Penalty Payment For Section 103a 103

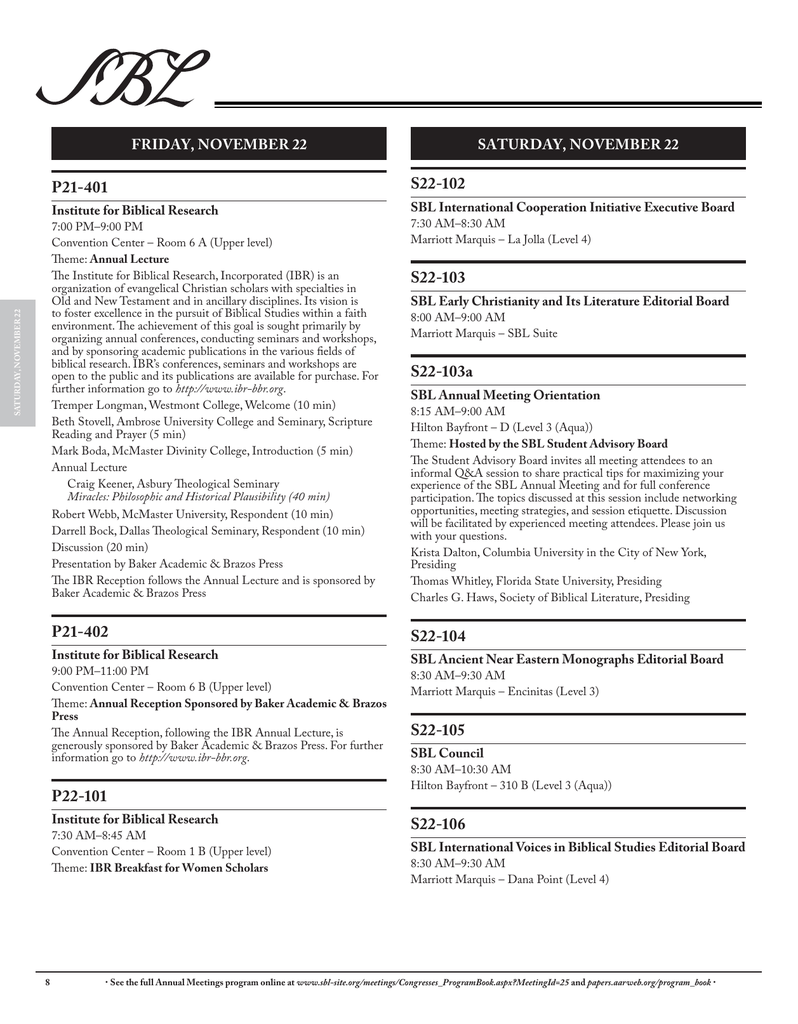

1a where an assessment or additional assessment has been made under section 91a the tax or.

Penalty payment for section 103a 103. 2 except as provided in subsection 3 tax. Real property gain tax payment rpgt 5. Penalty payment for section 103a 103. The debtor s must pay the filing fee according to the following terms.

Penalty payment for composite. Penalty payment for section 107c 9 107b 3 11. Deleted by act a1151 history section 103a deleted by act a1151 of 2002 s16 with effect from year of assessment 2004. Penalty payment for section 107c 9 107b 3 12.

Penalty payment for section 108. Penalty payment for section 107c 9 107b 3 11. Payment for court fee. The debtor s may pay the filing fee in installments on the terms proposed in the application.

Penalty payment for section. Payment for interest on judgement amounts. Order approving payment of filing fee in installments after considering the application for individuals to pay the filing fee in installments official form 103a the court orders that. 1 this section shall apply only to companies.

Penalty payment for section 108. 103a 1 pursuant to health and safety code section 13112 any person who violates any order rule or regulation of the state fire marshal is guilty of a misdemeanor punishable by a fine of not less than 100 00 or more than 500 00 or by imprisonment for not less than six months or by both. Payment for court fee. Income tax payment excluding instalment scheme 7.

Penalty payment for section 107c 10 107b 4 13. Penalty payment for composite. 1 except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not that person appeals against the assessment. Payment for court.

Penalty payment for section 107c 10 107b 4 12. Penalty payment for composite. Penalty payment for section 103a 103. Penalty payment for section 108.

Penalty payment for section 108. Penalty payment for section 103a 103. Income tax payment excluding instalment scheme 6. 1 any entity that violates the prohibition of paragraph a of this section is subject to a civil money penalty of up to 5 000 as adjusted annually under 45 cfr part 102 for each violation.

Penalty payment for composite. Payment for interest on judgement amounts. Section 103a formerly read. If you failed to make the full payment after april 30 following the year of assessment you will be charged a late payment penalty of 10 on the balance of tax not paid.

If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. Penalty payment for section 107c 9 107b 3 12.