Penalty For Late Submission Of Company Tax Return In Malaysia

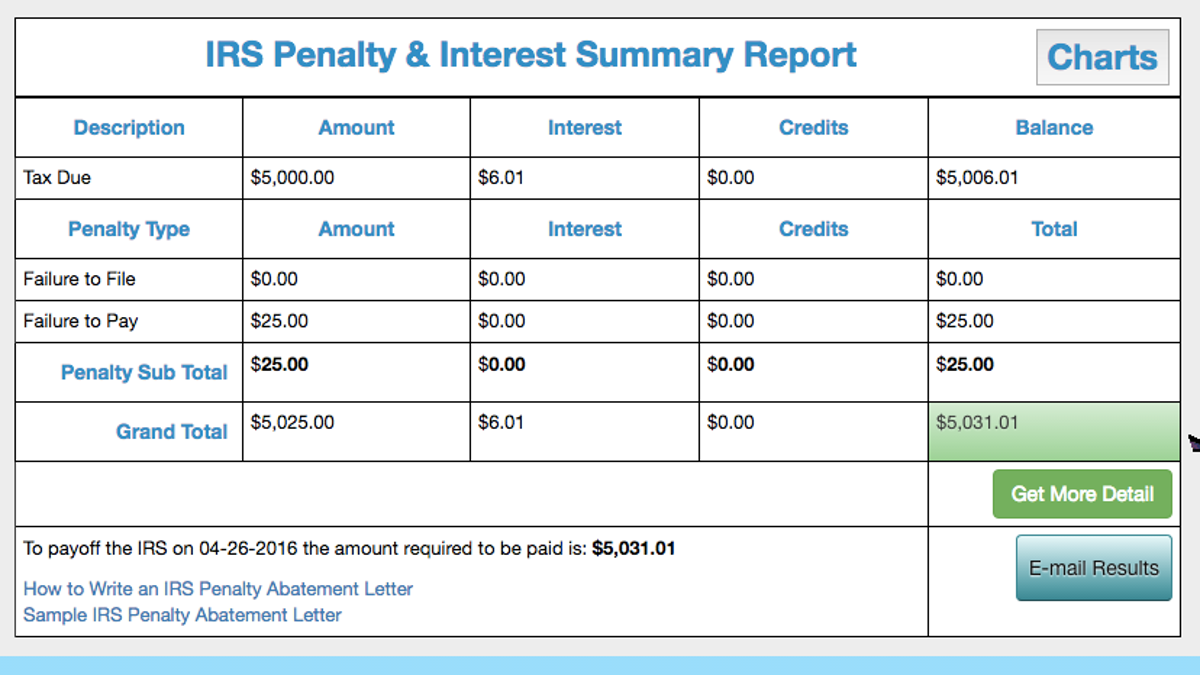

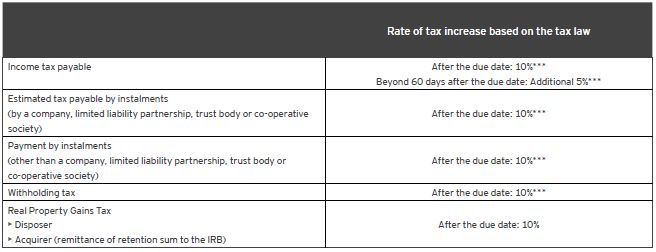

Fails to pay the monthly tax estimate instalment by 15th of the month a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the month.

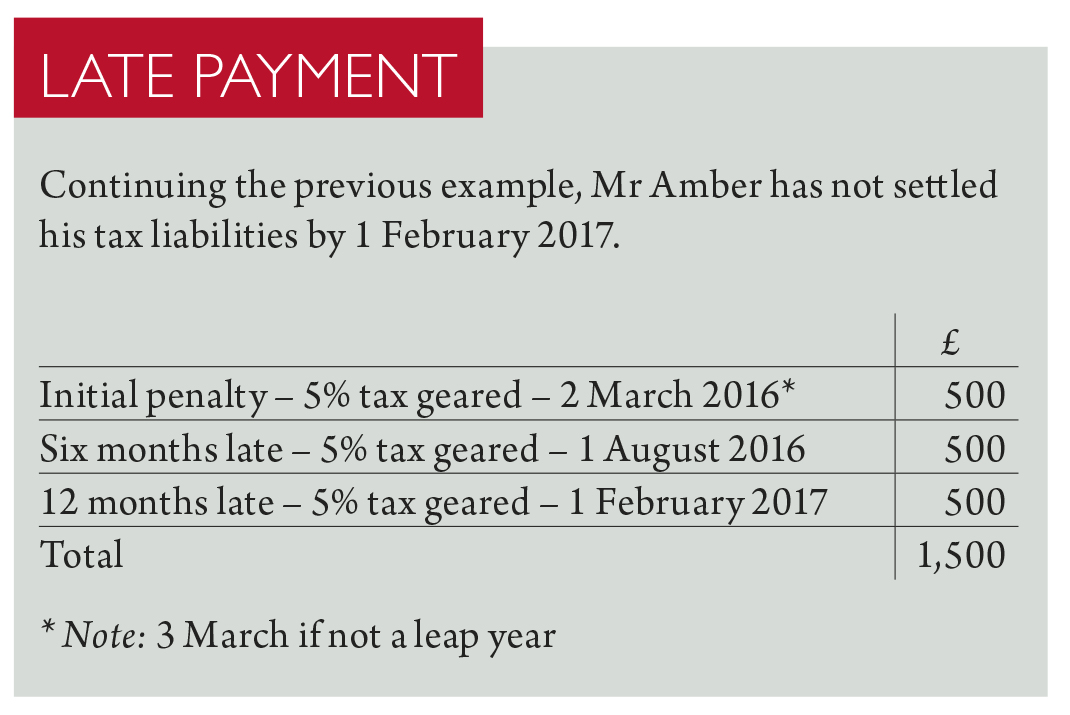

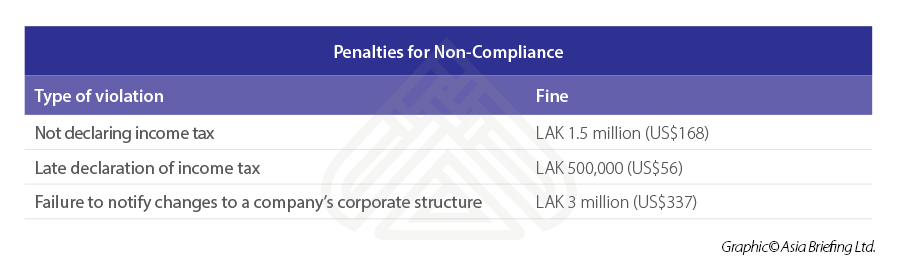

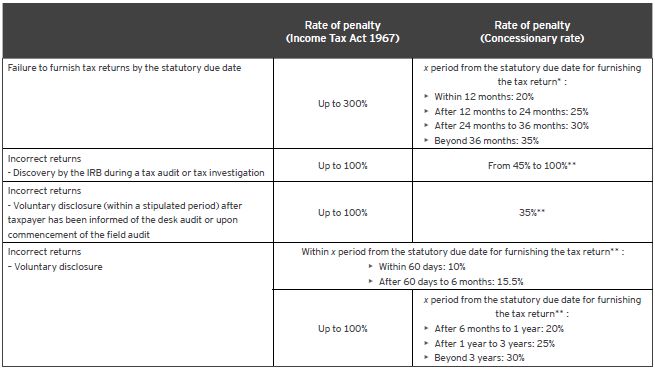

Penalty for late submission of company tax return in malaysia. Besides that penalties will also be imposed on those who submitted deficient net tax payable sst return is submitted without payment or lesser amount or any failure to register sst. 103 3 a 10 increment for the tax payable. B additional 5 increment on the balance of a if payment is not made after 60 days. Difference between the estimate submitted and final tax payable.

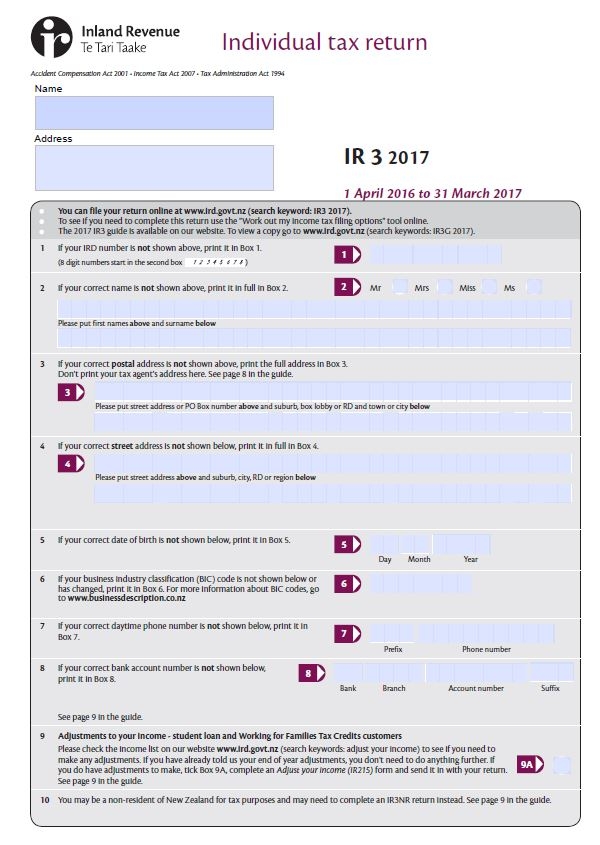

Failure to furnish estimate tax payable form cp204 liable to a fine ranging from rm200 to rm2 000 or face imprisonment or both. There are penalties and charges on private limited companies sdn bhd and public limited companies bhd for non compliance. Provisions under ita 1967. Pay taxes after 30th june.

Aside from having to pay more if you re late to submit your tax form you will get fined if you understated your taxes don t submit a form at all or for various other offences. Employment with no business. Failure to remit the instalments on a timely basis will result in an automatic penalty of 10 being imposed on the unpaid amount. Penalty of late payment of taxpenalty will be charged to those who make late payment of tax.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)