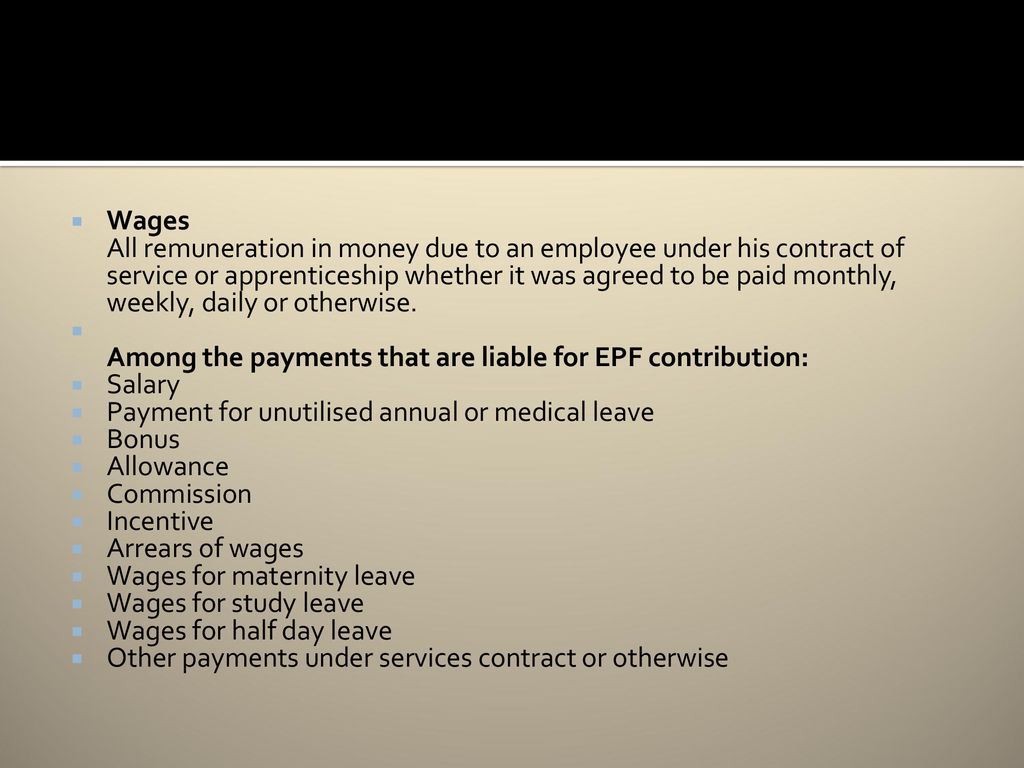

Payment Liable For Socso Contribution

Then at the bottom of next screen you can submit the file for payment.

Payment liable for socso contribution. Head to my sites top right socso contribution. Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee. You may refer to https www perkeso gov my index php ms if further info are needed. Yea this step quite confusing.

Click on arrears contribution. Then choose employer contribution add contribution portal now select text file. Click on under the action column to edit update your employee s salary and the portal will calculate the contribution automatically. Interest on late payment of contributions.

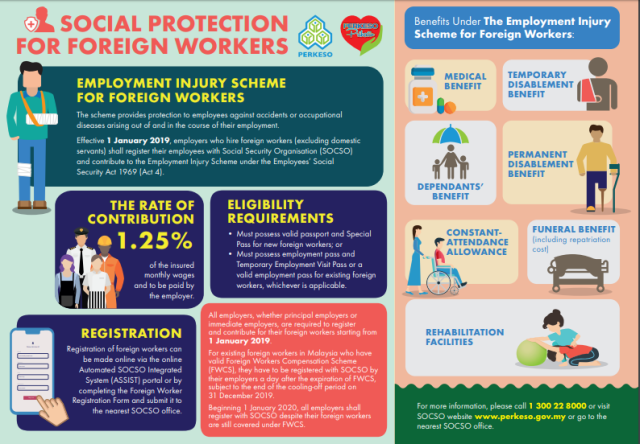

Salary wages full part time monthly hourly overtime payments. The rate of contribution under this category comprises 1 75 of employer s share and 0 5 of employees monthly wages according to the contribution schedule. Select the contribution month and click on short payment. Contributions payable for any month must be paid no later than the 15th day of each succeeding month eg.

All renumeration or wages stated below and payable to staff workers are subject to socso contributions. The system will then bring you thru the fpx payment process. After you upload the file it will need you to click back and check. For employees who are less than 60 years of age contributions payable by employers and employees are for the employment injury scheme and the invalidity scheme.

Any remuneration payable in money to an employee is taken as wages for purposes of socso contributions. Epf contributions payable for any month must be paid to epf no later than the 15th day of each succeeding month for example. Late contribution payment refers to the payment received by epf for a certain contribution month after the. Wages subject to socso contribution.

This includes the following payments. Interest on late payment of contributions. Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee. Commission and service charge.

Select add contribution portal under employer contribution. The company will pay 1 75 while the employees to contribute 0 5 of their salary for the employment injury insurance scheme and the invalidity pension scheme where the rates are depending on the total monthly wages. Payments in respect of leave. Contributions for july 2017 must be paid latest by 15 august 2017.

Paid leave annual sick and maternity leave rest day public holidays allowances. Payments exempted from socso contribution.