Pcb Late Payment Penalty Malaysia

Aside from having to pay more if you re late to submit your tax form you will get fined if you understated your taxes don t submit a form at all or for various other offences.

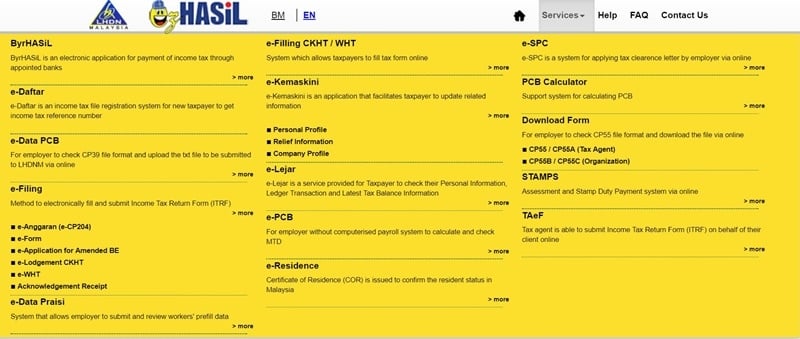

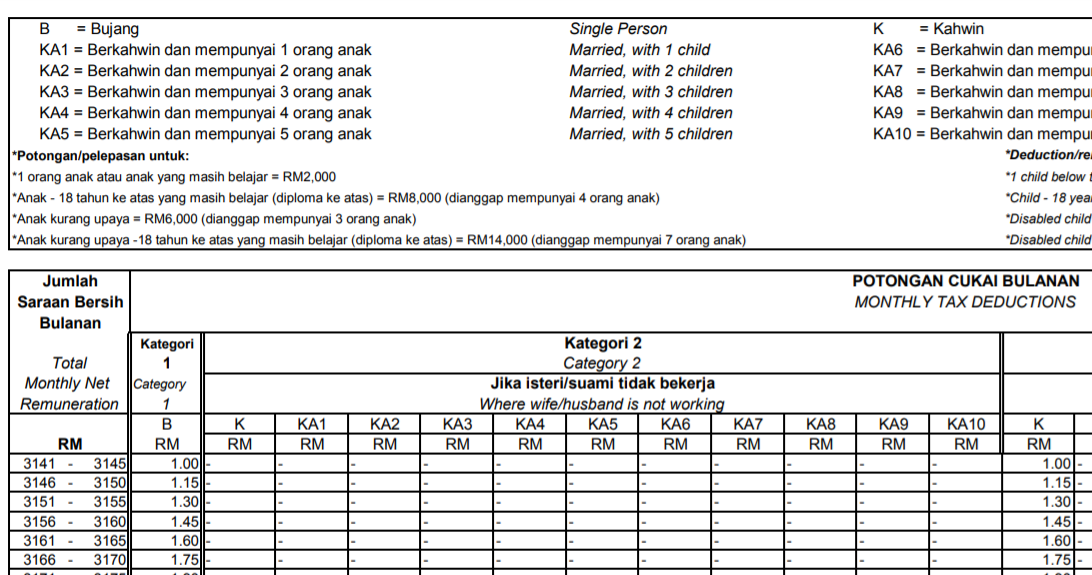

Pcb late payment penalty malaysia. A late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. For example january contributions should be paid not later than february 15. An employer who fails to remit payment on or before the 15th of the following month if the 15th is a holiday the deadline will be the last working day before the 15th can be fined and or imprisoned. If late payment interest is calculated to be less than rm5 then interest is charged at rm5 per month.

The minimum fine is rm200 and not more than rm20 000 or 6 months imprisonment or both. Penalty for late remittance of mtd an employer who fails to remit payment on or before the 15th of the following month can be fined. An employer who does not deduct mtd or deducts but fails to remit the mtd to irbm can be prosecuted in a civil court. Penalty as per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

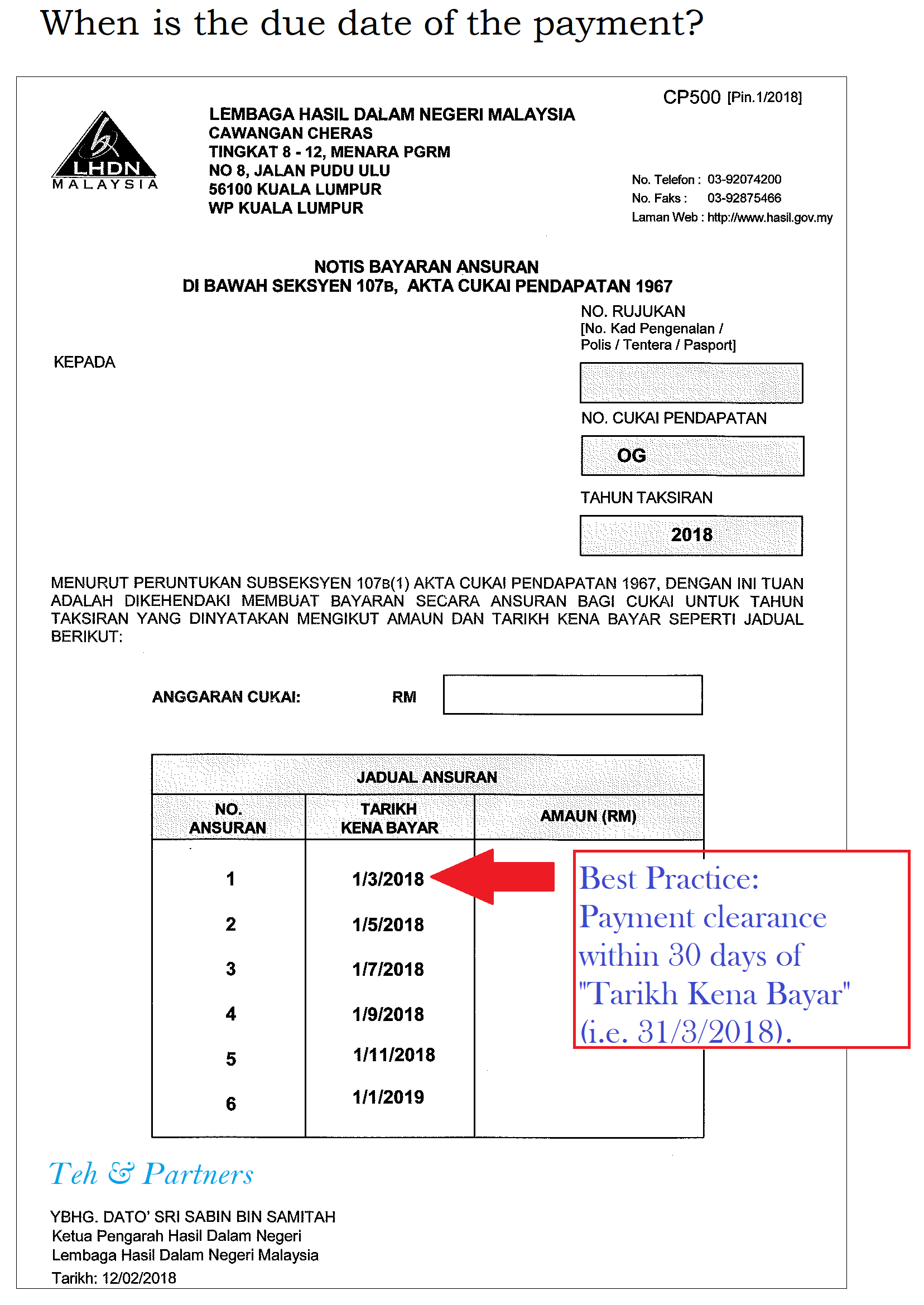

The following table is the summary of the offences fines penalties for each offence. Appeal on late of payment penalty. Penalty under instalment scheme. Penalty for late remittance of mtd or pcb.

Provisions under ita 1967. If the difference between the actual tax payable and the estimated tax payable if the revised estimate is not furnished is more than 30 of the actual tax payable a 10 increase in tax will be imposed on that difference. The minimum fine is rm200 and not more than rm2000 or 6 months imprisonment or both. Penalty for late remittance of mtd an employer who fails to remit payment on or before the 10th of the following month can be fined.

The fine is a minimum of rm 200 and not more than rm 2 000 or 6 months imprisonment or both. 103 3 a 10 increment for the tax payable. An employer who does not deduct mtd or deducts but fails to remit the mtd to irbm can be prosecuted in a civil court. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing.

If you as an employer failed to remit payment on or before the 15th of the following month you can be fined. The minimum fine is rm200 and not more than rm20 000 or 6 months imprisonment or both. Additional 5 increment on the balance of a if payment is not made after 60 days from the final date. B additional 5 increment on the balance of a if payment is not made after 60 days.

If a company fails to pay the monthly instalment on the tax estimate by the stipulated date a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the month.