Peer To Peer Lending

For this reason he likes kiva an international nonprofit founded in 2005 that connects investors with.

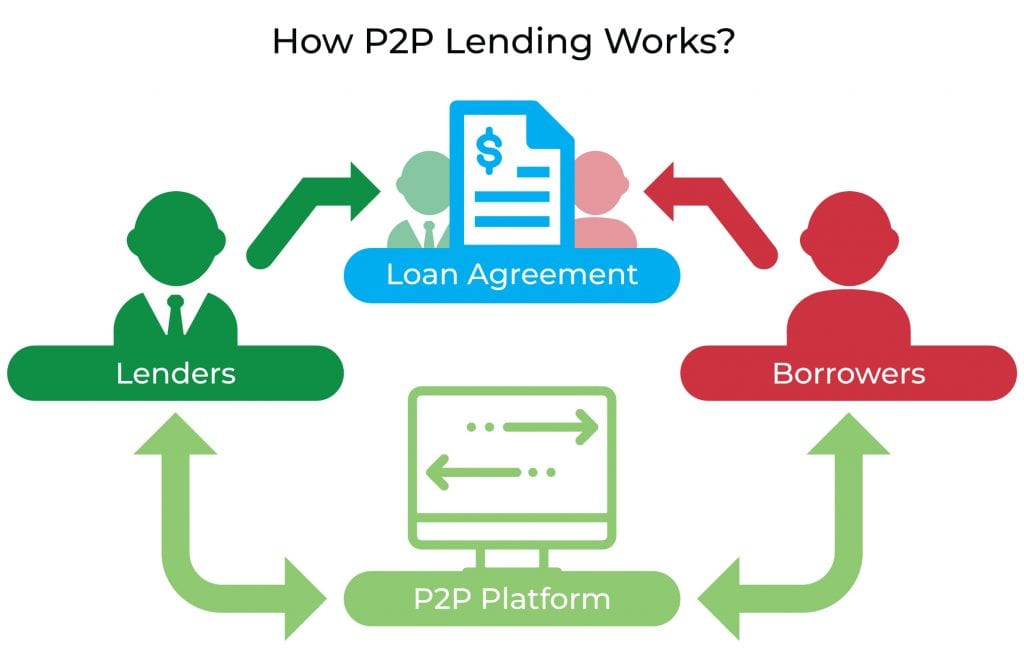

Peer to peer lending. Websites that facilitate p2p lending have. Borrowers can access our lending platform through our desktop and mobile interfaces. Peerform is a leading marketplace lender dedicated to helping individuals take control of their finances. Peer to peer lending also known as p2p lending is an online system where individual investors fund loans or portions of loans to individual borrowers.

Similarly when we refer to a lending platform we mean a company that provides loans funded by banks and other lending partners. A peer to peer lender is a company that helps connect borrowers to individuals corporations or other investors who have agreed to fund their loans. The individual investors decide after reading a profile whether or not they want to take the risk of loaning money to the potential borrower. Borrowers and lenders can both benefit from this lending system.

Who is peerform. Also called marketplace lending peer to peer lending is a growing alternative to traditional lending. Peer to peer p2p lending enables individuals to obtain loans directly from other individuals cutting out the financial institution as the middleman. Peer to peer p2p lending typically takes place on an online platform sort of a loan matchmaking service that connects borrowers with investors who supply the funds.

Also founded in 2005 prosper was the first peer to peer lending site in the u s. Peer to peer lending in a nutshell is when borrowers take out loans from companies that pair potential borrowers with individual investors that are willing to lend them their own money. Investors looking for yield should consider one of these peer to peer lending sites. Through personal loans auto refinancing loans business loans and medical financing lendingclub offers the borrowing and investing solution right for you.

-Lending-Market-Revenue-(USD-Billion).png)