Pcb Payment Due Date 2020

15th of the 10th month after the close of your tax year.

Pcb payment due date 2020. Pcb mar apr salary 15 apr 2020 15 may 2020. 15th day of the 3rd month after the close of your tax year. Bills are issued beginning three weeks before the term. If your filing or payment due date falls between 3 15 2020 and 7 15 2020 then your due date is.

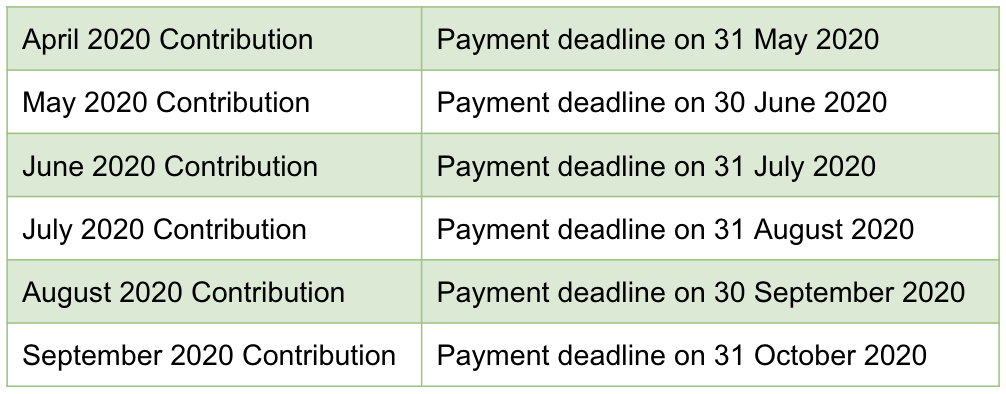

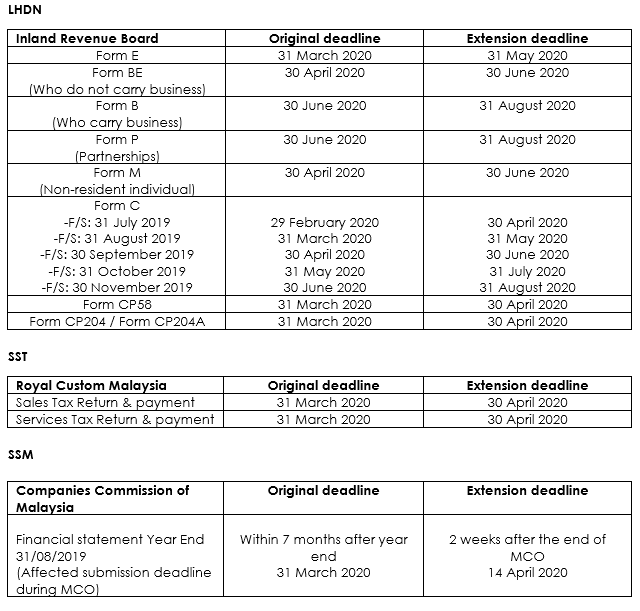

2 months from the due date of submission for accounting period ending. Monday march 16 2020. 30 th june 2020. Maybank berhad kawanku phone banking 1 300 88 6688 e payment via cheque deposit machine cdm.

You can see your balance access your bill and pay online via the mypcc paying for college tab. Withholding tax form payment 18 march 12 may 2020. Original filing and payment due date extension due date. Acknowledgment of receipt by the bank is the employer.

Cp204 tax instalment cp204 cp204a form submission due within the mco period. Irbm s instruction to deduct salary. D payment via tele banking. Payment of individual income tax and real property gain tax rpgt can be made via tele banking service at bank agent as follow.

Payment due dates by term. April as 3rd month special revision. An employer who fails to remit payment on or before the 15th of the following month if the 15th is a holiday the deadline will be the last working day before the 15th can be fined and or imprisoned. There will be no penalties imposed for late payment of taxes during the period provided that payment of the taxes is made before 30 april 2020.

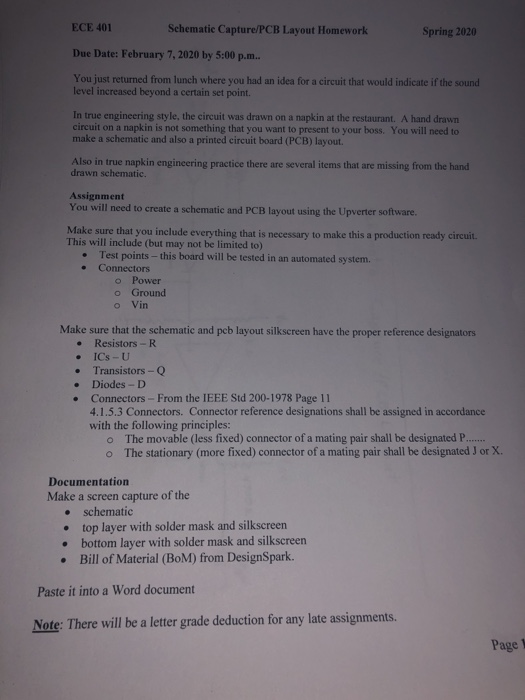

Contribution payment deadline. 15 april 15 may 2020. L 31 july 2019. Beginning 13 31 may 2020.

If the due date for submission falls within the mco period extension of time will be given until 31 may 2020 for the. Friday december 20 2019. March april 2020. E pcb consumer can make online payment via fpx or selected banks date of receipt of payment is the date payment is made via the fpx.

15th of the following month sources from hrdf hrd levy is to be made no later than the 15th date of the month in which the payment falls due as stated under regulation 8 1 of the pembangunan sumber manusia berhad registration of employers and payment of levy regulations 2001. The fine is a minimum of rm 200 and not more than rm 2 000 or 6 months imprisonment or both. 18 mar 2020 to 28 april 2020. Cp39 pcb monthly tax deduction data submission payment for march april payroll.

/i/798381/products/2020-02-17T11%3A21%3A38.358Z-500plusplus_21c_black_and%20_purple.jpg)