Personal Income Tax Rate 2018

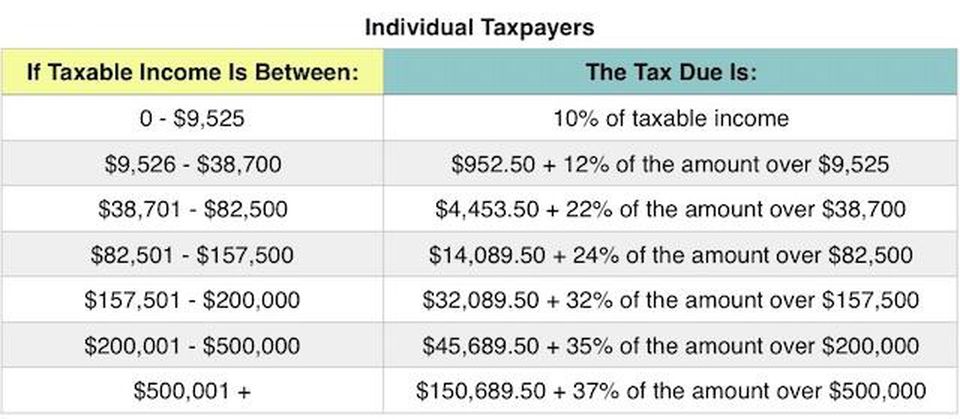

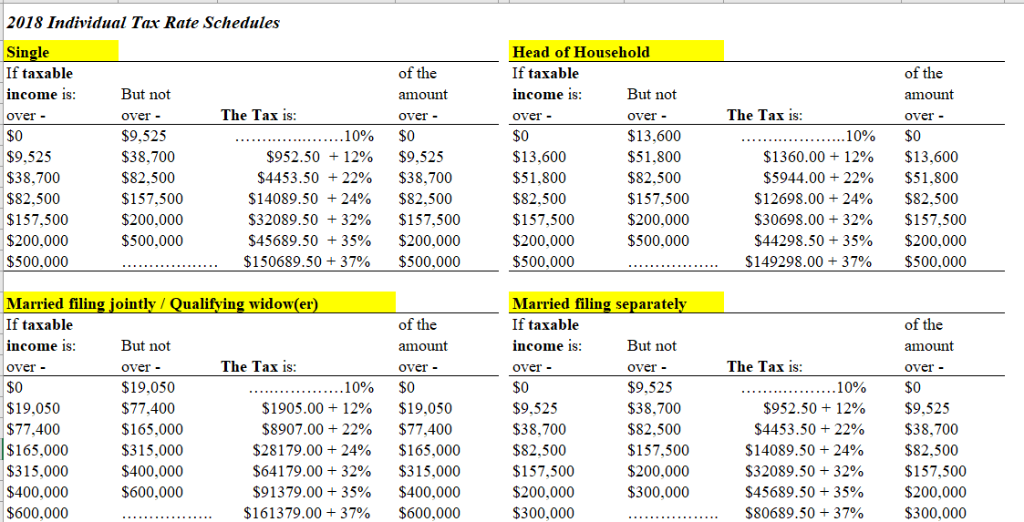

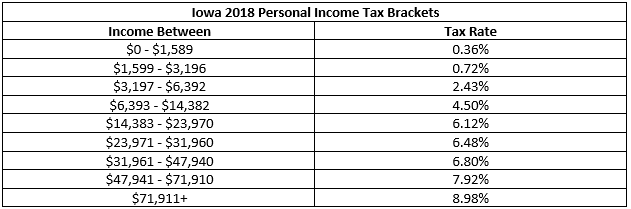

In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2.

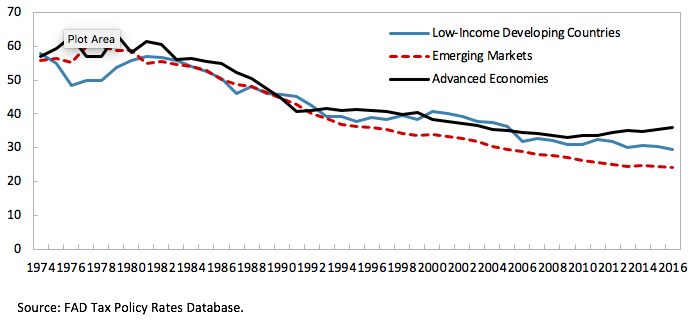

Personal income tax rate 2018. 10 12 22 24 32 35 and 37. The federal income tax has 7 rates. The tax cuts and jobs act that went into effect on jan. 2018 pass through sole proprietor and partnership tax rates.

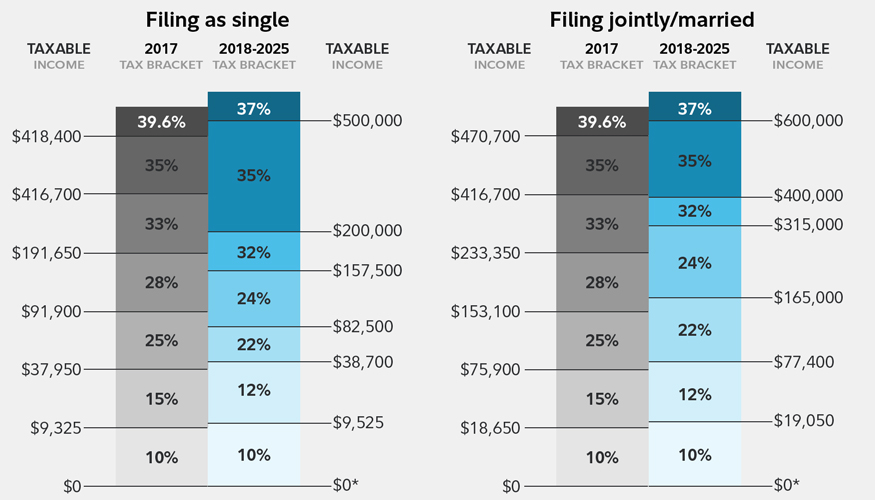

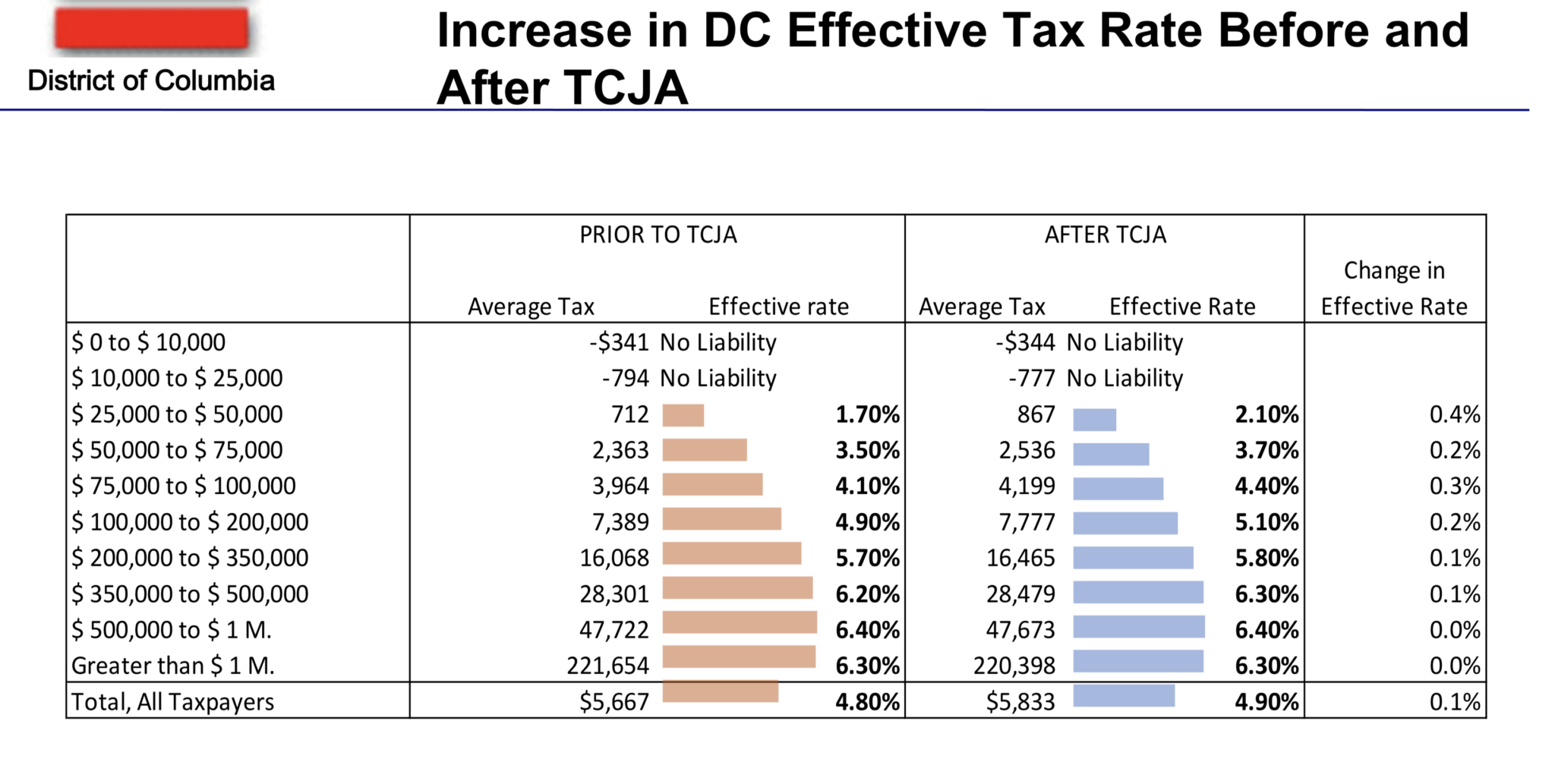

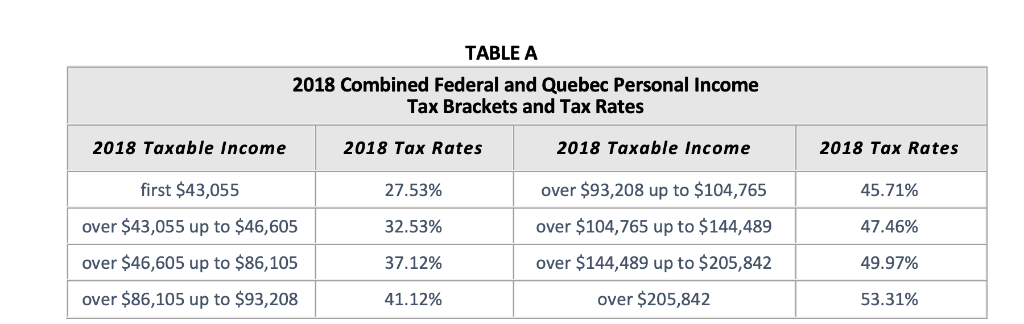

1 2018 retained seven tax brackets but lowered some of the tax rates and raised some of the income thresholds for those rates. Calculations rm rate tax rm 0 5 000. The tax cuts and jobs act tcja lowered five of the seven individual federal income tax rates for 2018 2025. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly.

The amount of tax you owe depends on your income level and filing status. On the first 5 000 next 15 000. 2018 individual income tax brackets. The top rate will fall from 39 6 to 37.

The bottom rate remains at 10 but it covers twice the amount of income compared to the previous brackets. After 2025 rates are. The quallfied business income deduction may apply and could save you a tremendous amount on your taxes. Tax rates for pass through entities s corps sole proprietors and parternships are the tax rates from the personal tax tables above.

Those rates are now 10 12 22 24 32 35 and 37. On the first 2 500. Extend existing individual tax rate cuts beyond 2025 the tax cuts and jobs act tcja lowered five of the seven individual federal income tax rates for 2018 2025.