Personal Income Tax Rate 2018 Malaysia

For example let s say your annual taxable income is rm48 000.

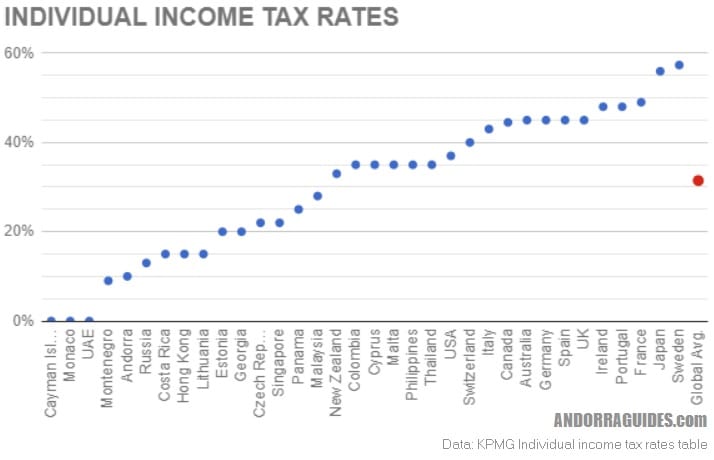

Personal income tax rate 2018 malaysia. Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. What is a tax exemption. The personal income tax rate in malaysia stands at 30 percent.

5 000 limited 3. Tax rm 0 5 000. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia personal income tax rate.

Malaysia personal income tax guide for 2020. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Calculations rm rate.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. On the first 5 000. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. Medical expenses for parents.

This page provides malaysia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. What is chargeable income. Other rates are applicable to special classes of income eg interest or royalties.

There are no other local state or provincial. What is tax rebate. Green technology educational services. This relief is applicable for year assessment 2013 and 2015 only.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. What is a tax deduction. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Amount rm 1.