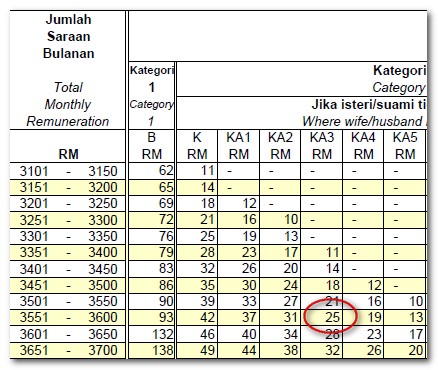

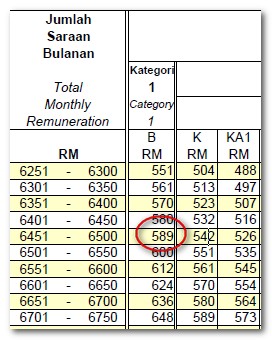

Pcb Deduction Table 2019

Borang pcb tp1 2020.

Pcb deduction table 2019. If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. Eis is not included in tax relief. Pernah bekerja sebelum ini dalam tahun semasa. The amount depends on your filing status.

Introduction 2 b. Introduced pcb schedule mode where pcb amount will match lhdn pcb schedule. Removed ya2017 tax comparison. 2019 27 411 904.

Employment insurance scheme eis deduction added. 2019 1 march 2018 28 february 2019. Monthly tax deduction mtd for computerised calculation 5 a. Borang pcb tp3 2020.

Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. The acronym is popularly known for monthly tax deduction among many malaysians. Weekly tax deduction tables fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables 2015 1 march 2014 28 february 2015 weekly tax deduction tables fortnightly tax deduction tables. About simple pcb calculator pcb calculator made easy.

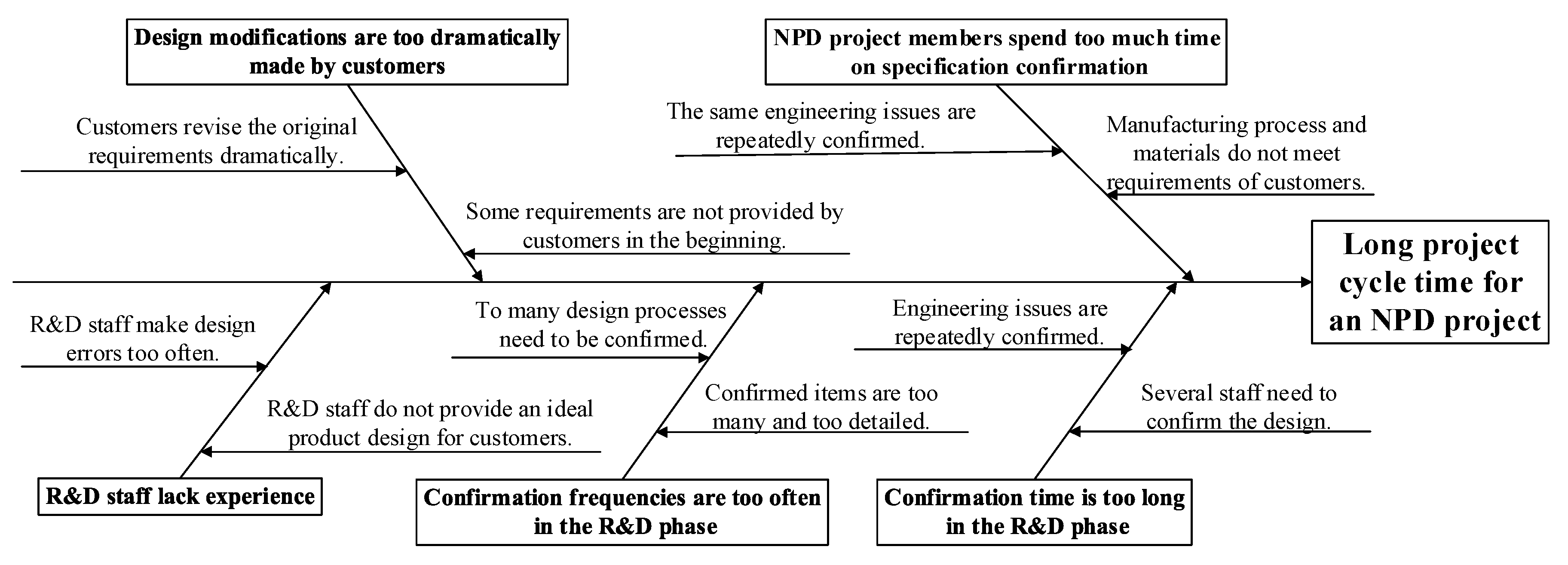

Procedure for verification of computerised calculation method 3 c. Amendment to specification for mtd calculations using computerised calculation method for year 2019 4 d. Table of contents a. With a separate assessment both husband and wife can separately claim tax rebates reliefs.

Official jadual pcb 2018 link updated. Kalkulator pcb lembaga hasil dalam negeri. The standard deduction for taxpayers who don t itemize their deductions on schedule a of form 1040 or 1040 sr is higher for 2019 than it was for 2018. 8 epf contribution removed.

Kkcp pind 2019. All married couples have the option of filing individually or jointly. Update of pcb calculator for ya2018. Jumlah pengguna tahun.

Pcb stands for potongan cukai berjadual in malaysia national language. Calculator based on malaysian income tax rates for 2019. Table 1 shows the filing requirements for most taxpayers.