Personal Income Tax Malaysia

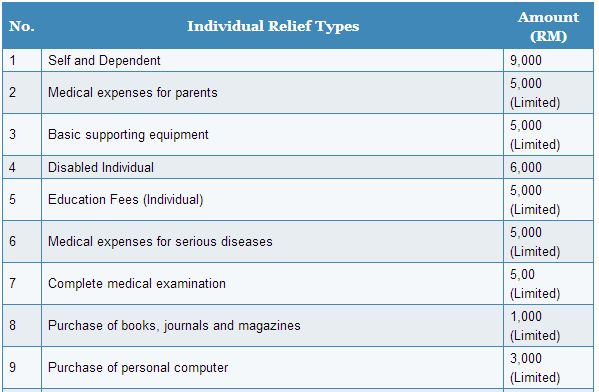

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

Personal income tax malaysia. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Malaysia personal income tax guide for 2020. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. This would enable you to drop down your tax bracket to 3 instead.

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. On the first 5 000 next 15 000. What is a tax exemption.

Income tax rates 2020 malaysia. On the first 2 500. For example let s say your annual taxable income is rm48 000. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

Sample personal income tax calculation. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Malaysia personal income tax rate a graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

Here are the income tax rates for personal income tax in malaysia for ya 2019. The following rates are applicable to resident individual taxpayers for ya 2020. Expenses of a private or domestic. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

Which means you only require to pay rm585. What is tax rebate. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Employees are allowed a deduction for any expenditure incurred wholly and exclusively in the performance of their duties but no allowance is given for tax depreciation.

Malaysia individual deductions last reviewed 01 july 2020. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Personal income tax rates.

Registering as a taxpayer in malaysia is rather easy. Green technology educational services healthcare. The personal income tax system in malaysia operates under the self assessment tax system sas. Hence it is everybody s legal responsibility to compute tax liability for individual who is liable for income tax to file his or her tax return before the deadline.