Pay Income Tax Online

If you suspended installment agreement payments during the relief period you must resume payments due after july 15.

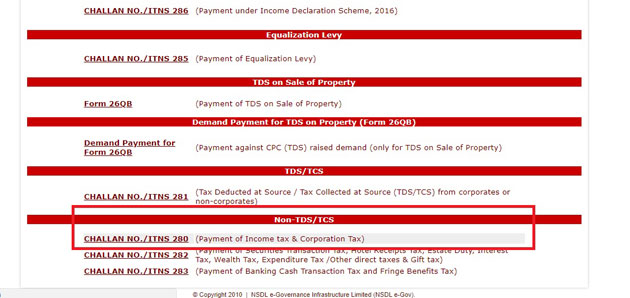

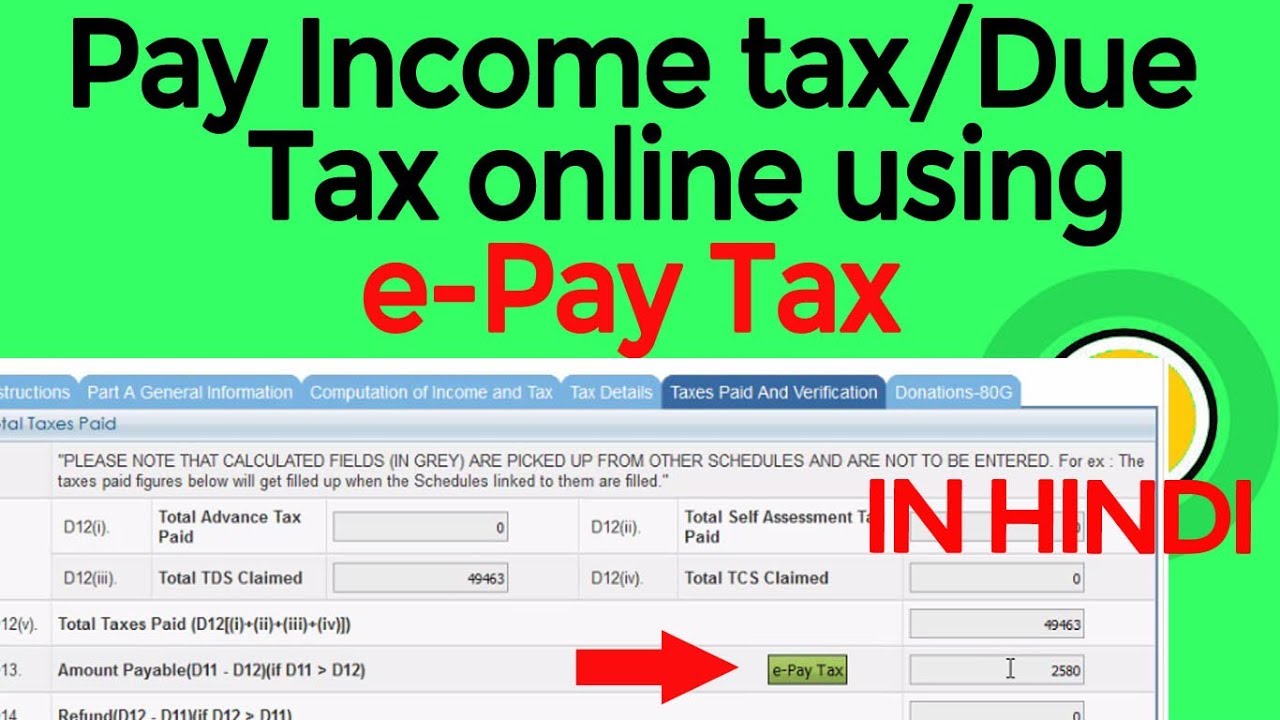

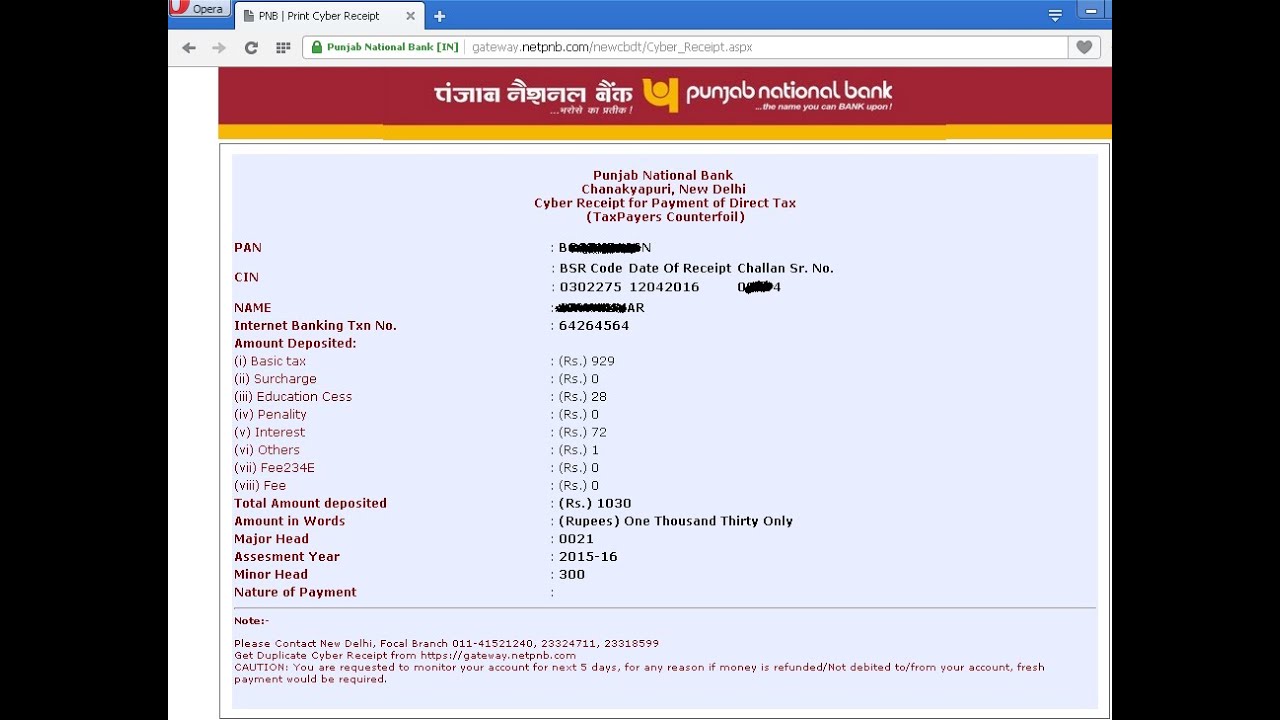

Pay income tax online. Challan no itns 281 payment of tds tcs by company or non company. The irs does not charge a fee but convenience fees apply and vary depending on the card used. You can also request a payment plan online. The deadline to pay 2019 income taxes was july 15.

Credit or debit cards. Payment with return check or money order form 525 tv extension payments form it 560 estimated tax payment form 500 es. It s quick convenient and accurate. You can check your balance or view payment options through your account online.

Any 2nd quarter payments made after june 15 will be considered late and may be subject to interest charges. They can change or cancel a payment two business days before the scheduled payment date. 2nd quarter estimated payments still due on june 15 2020 estimated tax payments for the 2nd quarter are still due on june 15 for both income tax and corporation business tax taxpayers. Challan no itns 280 payment of advance tax self assessment tax tax on regular assessment surtax tax on distributed profits of domestic company and tax on distributed income to unit holders.

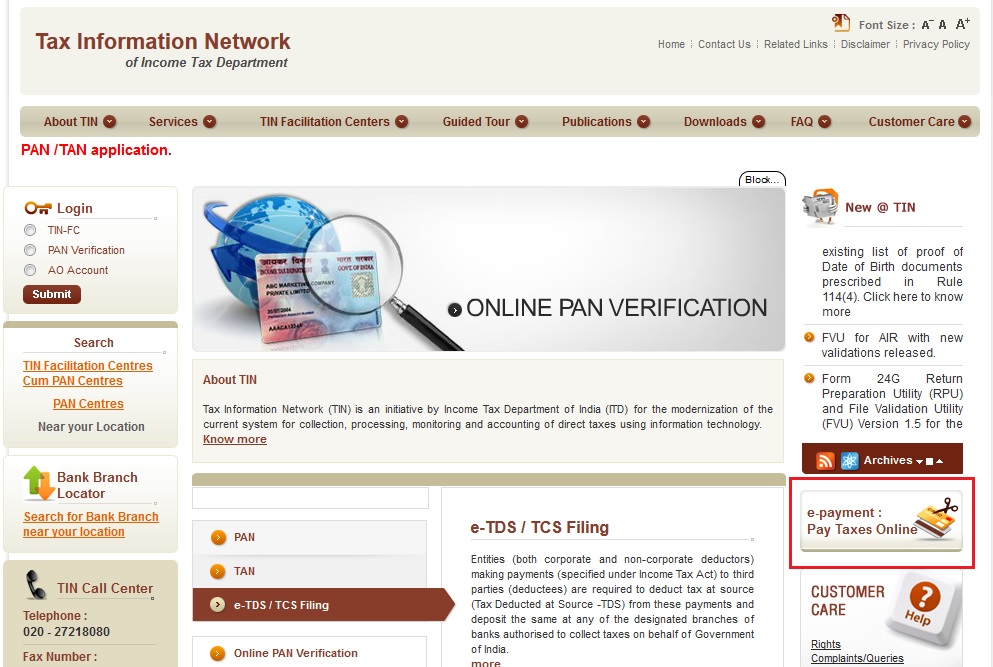

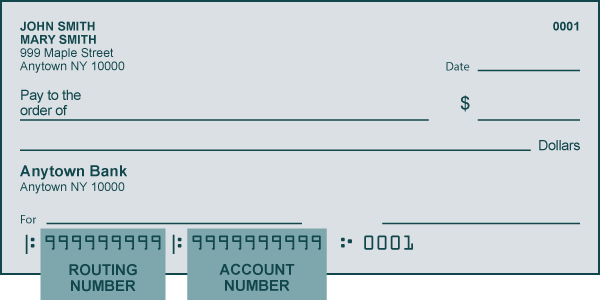

Challan no itns 282 payment of securities transaction tax estate duty wealth tax gift tax interest tax expenditure other. The taxpayer has to login to the net banking site with the user id password provided by the bank for net banking purpose and enter payment details at the bank site. Pay your taxes now. Online payment includes convenience fees collected by our payment vendor.

Pay individual income tax online. Taxpayers can also pay their taxes by debit or credit card online by phone or with a mobile device. If you have a balance due pay using your credit card or e check. Quick payments using gtc instructions state tax liens estimated tax and assessments only at this time paper forms.

With direct pay taxpayers can schedule payments up to 30 days in advance. Read our online payment page for complete details.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19661272/Screen_Shot_2020_01_31_at_9.43.13_AM.png)