Parental Care Relief Malaysia

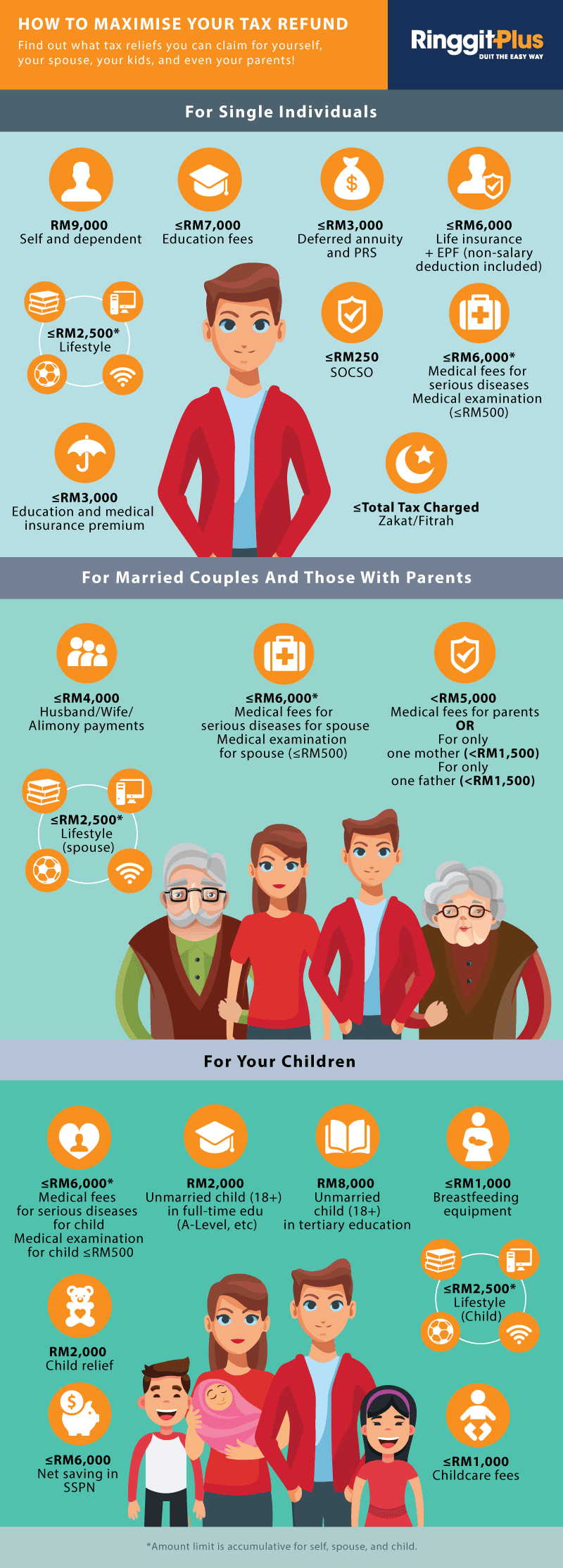

Rm5 000 medical expenses for parents or limited to rm3 000 parental tax relief split between each parent.

Parental care relief malaysia. Each unmarried child of 18 years and above who is receiving full time education a level certificate matriculation or preparatory courses rm2 000. Each unmarried child of 18 years and above that is. As a nod to the importance of breastfeeding and also to encourage more mothers to breastfeed their babies prime minister datuk seri najib razak announced a new tax relief in budget 2017. Carer shall not include that individual s husband wife or child.

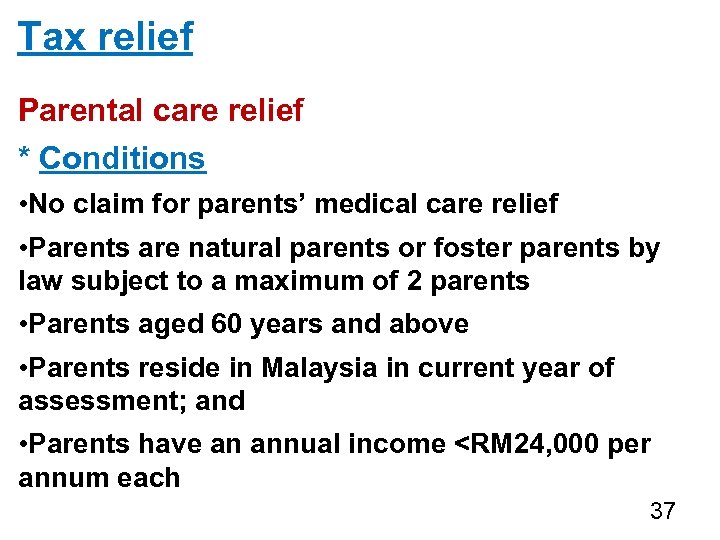

The maximum claim for this relief is restricted to rm1 000 even if the number of children who are eligible for this care exceeds one. Lhdn has stated in the income tax act that one criteria to claim parental care tax relief is that the taxpayer must not claim expenses related to medical treatment and care for the parents. This relief was previously given separately but now this basket covers many reliefs that were not given in previous years such as smart phones tablets gym membership subscriptions and broadband internet. As such taxpayers who take care of their parents must decide which tax relief they wish to apply for.

This tax relief is allowed for child care fees for a child aged 6 years and below paid to a registered child care centre or registered kindergarten. Basic supporting equipment for disabled self spouse child or parent rm6 000. Applicable to tax paying parents. For more information on parental care tax reliefs visit kpmg.

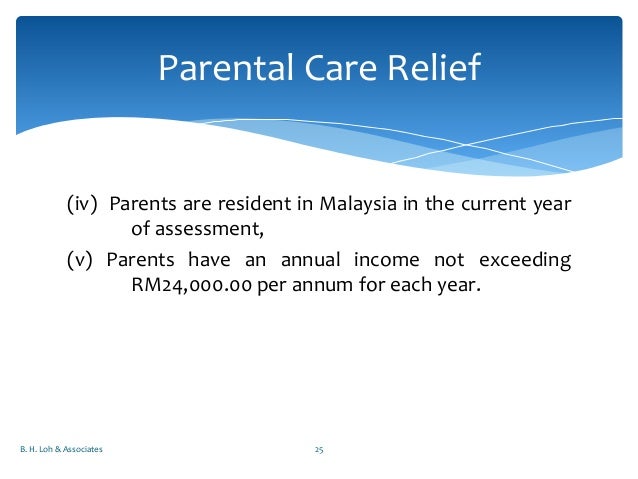

Breastfeeding tax relief according to a sinar harian report in 2012 only 34 2 of babies in malaysia are breastfed exclusively in their first six months. The medical treatment and care services are provided in malaysia. If you decided to apply for the medical expenses relief for your parents then you are limited to only medical expense relief and vice versa. In the case of a carer it shall be proved by a written certification receipt or copy of carer s work permit.

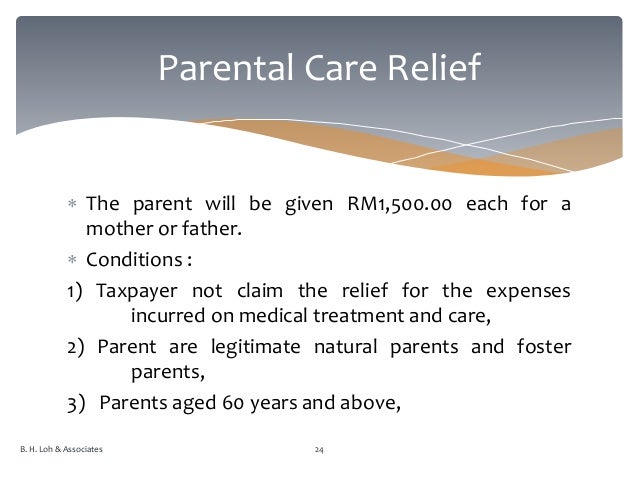

Relief of rm5 000 is claimable for medical special needs or care expenses for your parents or parental tax relief if medical expenses for parents were not claimed children are entitled to collectively claim up to a maximum rm1 500 for each parent mother and father. Myr 1 500 for a mother. The relief will be available as a tax deduction for individual resident taxpayers caring for their qualifying parents. Claiming tax deduction for parents medical expenses letters friday 04 dec 2015.

2 this income tax relief can be shared with other siblings provided that the total tax relief claimed does not exceed myr 1 500 for a mother and myr 1 500 for a father. Myr 1 500 for a father. On top of that the parents shall be resident in malaysia and the medical treatment or care services must be provided in malaysia. The parents shall be resident in malaysia.