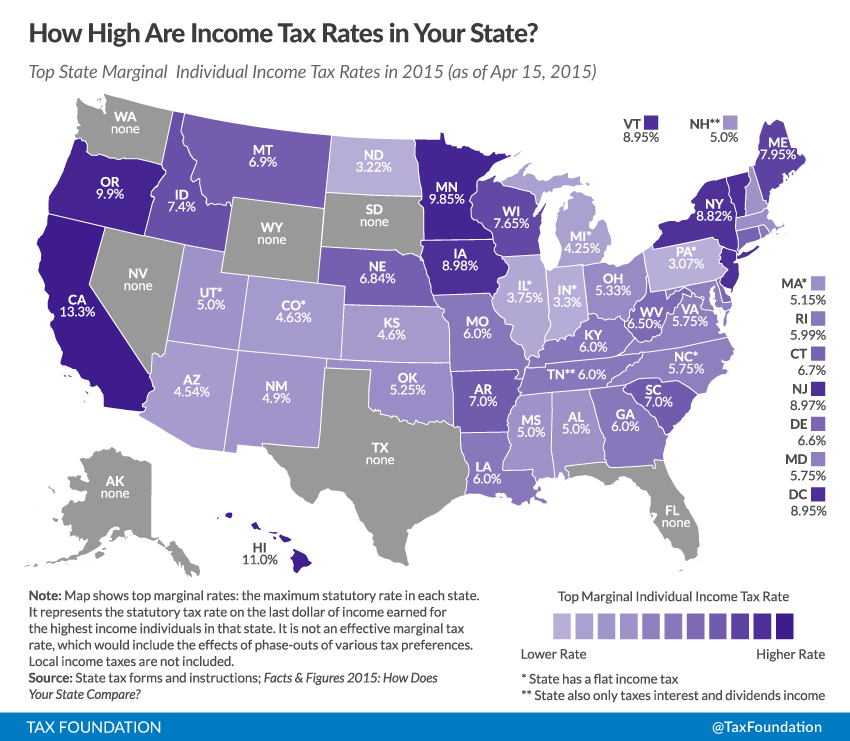

Personal income tax rate. Has a progressive tax system which means that. 12 65 11 national tax 15 municipality surtax on income tax 21 138 7 essential goods basic foodstufs water pharmaceuticals books tourism services etc. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Instead 37 is your top marginal tax rate. If you re one of the lucky few to earn enough to fall into the 37 bracket that doesn t mean that the entirety of your taxable income will be subject to a 37 tax. That s the deal only for federal income. The total bill would be about 6 800 about 14 of your taxable income even though you re in the 22 bracket.

Inheritance and estate tax. The federal government uses a. That 14 is called your effective tax rate. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

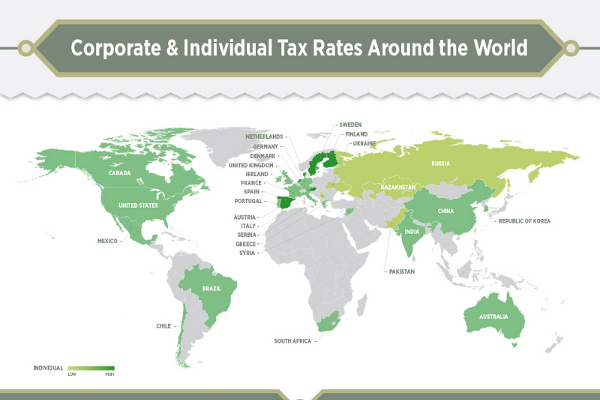

The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent. For detailed and historic tax information please see the tax compendium.